Bitcoin hits $50,000 to register yet another ATH for 2021

Another day, another ATH for Bitcoin, the world’s largest cryptocurrency.

A few days after BTC surged past the $45,000 and $47,000-price levels on the back of a Tesla-fueled price hike, the cryptocurrency is in the news again after it breached the much-anticipated $50,000-mark. Following the news that MicroStrategy will sell $600M in convertible senior notes to buy Bitcoin, BTC surged to record yet another ATH on the price charts, with the cryptocurrency’s market cap inching towards the $1 trillion-mark too.

At the time of writing, BTC was valued at $50,299, with the cryptocurrency having risen as high as $50,602 on the charts.

Source: BTC/USD on TradingView

As previously mentioned, many believe that Bitcoin’s latest price hike was fueled by news of Tesla’s purchase of Bitcoin worth $1.5 billion last week and more recently, MicroStrategy’s accelerated plans to buy more BTC. In light of speculations that Apple might be the next to dive in and the fact that Miami is looking into adding $BTC to its balance sheet, it’s perhaps no surprise that the cryptocurrency has surged the way it has.

Just like last time, Bitcoin’s breach of $50k was supported by a host of fundamental metrics flashing bullish signals on the charts.

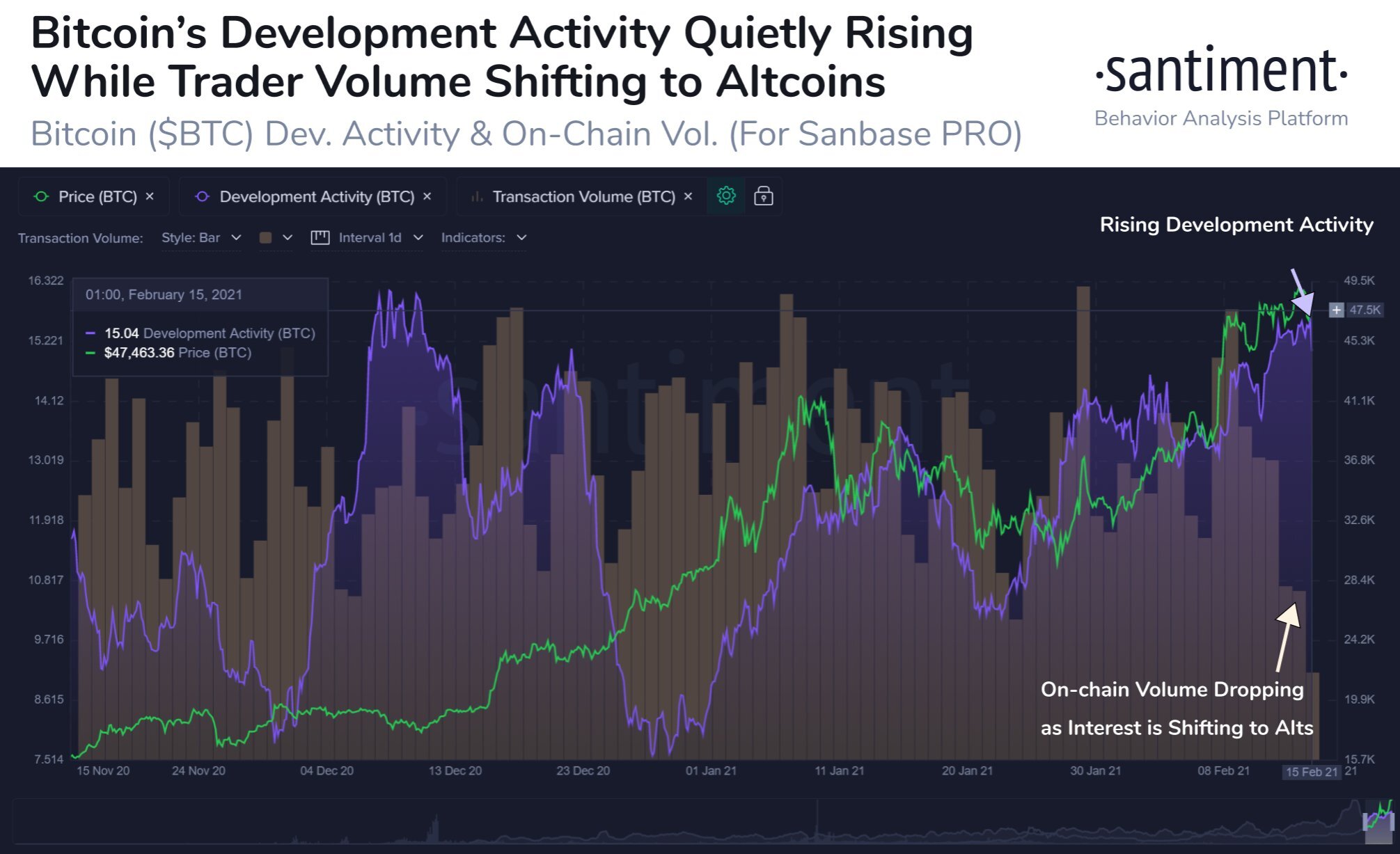

The 200-day moving average for active addresses on the network, for instance, has continued to climb on the charts. In fact, Bitcoin’s development activity too has risen “quietly” to a 2-month high.

That’s not all, however, with Bitcoin’s liquid supply continuing to fall on the charts. The same was highlighted by Glassnode recently, with the report in question stating that investors are increasingly acquiring or holding the crypto-asset for the long-term. It added,

“With float in the network drying up faster than ever, signs are promising for continued BTC price increases into the future.”

Source: Glassnode

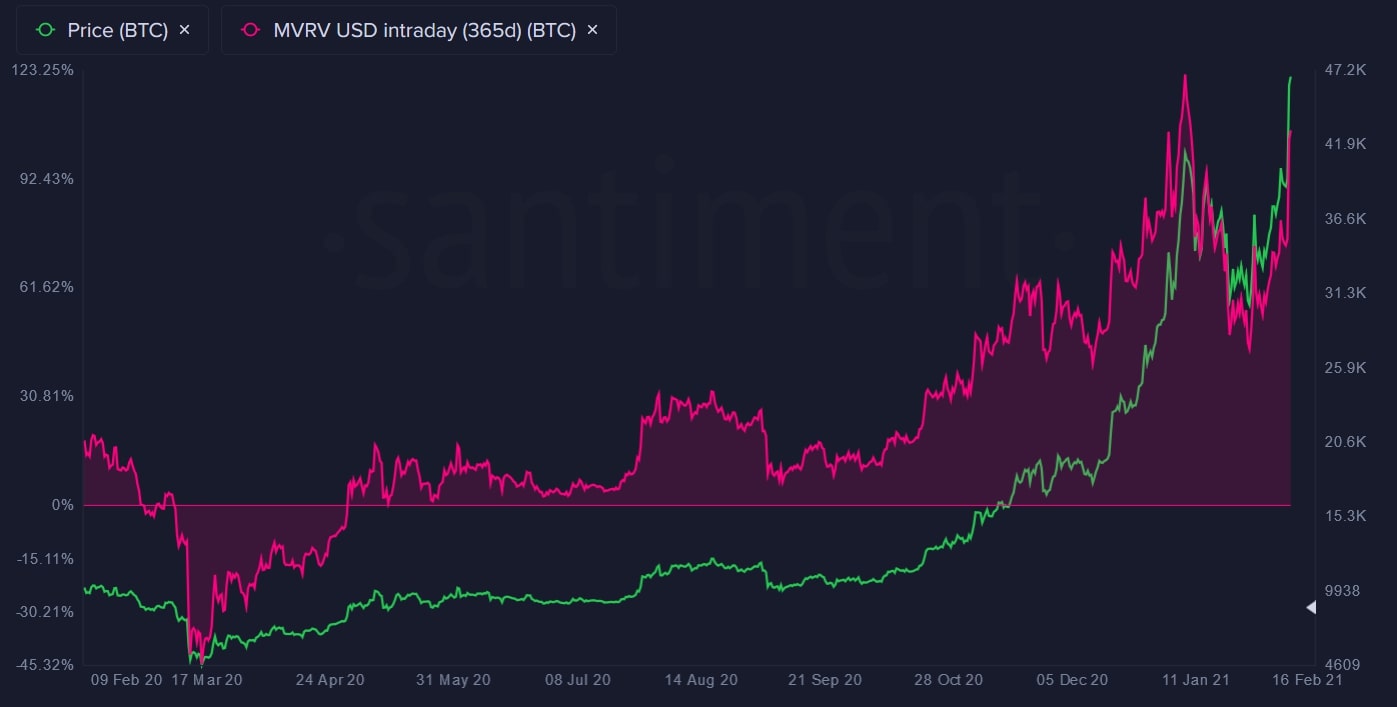

On the contrary, there were other indicators that seemed to suggest that corrections were incoming for Bitcoin in the near term. Until a few days ago, Bitcoin’s 30-day MVRV Ratio, for instance, was at its highest level since its top on the 14th of January. In fact, BTC’s 365-day MVRV Ratio was also nearing its ATH on the charts, with the indicator in question highlighting that Bitcoin was definitely in the ‘overvalued’ zone.

At the time, Glassnode had observed,

“…we’ve seen Bitcoin’s MVRV jolt even higher during the previous ATH push, but it’s safe to say that current MVRV levels are unorthodox and seldom sustainable, and usually beget a price correction in order to normalize. “

With Bitcoin hitting $50k on the charts, however, many argue that indicators such as the MVRV will count for naught. In fact, one can argue that there is precedence for the same too, especially since one of Bitcoin’s Elon Musk-related hikes wasn’t backed by most major indicators. Instead, all it took was a minor Twitter bio update to push BTC up the price charts.