Litecoin, Neo, SUSHI Price Analysis: 16 February

Litecoin moved within a fixed channel at press time, with the crypto’s indicators looking strong enough to warrant a move above the $230-mark. Neo could invalidate its bearish twin peak setup if buying activity picks up over the next few trading sessions. Finally, SUSHI was projected to rise to record levels if the bulls hold on to the $17-support level.

Litecoin [LTC]

Source: LTC/USD, TradingView

Litecoin stabilized around the midpoint of its immediate support and resistance levels, at the time of writing, after a minor correction took place on the charts. The crypto’s price climbed back above the 20-SMA, highlighting the strong uptrend over the past week, one that saw the cryptocurrency surge to a three-year high at $230. The Bollinger Bands registered some volatility in price as the price targetted the upper ceiling once more.

The CMF showed that capital inflows into the LTC market were healthy, despite dipping slightly over the last few sessions. The $207-support line could be crucial moving forward and if the bulls can hold on to this level, LTC could topple its most recent local high.

Neo [NEO]

Source: NEO/USD, TradingView

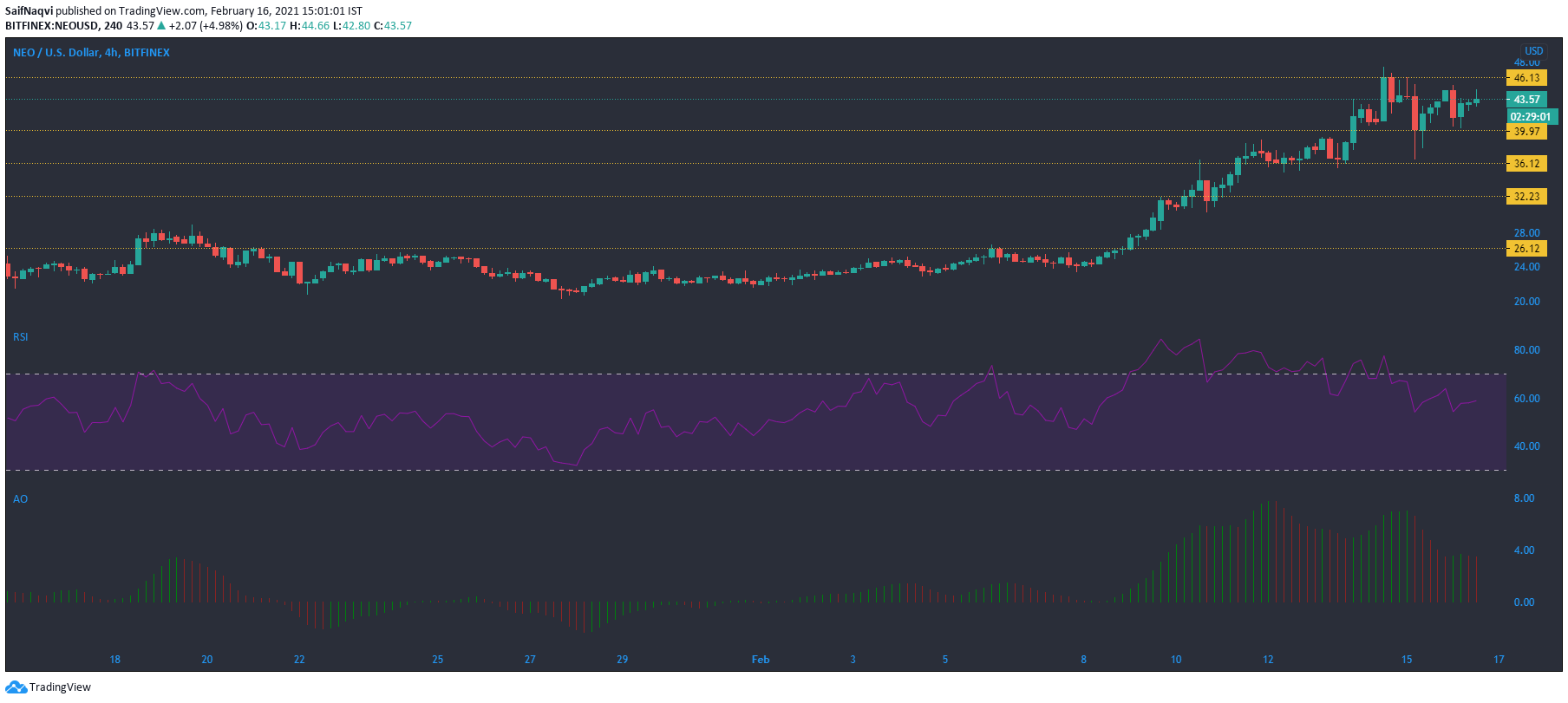

Neo’s market entered a phase of indecision after the price picked up from the $40-support level. Naturally, the indicators were mixed between the buying and selling side, at press time. The RSI pointed north from the 60-mark and sided with the market’s bulls. On the other hand, the Awesome Oscillator formed a bearish twin peak on the charts as momentum rested with the bears.

NEO could invalidate its bearish signals, however, as buying activity picked up over the last few sessions. A sharp rise in trading volumes could see the price break above its upper ceiling at $46.13.

Sushiswap [SUSHI]

Source: SUSHI/USD, TradingView

Sushiswap’s bulls held on to the $17-support level after the price retraced by over 4% after yesterday’s ATH. The MACD line moved above the Signal line, but the histogram noted a drop in bullish momentum. The Stochastic RSI moved lower from the overbought zone, but a bullish crossover could see the index trade in the upper zone once again.

The focus would be on the $17-level in the short-term and a record hike can be expected if the bulls maintain SUSHI above the press time support level.