Bitcoin holders should look at these metrics before deciding to HODL

Bitcoin [BTC] did give investors some hope as it showed some promising growth over the last seven days. However, it appeared that bears took control of the king crypto yet again.

According to data on-chain market intelligence platform Glassnode, BTC witnessed a massive decline in its volume which could indicate an extremely pessimistic outlook for BTC’s future.

Here’s AMBCrypto’s Price Prediction for Bitcoin for 2022-2023.

According to a tweet published by Glassnode on 8 October, the transaction volume for BTC reached a three-month low of 78,000 BTC.

Along with the overall transaction volume, the mean transaction volume also depreciated by a huge margin and reached a 15-month low of 7.275 BTC on 8 October.

This development could have a negative impact on BTC’s future in the long term and BTC traders might end up in losses. However, traders may not be the only ones that could be impacted. BTC miners may also feel the heat. To add to the same, miner revenue generated from fees, also reached a one-month low of 1.131% on 7 October.

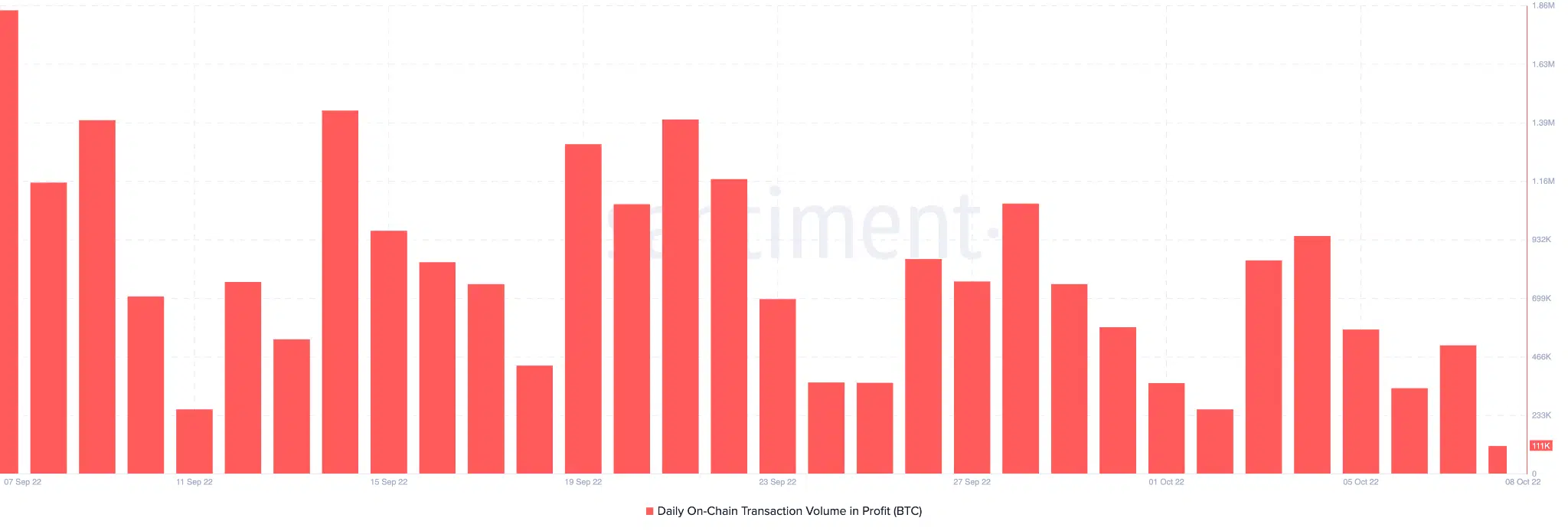

The decline in mining revenue could lead to selling pressure from miners that could impact the profitability of Bitcoin traders. Additionally, as can be seen from the image below, the daily on-chain transaction volume in profit also declined over the past month.

Crypto analytics platform, Santiment indicated that the number of profitable transactions on the Bitcoin network was decreasing.

The fall in profitability could alienate potential BTC investors and traders from investing in the king coin, thus forcing them to look for other cryptocurrencies to invest in.

When there’s a will, there’s a way

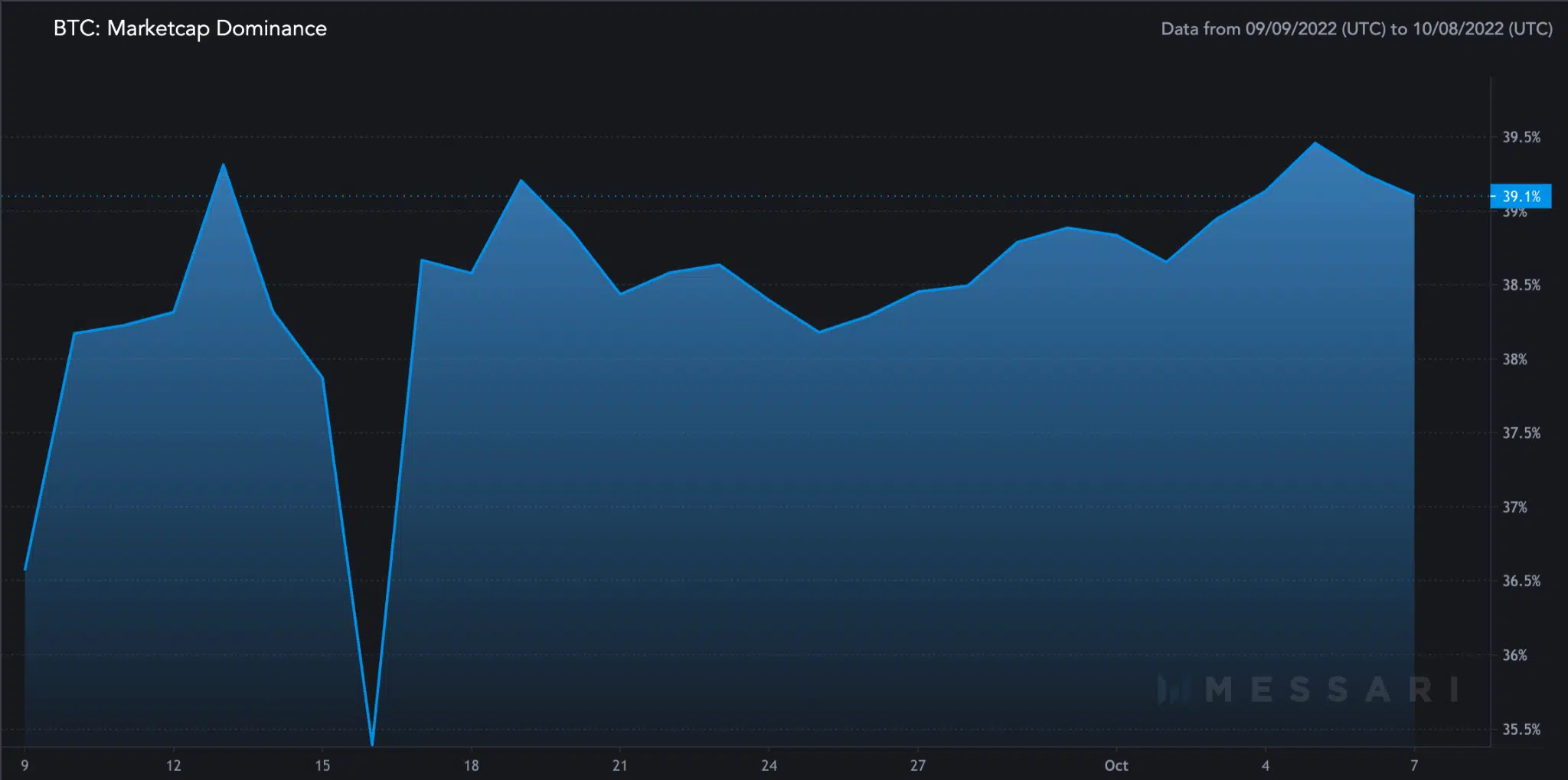

Despite the number and weightage of bearish indicators for Bitcoin in the last few days, BTC still managed to show some growth in terms of market cap dominance.

BTC’s market cap dominance grew by 5.95% in the past 30 days and managed to capture 38.38% of the total crypto market, at the time of press.

At the time of press, Bitcoin was trading at $19,522.17 and depreciated by 1.94% over the last 24 hours. Even with institutional interest in the king coin, the future still looks bearish for BTC and one of the reasons could be Bitcoin’s correlation with traditional markets.