Bitcoin following S&P500? Investors’ sentiment tell us what’s happening

Investing in crypto was traditionally thought to be a way to diversity one’s portfolio and hedge against market risks or inflation. However, when looking at Bitcoin’s recent price performance, analysts are asking if mainstream adoption and world events are changing this narrative.

With FUD, from Russia

Data from Santiment showed that while Bitcoin had rallied back to over $40,000, it was on shaky footing. This came after a drop during the week. What’s worth noting, however, is that the S&P500 also fell. On the other hand, gold prices hit an eight-month high.

What could be the reason for these drastic changes? The civil and economic tension in Europe could be a major factor. After all, news companies have been speculating for days as to whether or not Russia will invade Ukraine. As FUD fills the air, it’s only natural for investors to gravitate towards hard as well as tangible assets like gold. Stocks – and now Bitcoin – seem to be paying to price.

? #Bitcoin is barely hanging on above $40k, and this mid-sized drop to end the week coincided with the #SP500 once again dropping. Meanwhile, #gold has soared to an 8-month high. Look for a $BTC correlation break to be a sign of a positive breakout. ? https://t.co/QyUyr5Zgzz pic.twitter.com/8481wsk1vk

— Santiment (@santimentfeed) February 19, 2022

That said, however, the rising correlation between stocks and Bitcoin has given both analysts and traders good reason to worry. To that end, it might be a good idea to take a look at investors’ sentiments.

Weighing up your feelings

The weighted sentiment for Bitcoin was largely positive during February 2022. But it plunged below zero shortly before press time. This happened as Bitcoin’s price fell by 6.38% in the past seven days and dropped by 1.58% in the last 24 hours. Thus, dragging BTC below the $40,000 mark.

After weeks of market crashes, it makes sense that investors are losing hope again.

Source: Sanbase

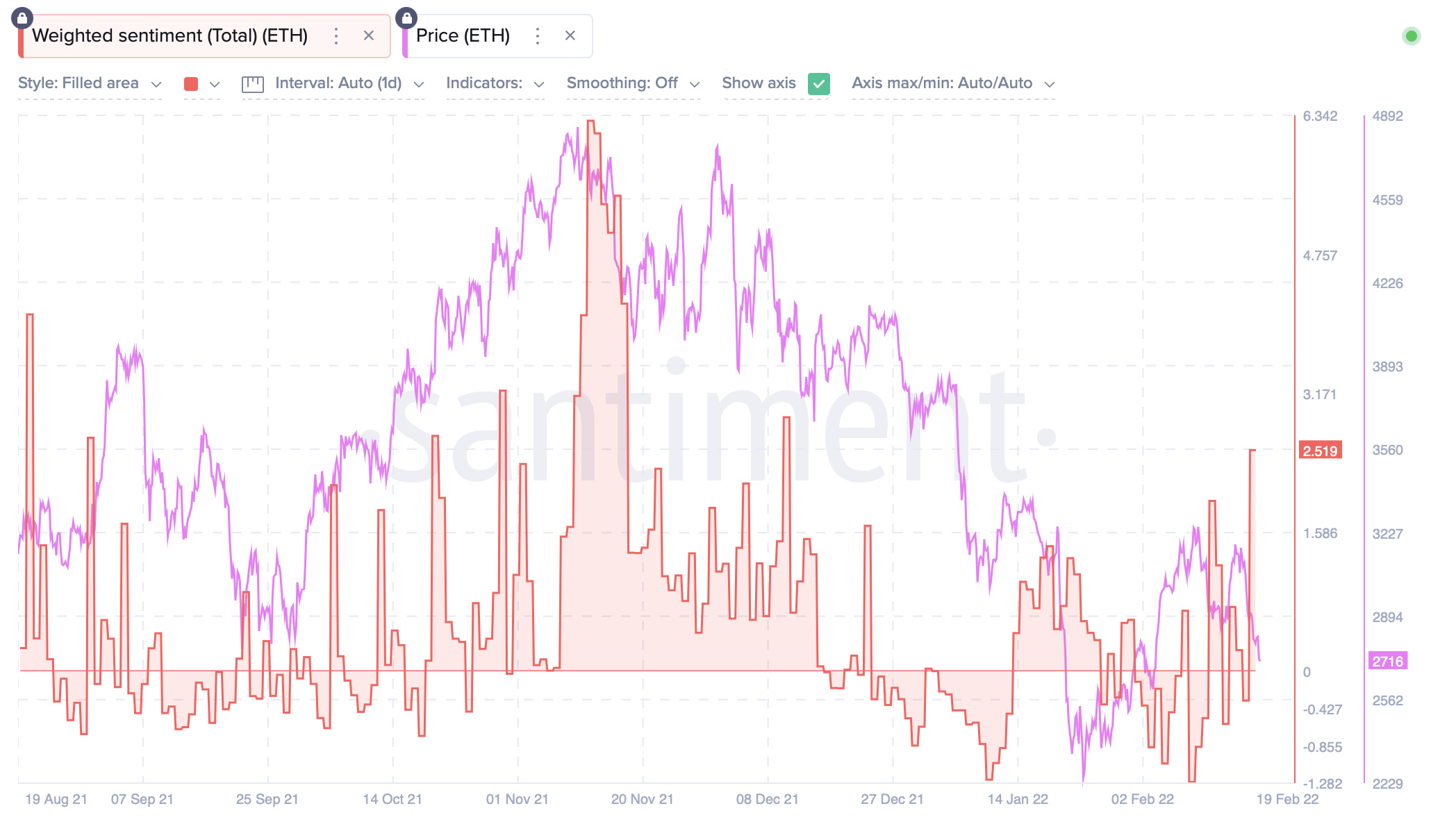

It’s also prudent to look at the top alt coin to better understand the sentiments of other investors as well. According to Santiment data, Ether’s price has fallen sharply. The last 24 hours alone saw a drop of 4.56%. Even so, investors’ sentiments were positive and well above zero. If the downward trend in price continues, it’s highly likely that investor sentiments will also fall – and hard.

Source: Sanbase

Time to face facts

When Meta [formerly Facebook] released its Q4 report with lower earnings per share than anticipated, shares plunged by more than 20% again. This was followed by Nasdaq’s drop of 1.9%.

However, what shocked both traders and analysts was that around the same time, it was none other than the king coin which dropped by 2.1%.

Though Bitcoin recovered and began to rally, this incident was certainly food for thought as many BTC holders wondered if their portfolios were diverse enough after all.