Bitcoin & Ethereum: which asset will cross this benchmark first in the next 2 weeks

Bitcoin and Ethereum both tested their initial targets of $40,000 and $2400 over the past day, after consistently rallying over the last week. The market sentiment is currently improving for both assets. While Bitcoin has been the driving force for the majority of the bull markets, smaller altcoins have rallied behind Ether’s bullish period as well.

In 2021 itself, Bitcoin reached its all-time high during April 15th-20th, reaching a valuation of $64,000. Other assets followed suit, but when Ethereum touched its ATH of $4375 during the 1st of May, assets such as Ethereum Classic and MATIC followed its path.

Keeping a bullish perspective in the backdrop, we analyzed which asset is likely to outperform the other during the next few weeks of price action.

Comparing Levels between Bitcoin and Ethereum

The price structure for both Bitcoin and Ethereum look similar but both assets have different bullish resistance ranges. For Bitcoin, $42,000 is the range above which the asset needs to close a daily candle, after which a strong bullish narrative can be justified.

For Ethereum, the price range is $3000. Now, there are evident discrepancies in terms of ETH’s range being more far off in terms of percentage growth, but it is the same range that was re-tested post-May 19th, after which collective collapse was observed.

So for both Bitcoin and Ethereum, it is currently about crossing their respective levels of $42,000 and $3000 to dictate the rally. The question is, which asset does it first?

Correlation status and Volatility Spread

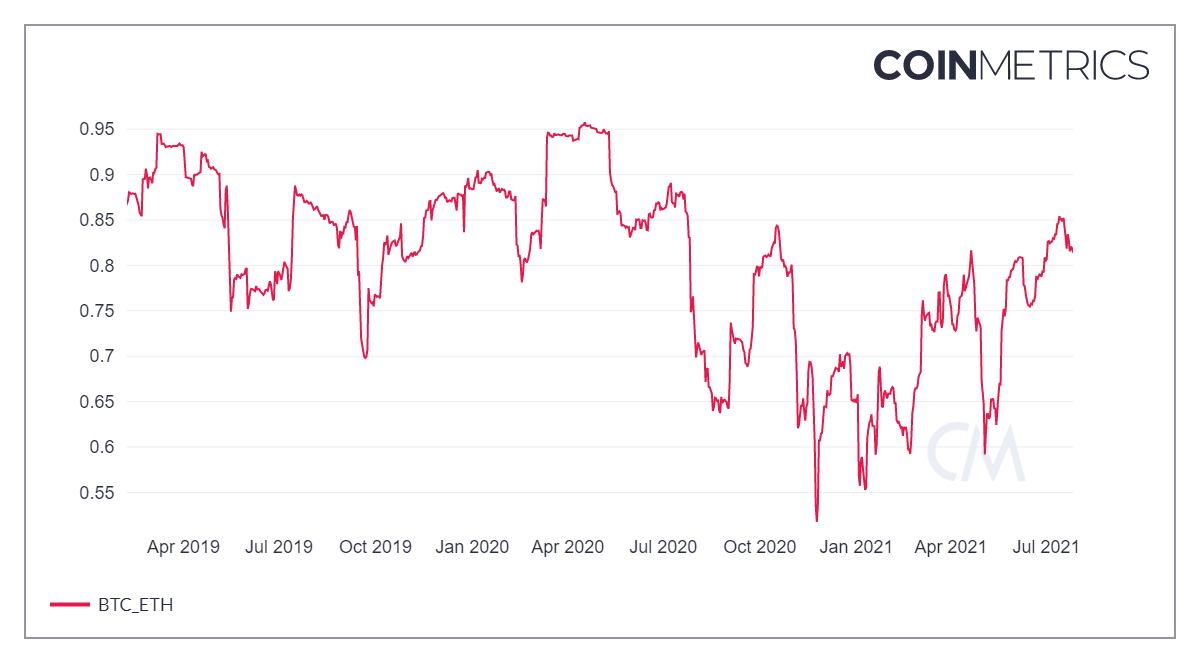

Analyzing the correlation chart between Bitcoin and Ethereum indicated that both assets have shared higher levels of correlation over the past few months. It currently sits at 0.85, which means regardless of dominance-tussle, there is common linearity between both, moving up or down. However, short-term volatility spreads reveal more about the current market momentum.

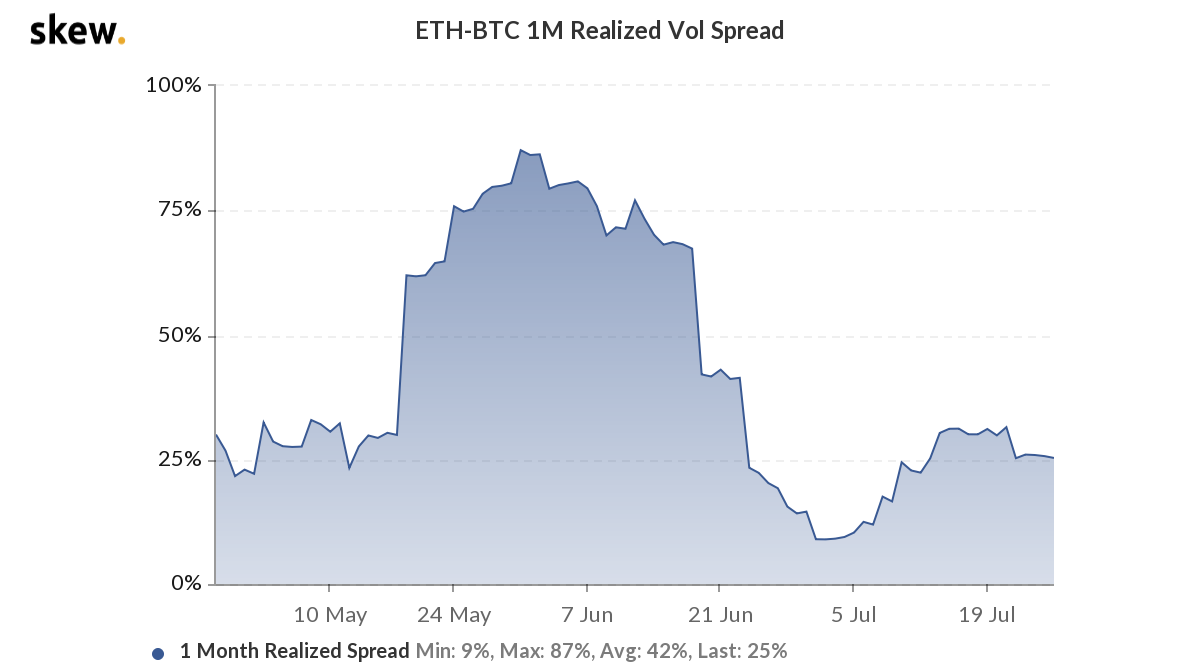

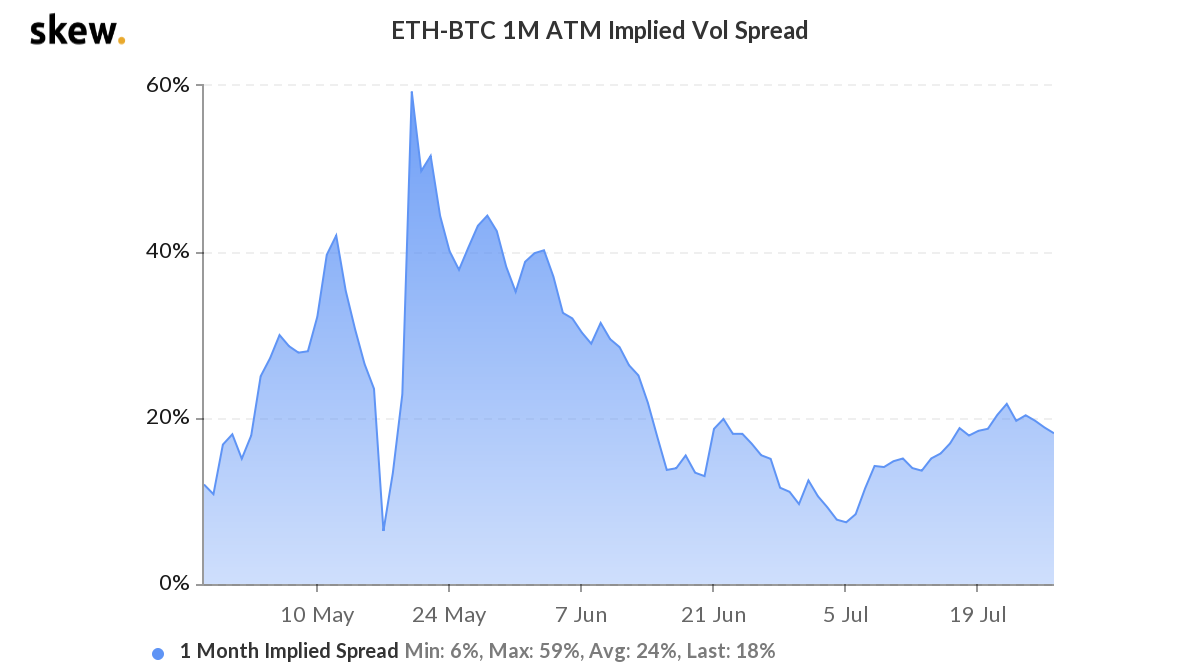

ETH-BTC 1-month realized volatility spread and 1-implied volatility spread has been indicative of which asset has a dominant hold over the other in the past few months. Whenever both indexes are rise, Ethereum has largely outperformed the volatility drive, in both bullish and bearish directions. Right now, ETH-BTC realized and implied volatility is undergoing a decline, which means BTC has a positional advantage.

Keeping that narrative in mind, Bitcoin reaching $42,000 will probably happen before Ethereum reaches $3000. The initial recovery is currently supportive of Bitcoin’s volatility being more strong and directive.