Bitcoin gains 9% post-halving: What will take BTC to $150K this cycle?

- Bitcoin holders have to be wary in the short term due to increased selling pressure surrounding the halving.

- The halving event was probably not priced in, but that does not guarantee the same returns from this BTC cycle as earlier ones.

Bitcoin’s [BTC] halving did not immediately lead to a massive sell-off, as some market participants feared. While things might change later this week, the $60k support zone was defended on the 19th of April.

Since the dip to $59.6k, prices have climbed by 9% at press time.

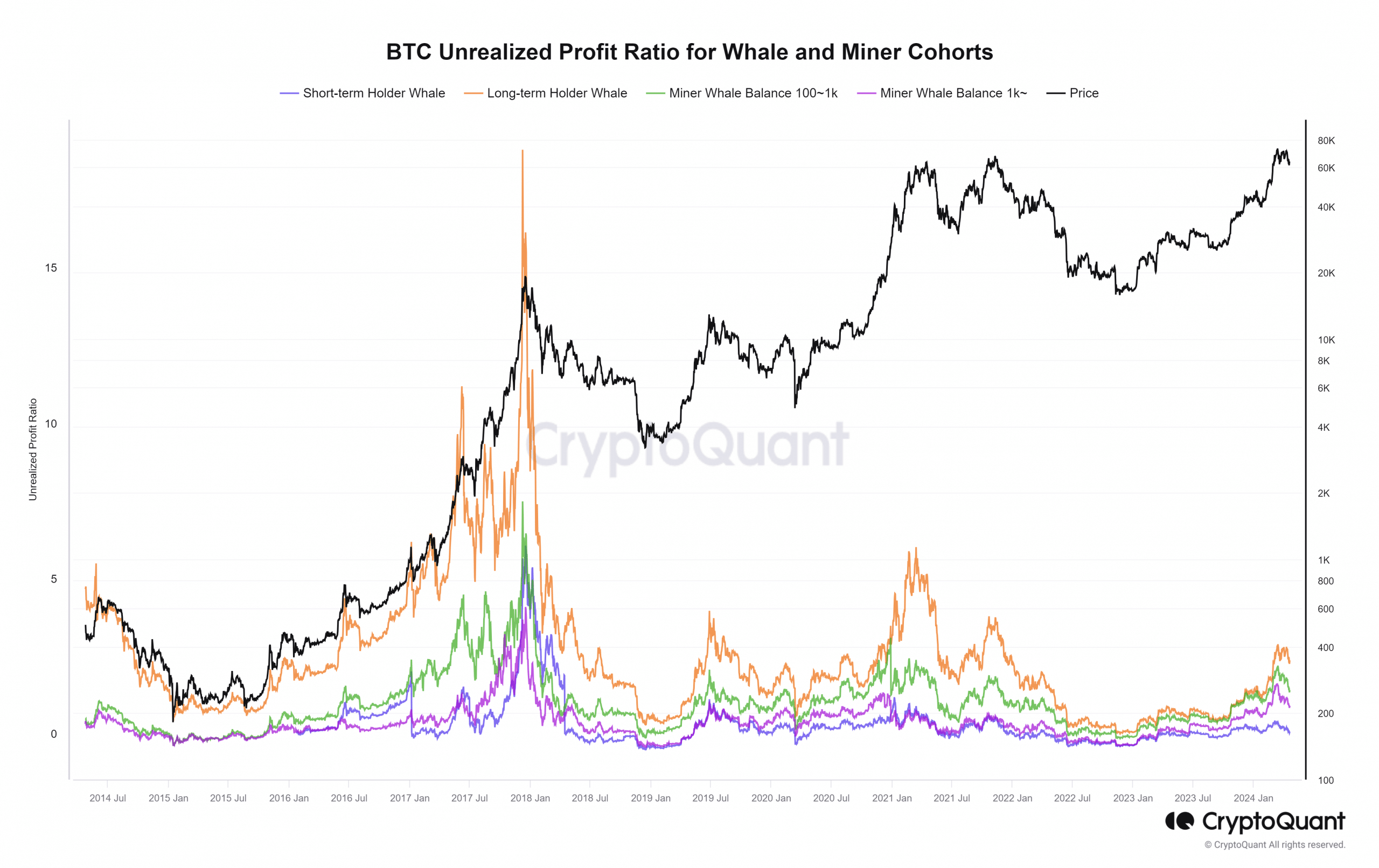

In a post on X (formerly Twitter), CryptoQuant CEO Ki Young Ju pointed out that we are not close to this cycle’s top. The Unrealized Profit Ratio metric showed that long-term whales were only at a 234% profit.

The 2021 run had long-term whales at 599% profit at the metric’s peak in February 2021. Although BTC made a new high later that year, the Unrealized Profit metric could not match it.

Playing the long game

Source: CryptoQuant

Comparing the 2020-21 cycle to the 2017-18 rally, we find that the long-term whales’ profit was more than 1700% in 2017. The respectable 599% figure somewhat pales in comparison.

This raises the question of a further drop in whale profits during this cycle’s top. Therefore, expectations of Bitcoin to $200k might be ambitious- but only time will tell.

With a reading of 286% in mid-March, bulls would be hoping for the halving to boost these numbers. Like Ki Young Ju says, perhaps this is not enough profit to end the cycle.

Crypto analyst Ali Martinez drew attention to the sentiment around Bitcoin as it reaches its peak. Based on the NUPL metric, we have not yet reached the “euphoric” phase that usually accompanies a Bitcoin top.

Threats in the short-term

Source: CryptoQuant

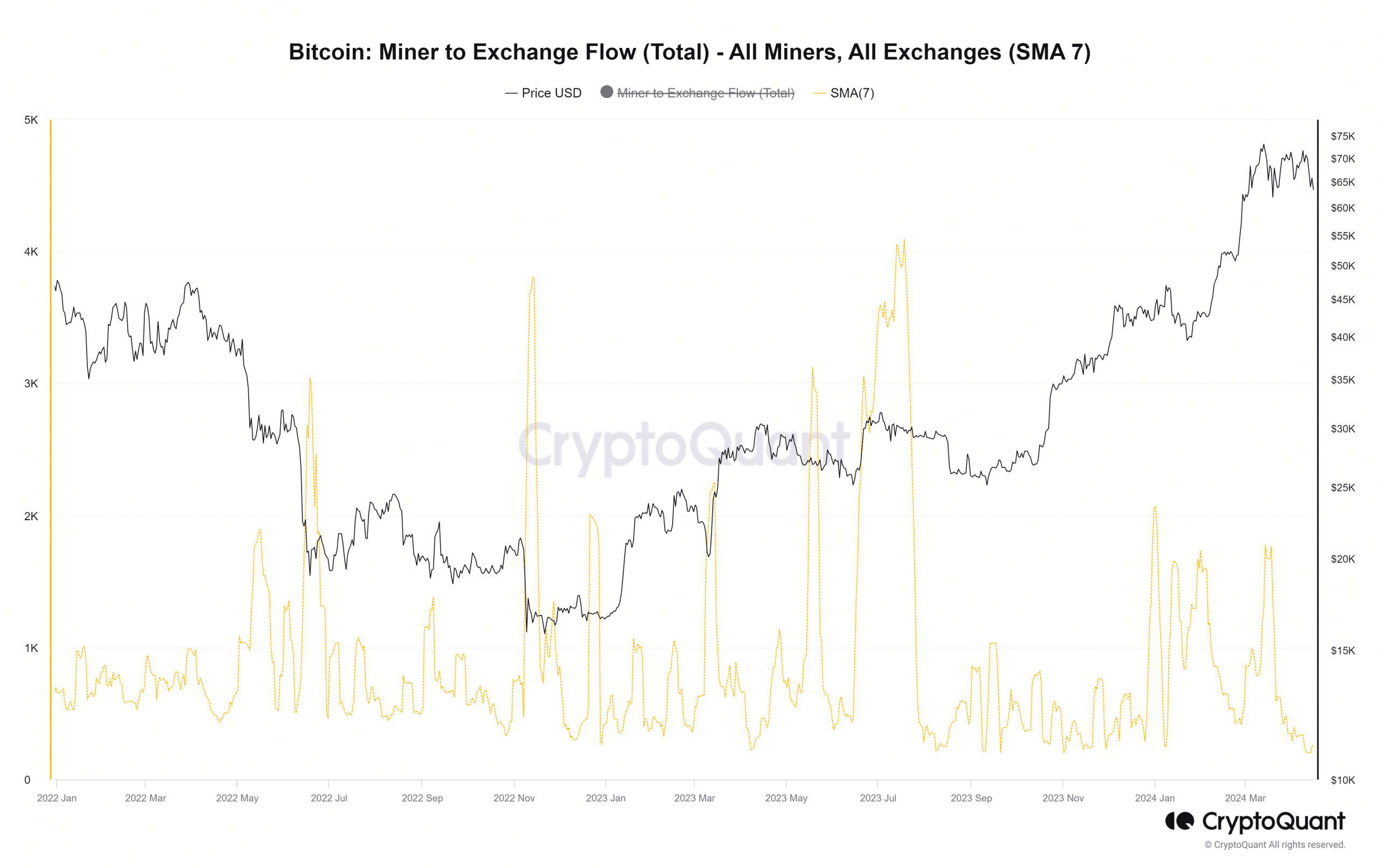

While the long-term outlook argues for higher prices, there is scope for volatility in the short-term. Data from CryptoQuant noted that miners were sending less BTC to exchanges in the past month.

The falling 7-day simple moving average of miner flow to exchanges was evidence for the same.

One possibility is that miners were hoarding Bitcoin to sell after the halving, since their rewards would be cut in half. In turn, this could cause significant downward pressure on the market.

Source: Farside Investors

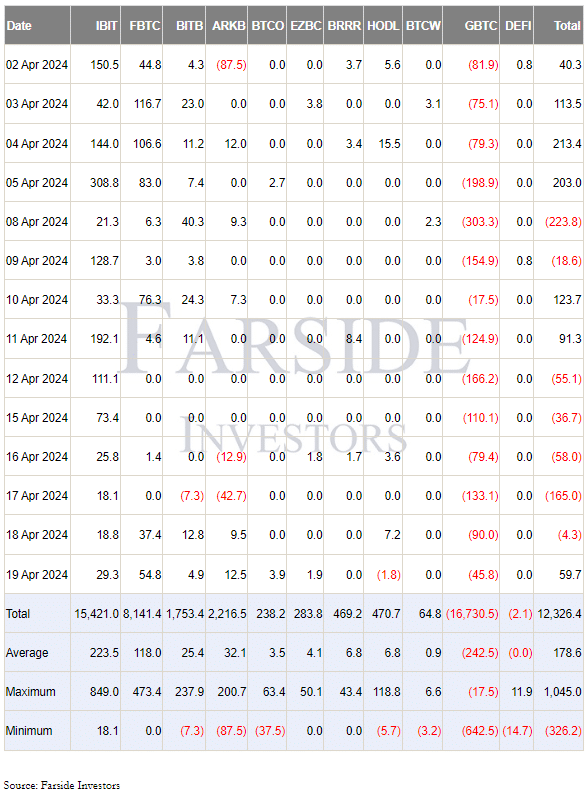

Additionally, there was evidence of a weakened demand for Bitcoin in recent weeks. The liquidity inflows peaked on the 12th of March and have slowed down in recent weeks.

The past two weeks saw Bitcoin prices decline from 10% to 15%, but the ETF inflows were not boosted. It pointed toward a saturation in the demand for U.S.-listed Bitcoin ETFs at the moment.

The halving event must be priced in, says common sense

The halving event on the 19th of April (or the early hours of the 20th if you’re in the eastern hemisphere) is an event the whole market has known about for years.

The aftermath is not as simple as rewards dropping to 3.125 BTC per block mined.

The crux of the problem is the multitude of other factors in play, all of them revolving around supply and demand, and public sentiment toward Bitcoin.

Arguing that the event is priced in because the market has known about it for ages might be redundant, argues on-chain Bitcoin analyst Willy Woo.

A shift in public sentiment occurs relatively late in Bitcoin’s cycle. Bitcoin usually captures public attention close to or after the NUPL euphoria phase.

This cycle might be different due to the ETFs, but the argument against pricing is still valid.

We simply have not had the capital inflow, yet that will eventually price Bitcoin correctly. As things stand, the asset appears massively undervalued in the long-term.

Read Bitcoin’s [BTC] Price Prediction 2024-25

A more pessimistic outlook would conclude that this cycle would be far shorter and not as parabolic as the ones that came before.

In either scenario, the roller coaster ride has not yet had its quota of air time. So strap in and hold on.