Bitcoin HODLer count hits 5-year high amid price rebound

- Bitcoin bulls kicked up some dust as the market showed signs of accumulation.

- BTC could secure enough momentum to propel away from ascending support.

There’s no doubt that Bitcoin [BTC] and the rest of the crypto market have experienced a phase of relatively low volatility in the last few weeks. The longer this continues, the greater the likelihood of explosive volatility. But in which direction will the market sway?

Is your portfolio green? Check out the Bitcoin Profit Calculator

Let’s start by looking into the latest findings regarding Bitcoin holders. According to recent Glassnode findings, the BTC amount of lost or HODLed coins are now at a new 5-year high. But does this mean that Bitcoin’s bullish momentum is rallying?

? #Bitcoin $BTC Amount of HODLed or Lost Coins just reached a 5-year high of 7,803,692.388 BTC

View metric:https://t.co/dJK8rxBVD3 pic.twitter.com/vb4dTp2Ezp

— glassnode alerts (@glassnodealerts) August 9, 2023

The amount of HODLed or lost BTC was at 7.8 million Bitcoins at press time. The fact that BTC holders are opting to HODL is a good sign for the bulls. This may explain why its sell pressure has been limited.

However, it is not the only sign favoring a bullish outcome.

Whale are finally warming up to Bitcoin

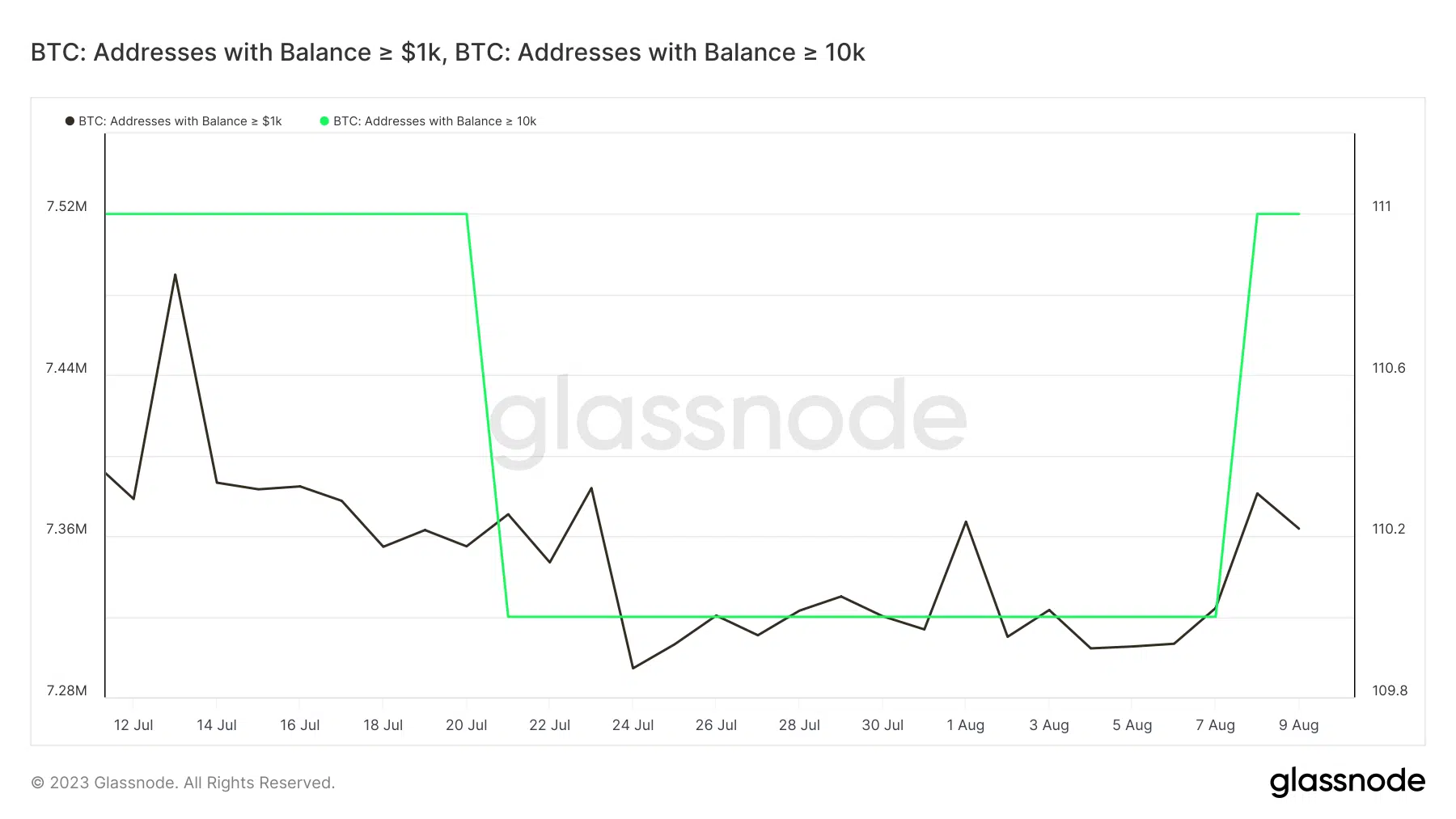

A look at whale activity revealed that Bitcoin’s demand has been improving as of late. For example, addresses with balances of at least 1,000 BTC registered a sizable uptick from 6 to 10 August. Even more impressive was that addresses holding at least 10,000 BTC registered a large spike between 7 – 10 August.

This confirmed that whales were once again accumulating BTC.

Whales have a considerable impact on asset prices, hence growing demand from whales could result in more upside. Interestingly, these findings occurred at a noteworthy point in Bitcoin’s price action.

The cryptocurrency’s price action has been trading within a support and resistance bound upward channel. Bitcoin’s price weakness recently led to a retest of the ascending support line.

We have since seen Bitcoin regain a bit of bullish momentum in line with the recent whale accumulation. BTC exchanged hands at $29,502 at the time of writing.

Bitcoin’s MFI indicator confirmed the resurgence of bullish momentum. However, only a slight uptick was observed recently, hence indicating that bullish momentum is still low.

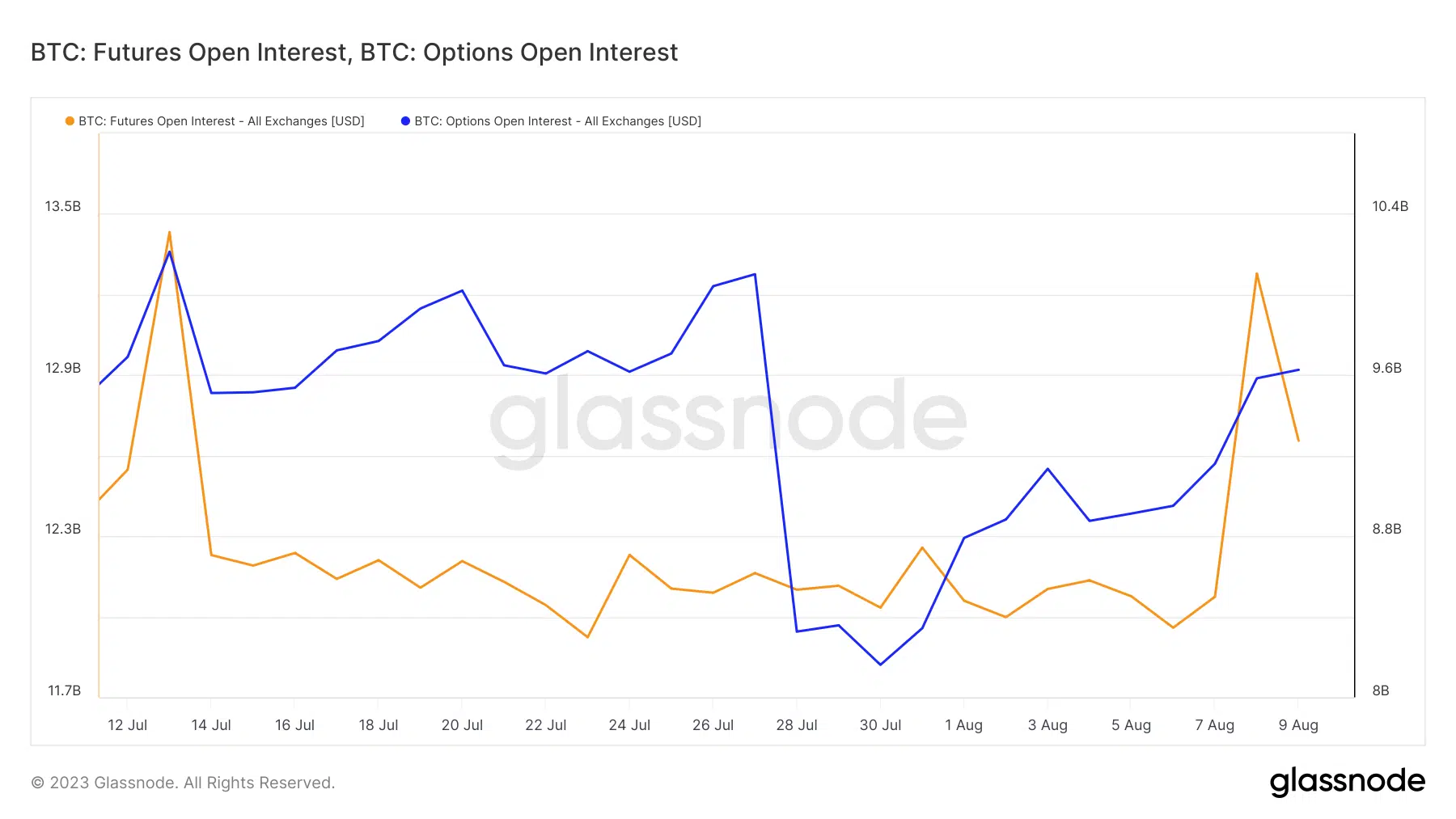

The derivatives segment also demonstrated similar optimism. Both futures and options Open Interest recently bounced back after previously declining in July.

How much are 1,10,100 BTCs worth today?

The above findings confirmed that Bitcoin was swaying in favor of the bullish side. In addition, the regulatory environment has been gradually improving and there is more to come.

El Salvador is one of the countries that has played a key role in paving the path for regulatory structure.

??El Salvador's @nayibbukele, known for adopting #Bitcoin as legal tender in 2021, has set the stage for digital asset regulation.

? @binance's recent milestone as the 1st fully licensed crypto exchange there is a testament to this.

The El Salvador crypto market's appeal… pic.twitter.com/aBwKo0dJDX

— Orion M. Depp (@OrionDepp) August 9, 2023