Bitcoin, Ethereum and Alts hodlers: Here’s one way to trade the current market

Being on the wrong side of a crypto market cycle can be detrimental. Be it for Bitcoin, Ethereum, or any other Altcoin, volatility can act as both a blessing and a bane. At present, the majority of the market was facing another dilemma, which is in regard to unpredictability.

Assets are indicative of sideways movement, and neither bullish nor bearish traits can be observed. So the question arises, how does one navigate through these periods, where it seems both early and late to enter the market?

Bitcoin-ing during choppy sessions; How does that work?

After back-to-back weeks that exhibited a 20% and 25% decline for Bitcoin, the present week pictured a 3.78% recovery. $40,000 resistance has been tested but closing a position above the range hasn’t occurred on a daily chart.

It is fair to say, there is uncertainty as to where the market is heading in the immediate future. There are other factors that currently pertain to that sentiment.

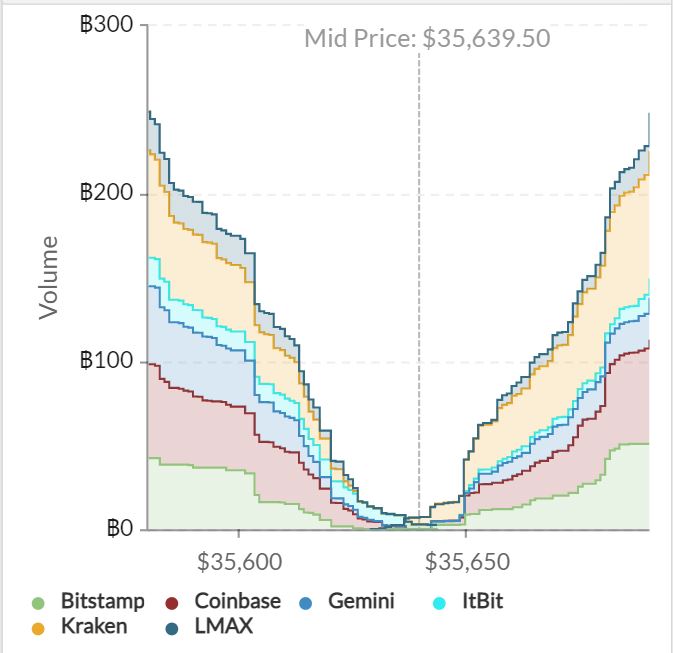

Firstly, Order books for BTC are really thin at the moment. Transaction volumes are dropping down as well, with market movers hardly pushing the price up or down. When it comes to building momentum, there is a lack of liquidity, as capital inflows have drastically reduced. On-chain metrics have undergone a re-set but they haven’t formed a concrete bounce-back yet.

However, this can be just another calm before the storm. Historically, lower liquidity periods dating back to September 2020, and early April 2020, have led to stronger bullish rallies. Yet, a bullish outcome is not a complete guarantee.

Funding rates are negative as market sentiment is down, Therefore short squeezes can occur, taking the market by surprise again.

In such cases, it is important to understand how to manage your crypto portfolio in order to minimize losses and also be prepared to enter the market at the right time.

Cut your losses or HODL on?

There are two trains of thought to such a process at the moment. First, it is important for traders to identify if they are investing in assets such as Bitcoin, Ethereum, and Altcoins for the long-term, or looking for short-term profits.

BTC/USDT on Trading View

Now, for traders buying in at the supply range between $62,000-$64,000, it will be ideal if some scaling in value is initiated. What it means is that they can start looking at the retracement levels at 0.382, 0.5 to liquidate half of their allocations.

At current market momentum, it will never be a straight swing up to the high levels, hence liquidating some assets would allow these traders to buy at a lower level and average down on the price. Reaching the same level again would recover close to 10-15% more than what straight hodling would have brought in.

Ethereum holders can follow a similar blueprint after identifying respective retracement levels. Now, when it comes to Altcoin assets, it is essential to accept their high volatile movement against Bitcoin. Therefore during corrections, portfolios should look to preserve higher existing value only in higher volume assets. It opens up the door for a potential break-even scenario or exit strategy market at minimal losses. Hodling Altcoins can be massively detrimental during an extended bearish period.

To Enter or Not?

For new investors, It is not the right time yet to jump in. Bitcoin isn’t completely out of the woods and discussions over a bullish recovery can only be entertained once it closes a daily candle above the $41,800 mark. The bearish rally may end next week or next month, as lower liquidity markets often witness the sharpest movements. However, it is better to be cautious than to take a chance, which may turn into an expensive mistake.