Bitcoin is at $38k but is there more room for growth?

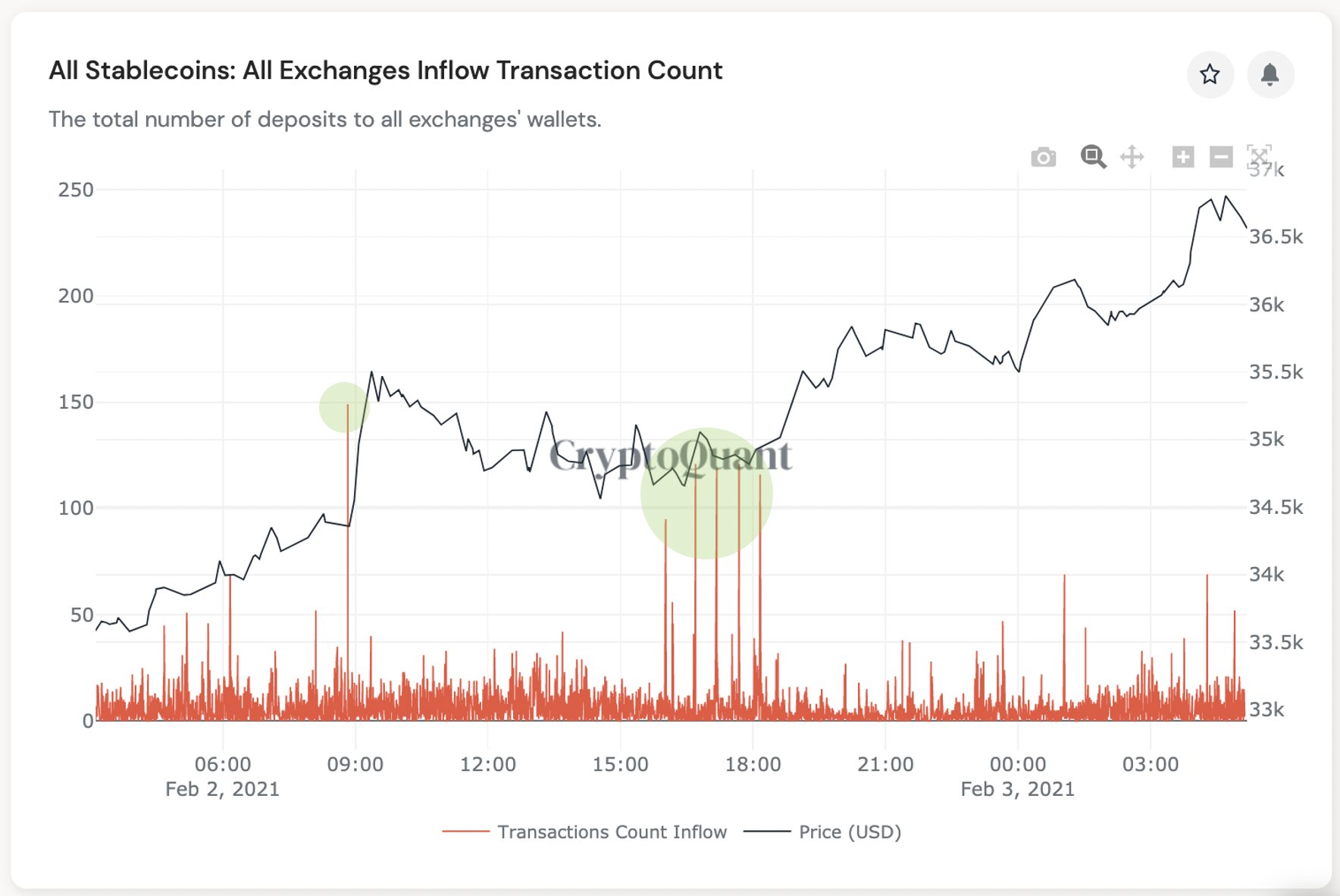

Bitcoin’s recent surge above $37000 is the second time the king coin has breached the level in the past five days and has retail traders asking, what happened? What’s behind the investment flow, that signals a positive shift in trader sentiment? This time around, there were no bearish signals from miners, stablecoin deposits to all exchange wallets surged considerably in the past week and the outflow from Coinbase was significant. The outflow from Coinbase can be attributed to increasing institutional interest in Bitcoin and maintaining treasury holdings in Bitcoin as the reserve asset, and demand on both spot and derivatives exchanges.

Source: Twitter

The inflow of stablecoins to whale wallets is a strong indicator of the direction of Bitcoin’s price rally. It can be relied on for predicting an instant rise, a short-term top or trend reversal, regardless of other metrics and the overall market trend. The recent surge in the number of whales and the concentration of Bitcoin HODLers has made the buzz, and it could be behind the price surge. Hence, the price is a reflection of traders’ interest, risk-adjusted against returns and volatility in the short-term.

This decides the duration for which active supply will be down and Bitcoin will remain away from exchange wallets, in cold reserves. Additionally, contrary to popular opinion, BTC ownership is much less concentrated than often reported and has become even more dispersed over time. However, with every rally, the number of institutions has increased, suggesting the arrival of more institutional investors.

The smallest participants in the market, have increased nearly 130% since 2017. The second smallest group is up 14%. Together, this would make up ownership by small retailers, in contrast to large entities whose holdings have dropped to between 3% to 7%. This suggests that the number of institutions invested in Bitcoin is up, but the number of whales HODLing Bitcoin has dropped, and this has a critical role to play in the ongoing price rally. With institutions, the supply is influenced more significantly, as institutions seldom sell, if Bitcoin is on their balance sheet. This keeps the active supply down. These are a few reasons behind Bitcoin’s price rally to $37000 and there may be room for vertical growth in the current price rally.