Bitcoin investors who can’t ‘bear’ the price fall should take note of this

Is Bitcoin going up or down? Every analyst has their own answer and as investor sentiments get muddled, so does the king coin’s price. Throw in war, a pandemic, inflation, and you have yet more factors that could be driving the price either into bullish or bearish territory. To that end, let’s see what the latest update is.

Bulls can’t “bear” it any longer

Something definitely has bulls in a tizzy and it’s the fact that more than 25,000 BTC moved off the exchanges in the past day. This suggests that accumulation is taking place, which has triggered rallies in the past.

? 25,878 #Bitcoin were moved off of exchanges in the past 24 hours, the largest difference between outflow & inflow in 5 weeks. Historically, large quantities of $BTC moving off exchanges leads to price rises given a few days for the pattern to hold. ? https://t.co/wZ4Q8LZsxn pic.twitter.com/UCWp7G5WuZ

— Santiment (@santimentfeed) April 14, 2022

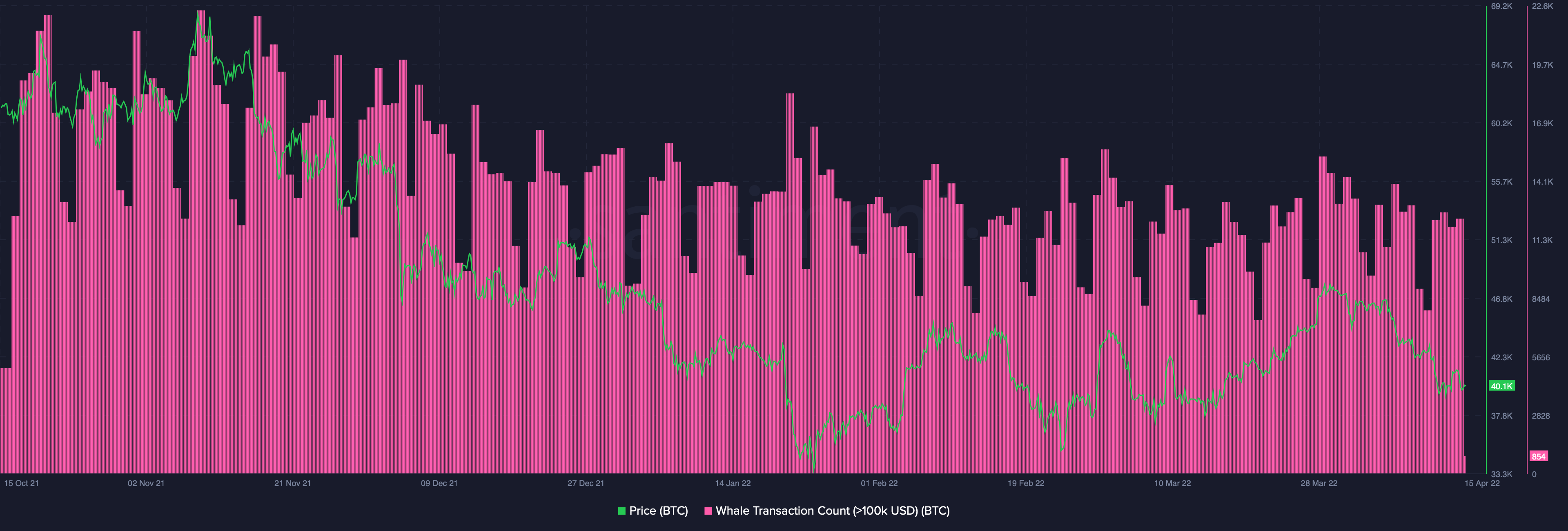

So which group of traders is responsible for these outflows? You might be tempted to point at the whales, but Santiment data revealed that whale transactions worth above $100,000 did not see any significant spikes in the past few days. In this case, it’s possible that smaller buyers may be behind the outflows.

Source: Santiment

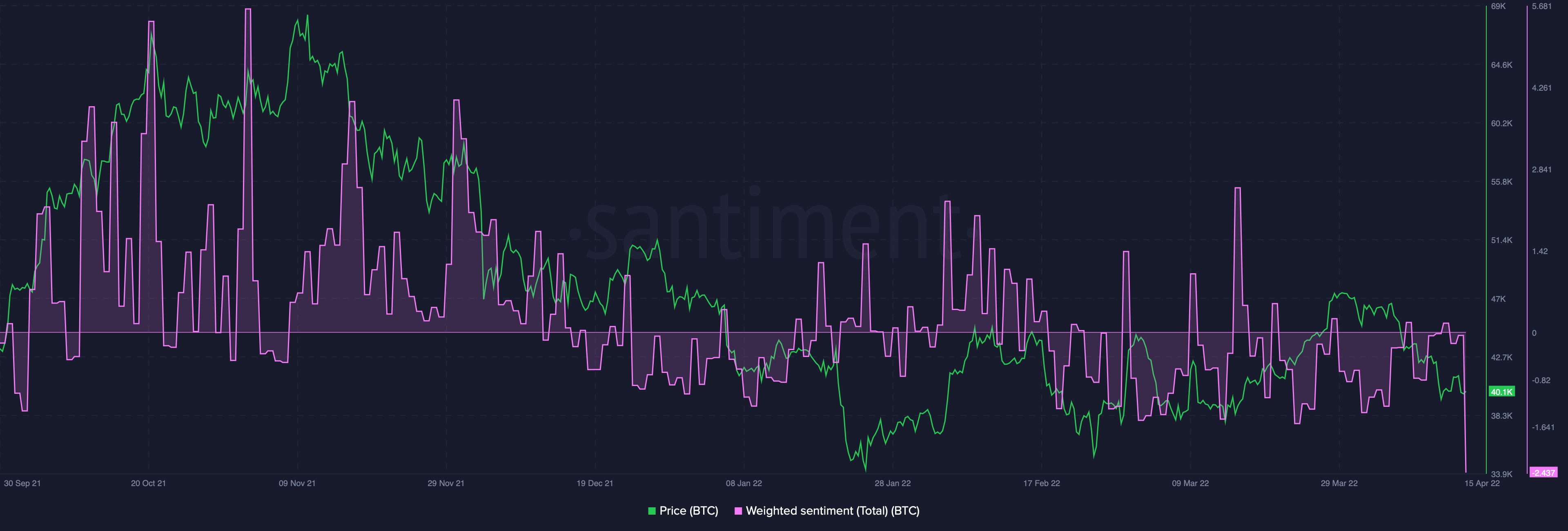

On that note, it’s important to see if sentiment levels are low enough to set off a rally, or if investors are feeling dangerously euphoric. Santiment data revealed that weighted sentiment was deep in negative territory, clocking in at -2.437, even as Bitcoin was just above $40k. If sustained, this could also boost a future rally.

Source: Santiment

An analysis by Glassnode’s Uncharted revealed that in addition to this, new support levels were being formed. The report noted,

“Bitcoin’s on-chain metrics and trading structure seem to imply a new support level forging at $39k to $40k…yet as the correlation to traditional risk-on assets remains high, caution is still advised.”

The first Bitcoin War?

Experts are still watching the crypto scene in Russia to understand if oligarchs or ultra-wealthy individuals might be adopting crypto in order to evade sanctions.

For its part, Chainalysis analyzed the liquidity of the crypto market to conclude that if crypto was being used to violate sanctions, these would likely be small amounts. The analytics firm’s report claimed that market liquidity at present could not support large-scale sanctions violations by Russian elements. It added,

“The assets of sanctioned actors far exceed what one could hope to sell without either crashing the prices of crypto assets or drawing the attention of blockchain observers. “