Bitcoin: Here’s what short-term holders are doing right now

- Short-term holders began to sell their holdings taking losses as prices fell.

- Number of Ordinals buyers grew, indicating rising interest in the Bitcoin ecosystem.

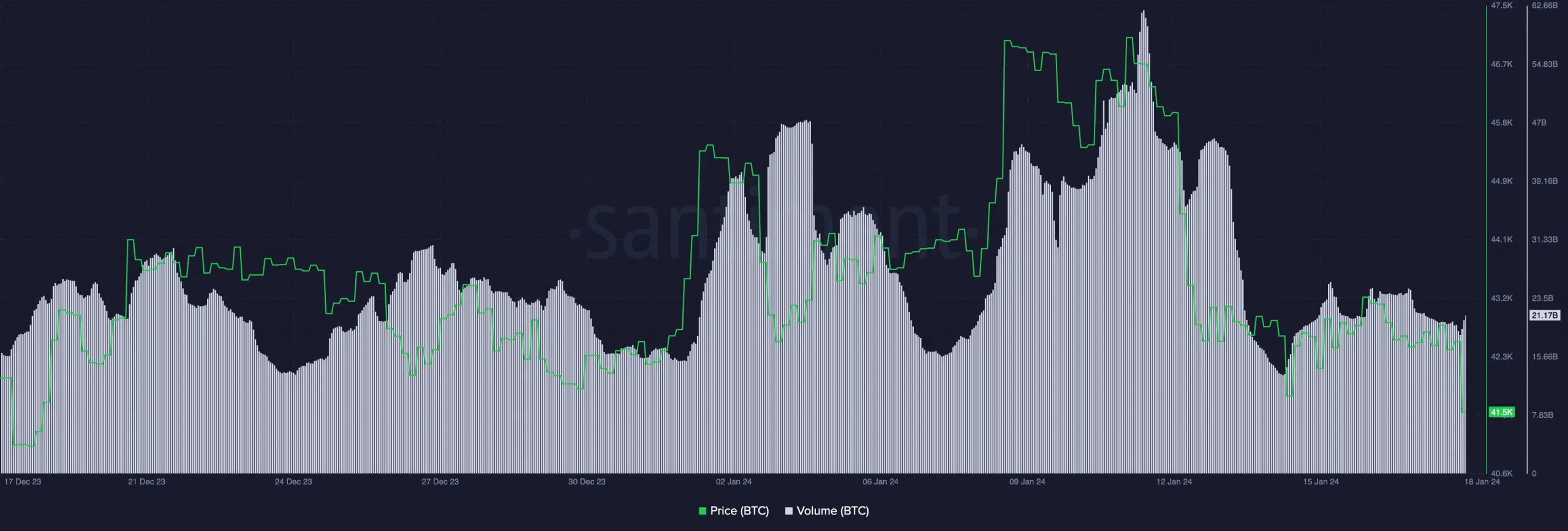

Bitcoin’s [BTC] price saw a period of stagnancy after its price plummeted post the approval of Bitcoin ETFs. Many have tried to speculate what happens next for BTC.

Here for a good time, not a long time

CrazzyBlockk, an analyst from CryptoQuant, shed light on the pivotal role that short-term holders may play in shaping BTC’s path forward.

A pronounced aspect of concern is the noteworthy 50% reduction in profit for these short-term holders, which is discerned through metrics tracking both unrealized and realized profit/losses within the Bitcoin network.

50% reduction in profit of The short-term holders:

"Usually, such significant reductions in the average profits of short-term holders, given their sensitivity to short-term market conditions, provide a strong rationale for selling pressure or Exit liquidity."

by @Crazzyblockk… pic.twitter.com/KsgZiG20Us— CryptoQuant.com (@cryptoquant_com) January 19, 2024

From the peak at $44,000 until the present day, the descent in Bitcoin’s price has eroded more than half of the profits held by short-term holders.

Remarkably, numerous holders who have possessed Bitcoin for less than one month are currently exiting the market at a financial loss. Such a substantial decline in the average profits of short-term holders, given their heightened sensitivity to short-term market conditions, serves as a compelling rationale for potential selling pressure or exit liquidity.

In the face of this prevailing bearish sentiment in the Bitcoin market, analysts are closely eyeing a crucial price level that could act as a support zone for Bitcoin. This pivotal range is identified within the $38,000 to $36,000 spectrum.

The anticipation of a drastic price correction is grounded in the observable conditions where short-term holders are experiencing notable reductions in profitability, adding complexity to the prevailing market dynamics and hinting at potential shifts in investor sentiment.

On the brighter side

However, there may be some positive factors that could help BTC support its price levels. For instance, there was a surge in interest in BTC ordinals over the last few weeks.

According to CryptoSlam’s data, the number of unique buyers of Bitcoin Ordinals grew by 69.93% in the last month. The rising interest in Ordinals could help the ecosystem around Bitcoin to grow.

Read Bitcoin’s [BTC] Price Prediction 2024-25

At press time BTC was trading at $42,507.73 and its price had fallen by 0.65% in the last 24 hours.

The volume at which it was trading also fell during this period.