Bitcoin: Is 2023 the best time to ‘buy the dip’

The crypto-market is infamous for being highly volatile, with the same often fueling a shift in market sentiment. When the market witnesses a price correction, several investors tend to dump their assets in order to minimize their losses. However, many others follow the “buy the dip” strategy as it often bears fruit. History suggests that the market always bounces back when fear among investors is at its peak, giving investors the opportunity to maximize profits.

Never miss an opening

For starters, buy the dip is a popular investing strategy that revolves around acquiring an asset at a lower price, hoping that the market will bounce back. Opting for this strategy has been useful when a crypto’s price declines due to the doings of a third party and not based on the asset’s real-world use or performance. Therefore, buying at such a time gives investors the opportunity to increase profits as the market will most likely rise.

The 2021 crypto market dip

The crypto-market recorded a fall in early 2021 due to several reasons, including the Russia-Ukraine war. At that time, Bitcoin’s [BTC] price declined from $60,000 and drifted below $30,000, a nearly 50% depreciation. The market was quick to recover though as just in a few months, BTC’s price soared on the charts.

In November 2021, the crypto’s price hit an all-time high of over $64,000. However, the crypto-winter followed, once again causing the market to decline. Ethereum [ETH] also saw a similar trend in its price during that period, when its price touched an ATH of > $4,700.

Did investors buy the dip?

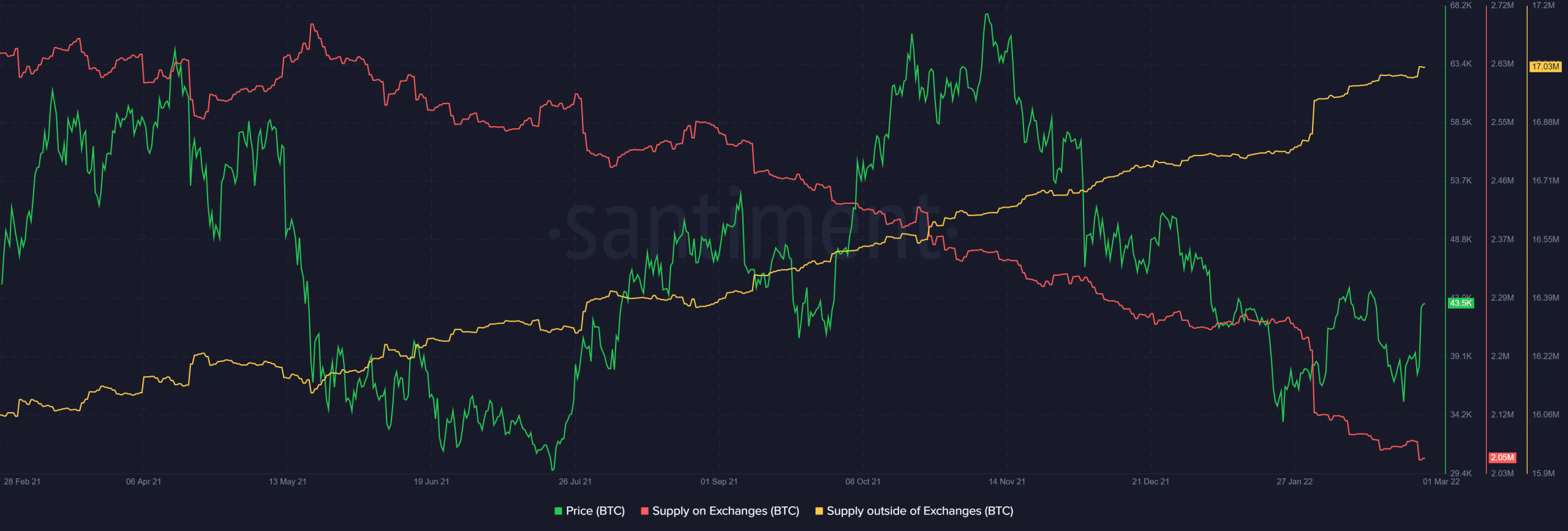

During the 2021 episode, a look at BTC’s on-chain metrics clearly revealed that investors were buying the dip. As per Santiment’s chart, after November, when BTC’s price plummeted, its supply on exchanges declined.

This happened while BTC’s supply outside of exchanges rose – A sign of increased accumulation.

Not only BTC, but ETH metrics also conveyed a similar story.

Ethereum’s supply on exchanges declined, with the same accompanied by a hike in supply outside of exchanges. Moreover, the chart also revealed that ETH’s supply held by top addresses was also on the rise, reflecting investors’ trust in the token. However, ETH’s network growth declined over that period, indicating fewer new addresses were created to transfer the token.

2022 was no better

The series of mishaps did not come to an end in 2021. The following year began on a sour note, and it was further worsened by the Terra LUNA collapse. It severely affected the prices of all the cryptos, the effects of which are visible to date.

However, it was interesting to see that a similar “buy the dip” trend was also seen during that period as investors remained confident for a change in the market’s fate over the coming years.

Will the market revive itself anytime soon?

Though 2023’s opening quarter was better as the market gained bullish momentum, the good days were short-lived.

Right now, BTC seems to have settled under the $28,000-level – A concern for investors. However, this might be a good opening for investors to accumulate or rather “buy the dip”, before BTC’s price action once again turns bullish.

BTC halving is less than a year away

Bitcoin is scheduled to undergo its fourth halving next year in the month of April. If history is to be believed, Bitcoin’s price can skyrocket after its halving.

For instance, during 2020’s Bitcoin halving, it was valued at $8,500, but it took a few months to climb over $27,000. A similar trend was seen during the first Bitcoin halving. The value of Bitcoin surged considerably in November 2013, after its first halving in November 2012. Therefore, this might be an appropriate opportunity for investors to accumulate BTC.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Investors are still in accumulation mode

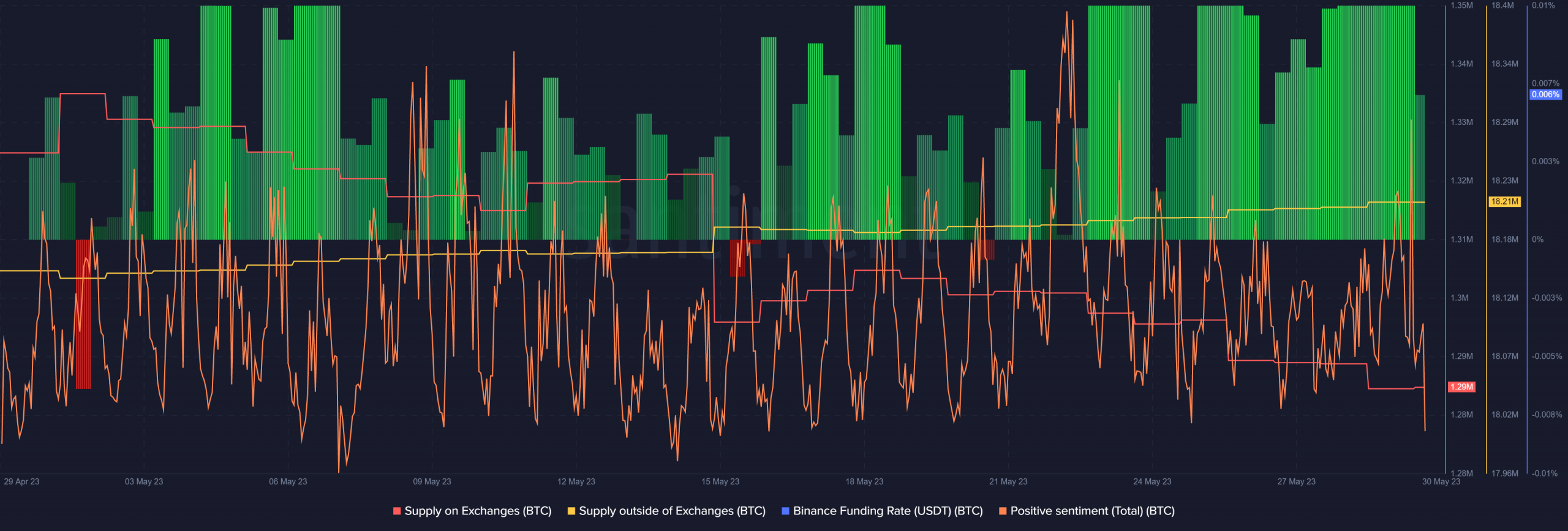

A similar hike in the amount of supply outside of exchanges was also plotted on last month’s graph, indicating that investors were still buying. Not only that, but BTC’s Binance funding rate has been substantially high too.

A high funding rate is a sign of demand in the derivatives market. Positive sentiment around Bitcoin is also high – A sign of investors’ confidence in the king coin.