Bitcoin: How are investors reacting with BTC breaching $30k on the downside

Bitcoin, for the first time, did not lead the market into downfall as the reason behind cryptocurrencies’ price crash was twofold. One was the rising fear surrounding the rising inflation and a potential recession, and the second was the fall of the biggest decentralized non-collateralized stablecoin TerraUSD (UST).

Bitcoin makes new records

The latter resulted in the selling of almost $3 billion worth of BTC within five days from the Luna Foundation Guard Reserve, leaving the balance of the $10 Billion reserves at just $110.82 million.

In the case of the former, it appears to be that investors have begun treating Bitcoin as a risk-on asset which is why most investors seem to have sold it off to protect their position of profits or to minimize losses.

And it does make sense since the king coin and the stock market now share a correlation of nearly 0.58, according to data obtained by CoinMetrics as of April 2022.

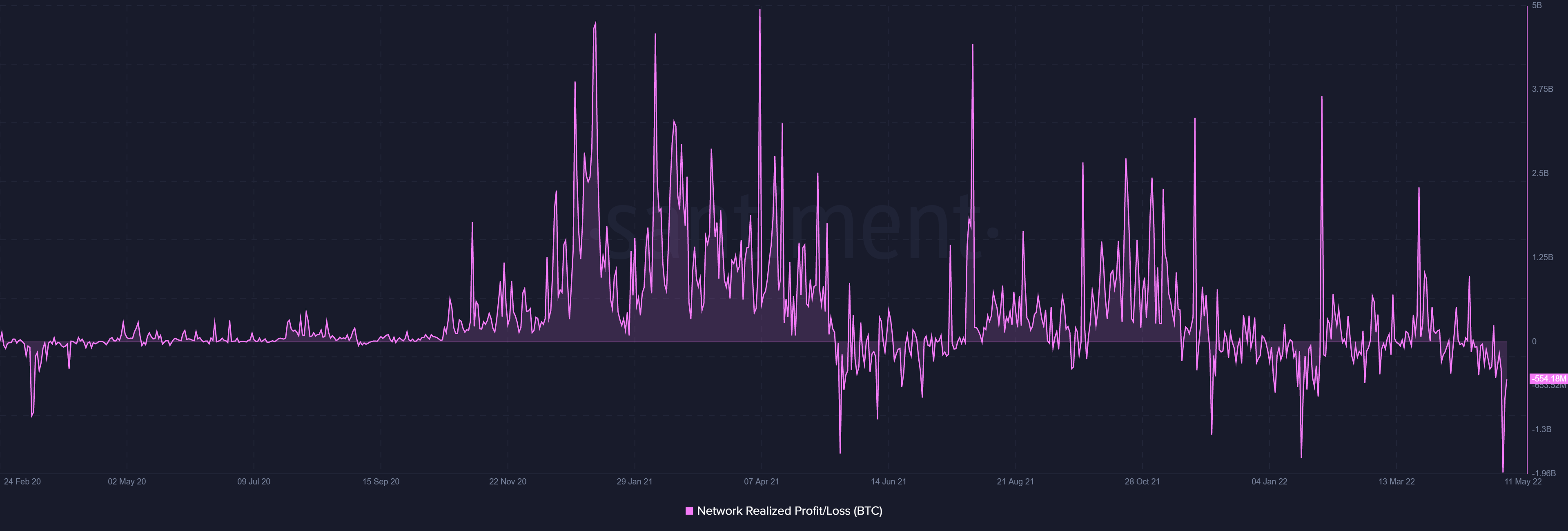

Regardless, investors have sold about 100k BTC in the span of five days, amounting to $3.17 billion. The move made sense as yesterday marked the day that Bitcoin holders experienced the most losses they ever had in the history of Bitcoin.

With over 61k BTC worth over $1.94 Billion, noting losses across the network, investors weren’t expected to have much optimism.

Bitcoin network-wide losses | Source: Santiment – AMBCrypto

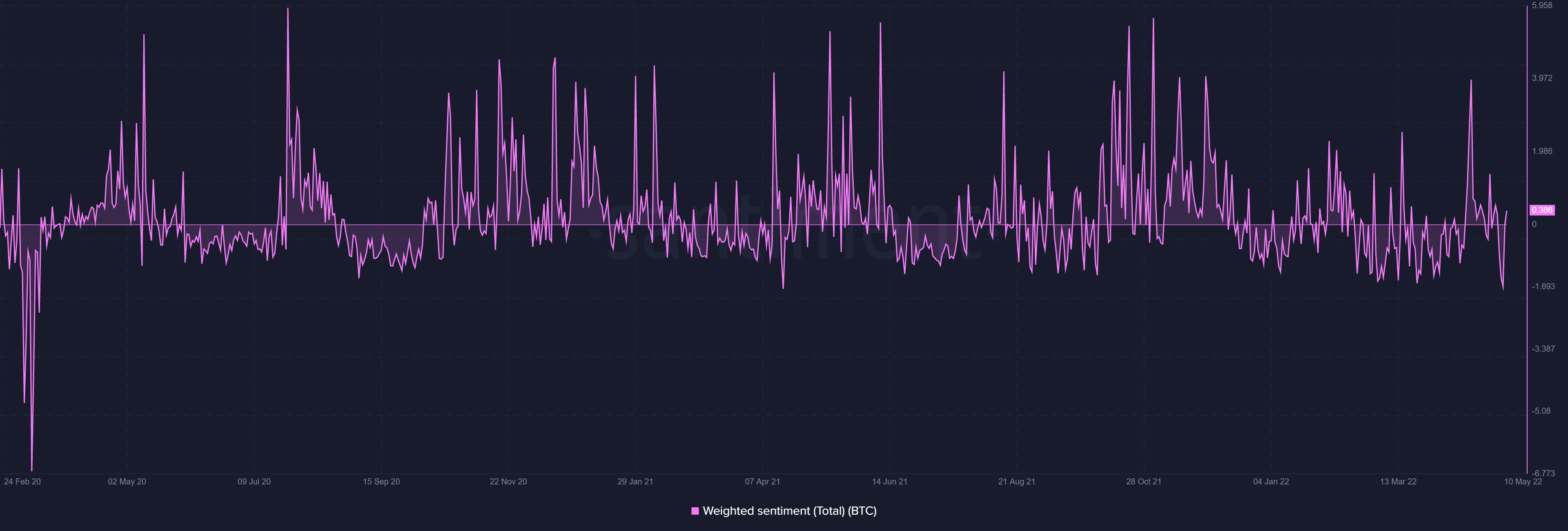

This lack of support was visible in their sentiment. Even those who bought their Bitcoin at prices under $30k were downhearted yesterday since recovery from such a low point will take time, killing their profits. Consequently, the lack of optimism concerning Bitcoin fell to the lowest point it had since February 2020.

Bitcoin investor sentiment | Source: Santiment – AMBCrypto

In fact, even the Bitcoin holding whales reached their highest point in terms of activity when transactions worth more than $100k peaked at 3.5k, the most noted since January this year as BTC fell through the $30k mark.

Bitcoin price action | Source: TradingView – AMBCrypto

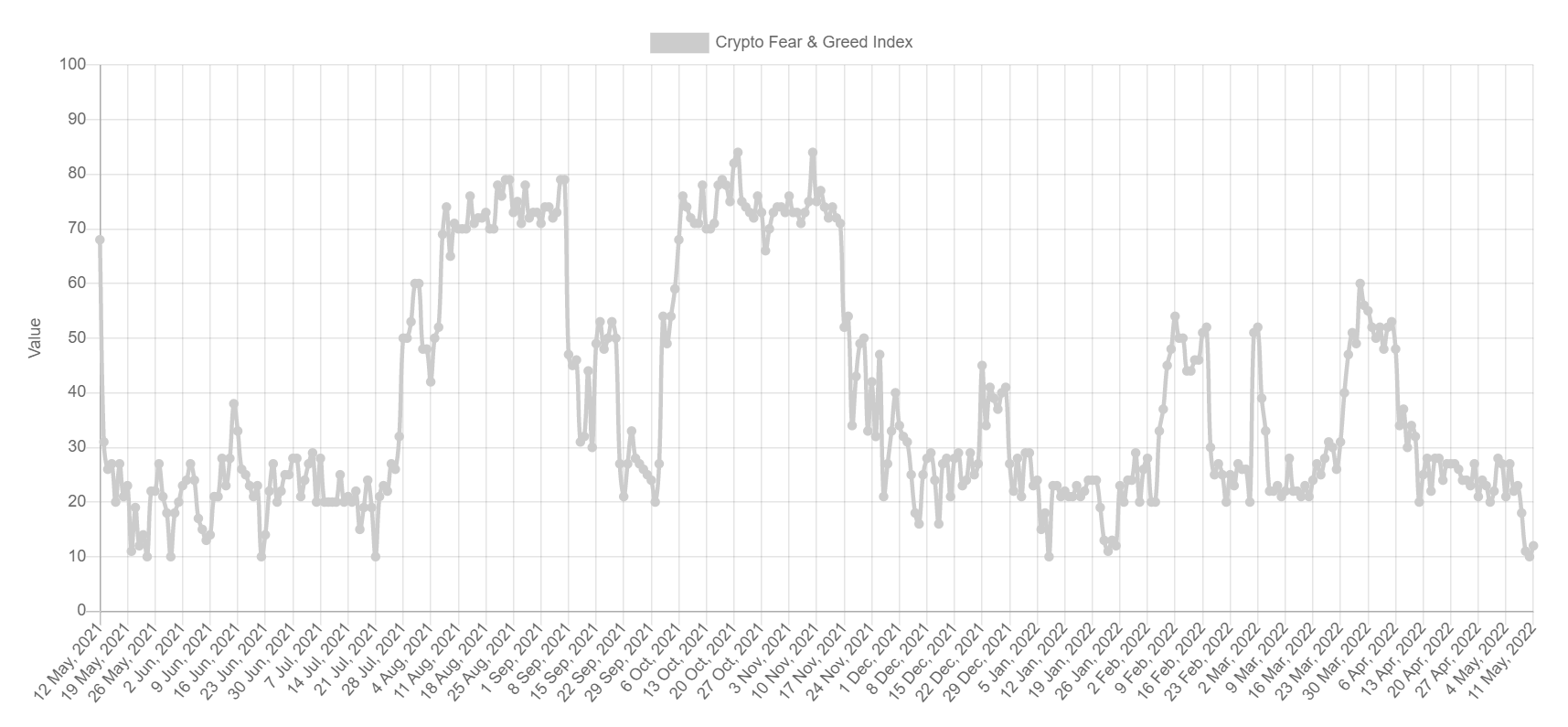

With the broader market sitting in absolute fear at the moment, it will be a while before we see some positive activity from them. The fear index hit its lowest point for the second time this year, and until some optimism returns in the market, it is best if investors hold on to their assets.

Crypto Fear and Greed Index | Source: Alternative