Bitcoin is stuck between two trends, but is it too late now

Keeping up with its usual unpredictable self, Bitcoin was well below $47,000 at press time. Days after it briefly hit $50,000. While Bitcoin proponents continue to trust the bullish side of the market, prices continue to stall on the charts.

Consolidating higher on the charts is still a good sign for positive ascendancy. But collectively, there might be more contradictions at the moment.

In this article, we will try to analyze the ‘why’ part of the current market structure, one that is becoming more unsure by the day.

Modern-day disbelief in Bitcoin?

Bitcoin’s long-term credentials have become more healthy over the past few weeks as the threat of dropping below $30,000 has dissipated. However, there is a strong difference between the rally in Q1 of 2021 and the current recovery.

Now, a part of the community believes that BTC’s bullish momentum is on par with its early-year exploits. However, that might not really be the case. Open Interest for both Futures and Options has risen alongside the price. BTC witnessed a hike of $1 billion in Futures contracts over the past week as traders took on more leverage.

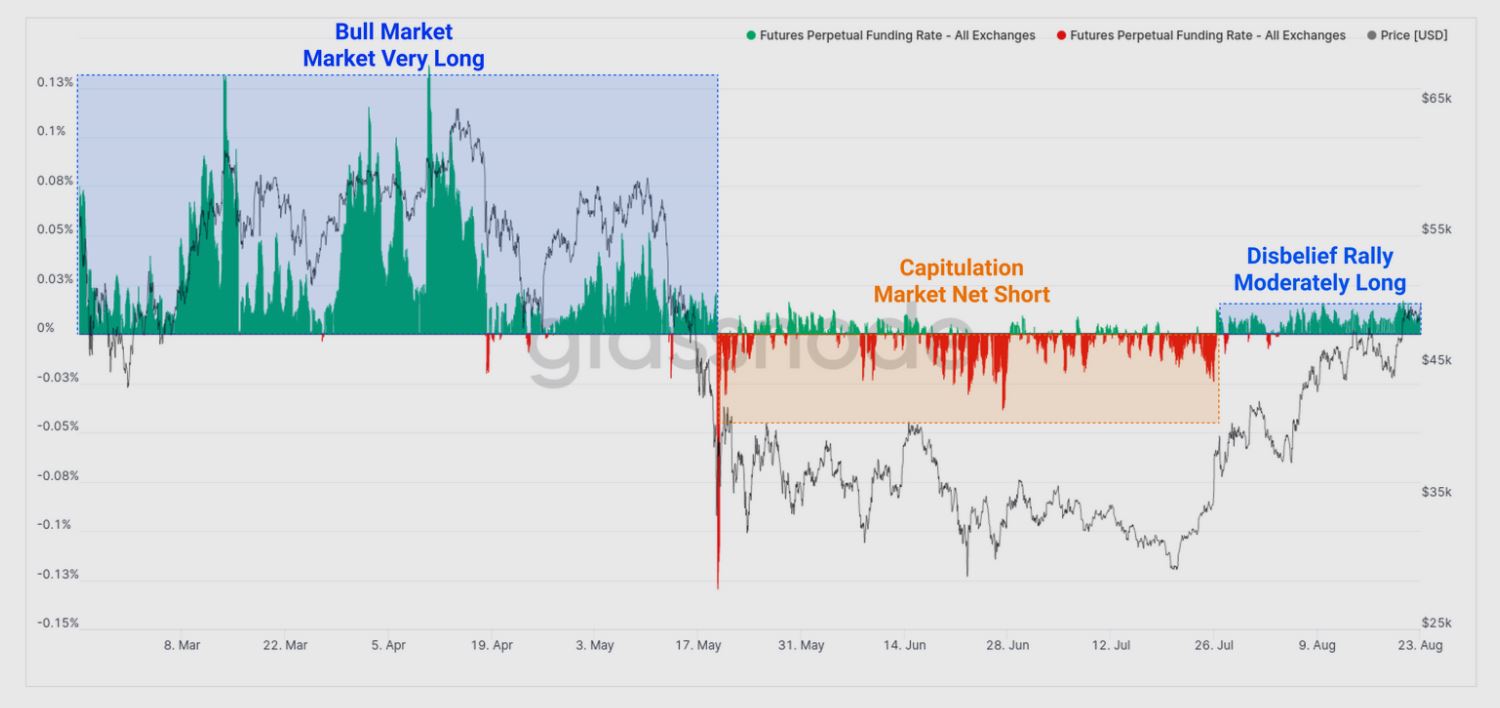

However, the attached chart can be looked at to explain the overall directional bias. At press time, inferences could be drawn from funding rates that traders are only moderately long or bullish, unlike the aggressive long positions witnessed in Q1 of 2021.

It is a stark difference because, in Q1, the idea of a correction did not cross anyone’s mind after Bitcoin crossed $20k. The sky was the limit for the king coin. Right now, BTC has levels to capture again and this is leading to contrasting expectations from the market.

Balance on Exchange activity – Stagnancy vibes?

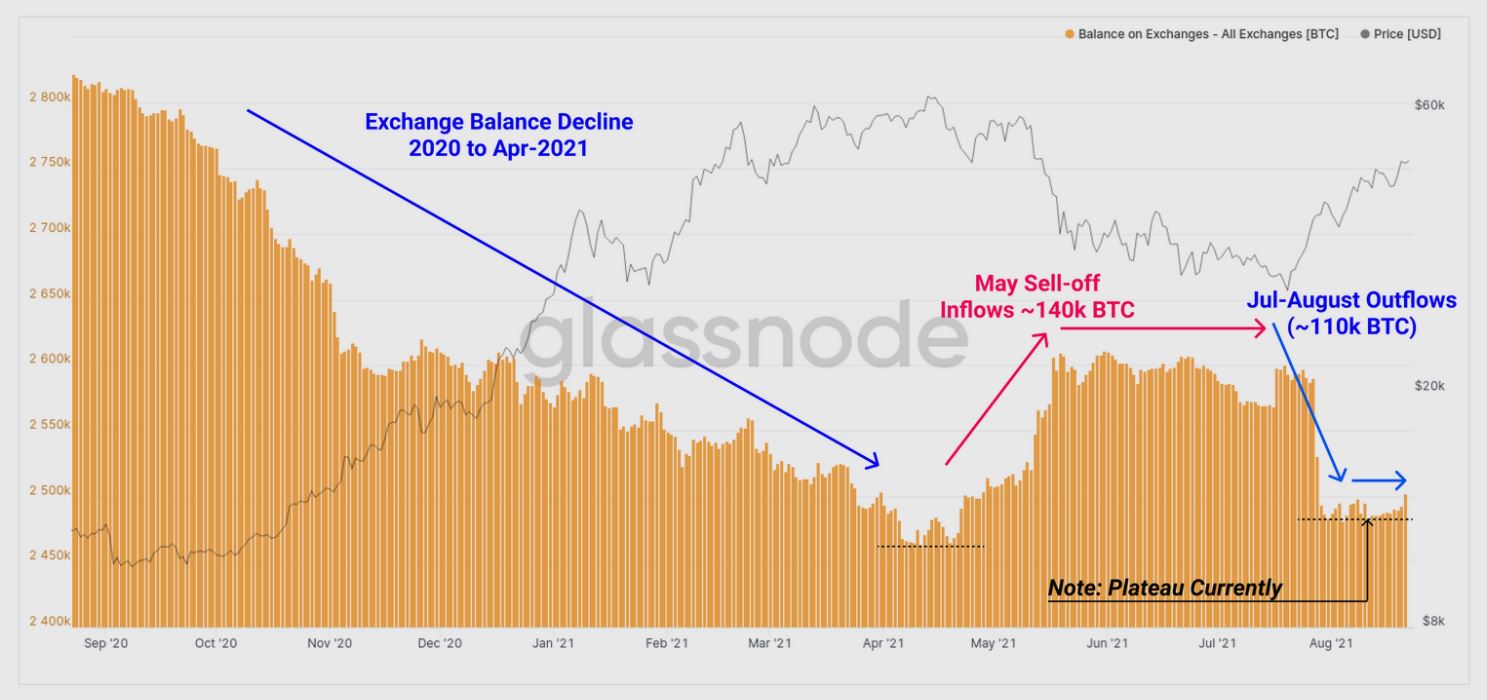

Now, data from Glassnode pointed to another interesting disagreement. During the month of May, significant net inflows for Bitcoin were observed with close to 140k BTC entering exchanges. The sell-side of the market was taking over. In July, however, close to 110k went out in outflows. So, bullish momentum was built for more outflows correction? Nope.

Over the past few weeks in August, the net exchange flows have stalled at around 2.5 million BTC – Around 13% of the circulating supply.

It meant that both profit-taking and accumulation had similar levels of activity. In fairness, the present stalling nature of BTC is due to the market’s split opinions. There are both bullish and bearish traders, and one of them would have to give way first before there is some directional bias again. At press time, bears seemed to have the upper hand. However, it might not be too late for the bulls to recover their positions.