Bitcoin: Making the most of this bull run

Bitcoin had a strong rally over the last couple of days, placing the coin at $37,000 also reaching $40,000 earlier in the day yesterday. So naturally the question of “Is this a bull run?” comes to one’s mind. Considering what on-chain metrics and analysts say, the answer might not be what one would expect.

Bitcoin in a bull run?

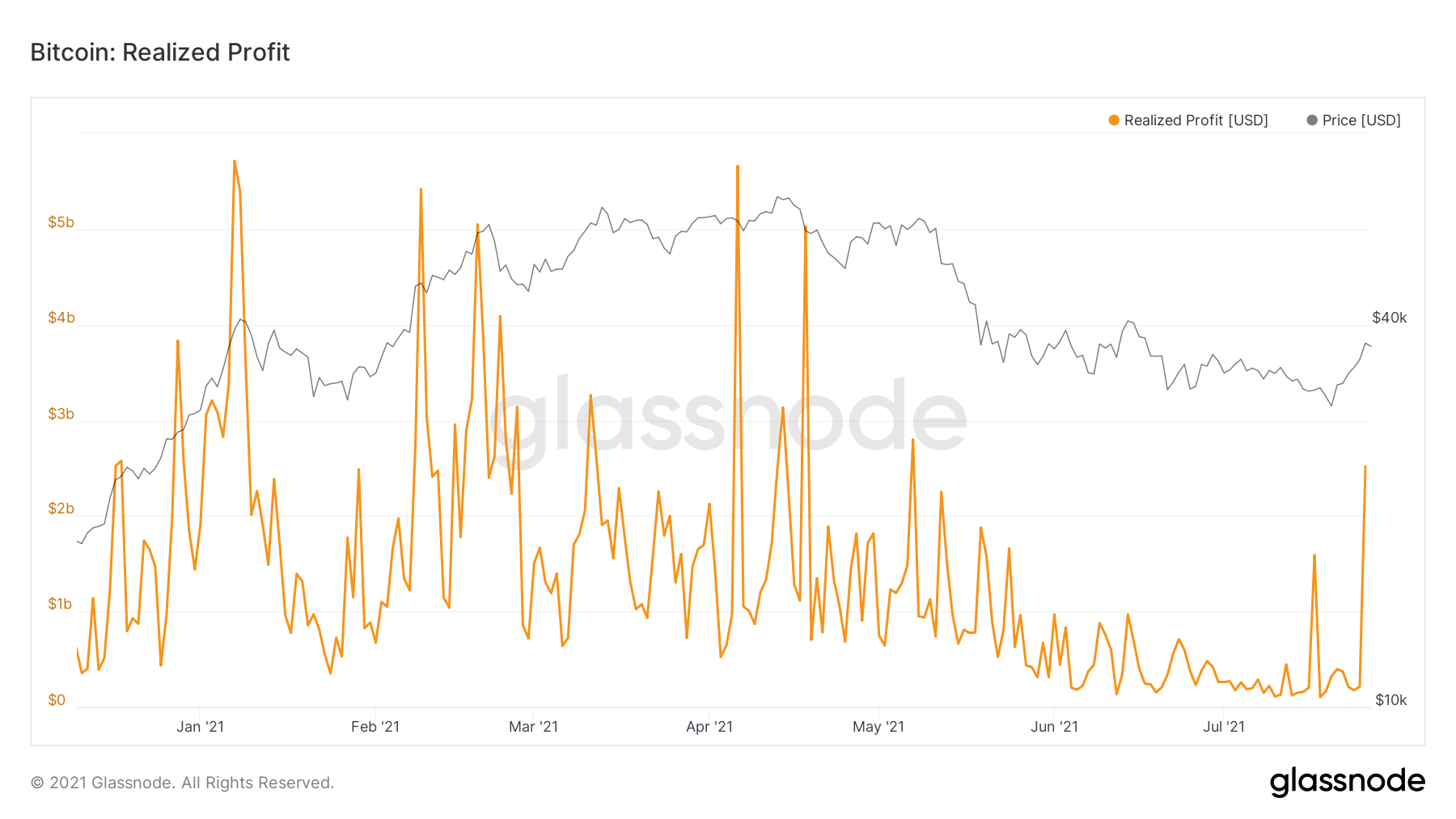

Bull runs can be both short and long term, but depending on what kind of investor you are, your perspective may vary. However, based on the movement registered by multiple metrics on the daily chart Bitcoin seems to be in a good shape. Since July 20, the king coin was up by 25.19% and the price actions’ movement could be seen reflected upon the metrics as well. Realized profits displayed the biggest jump of all as the indicator was up by $2.3 million. This is calculated on the basis of comparing the price of coins at last movement in comparison to its current movement price.

Bitcoin’s Realized Profits were up by $2.3 million in 24 hours | Source: Glassnode – AMBCrypto

Prior to July 26, realized profits were at a mere $214,027, whereas yesterday the same profits stood at $2.5 million. This shows that at the moment Bitcoin is much more profitable than it has been in almost 80 days. Additionally, Active Addresses spiked as well since more people became active as the prices went up.

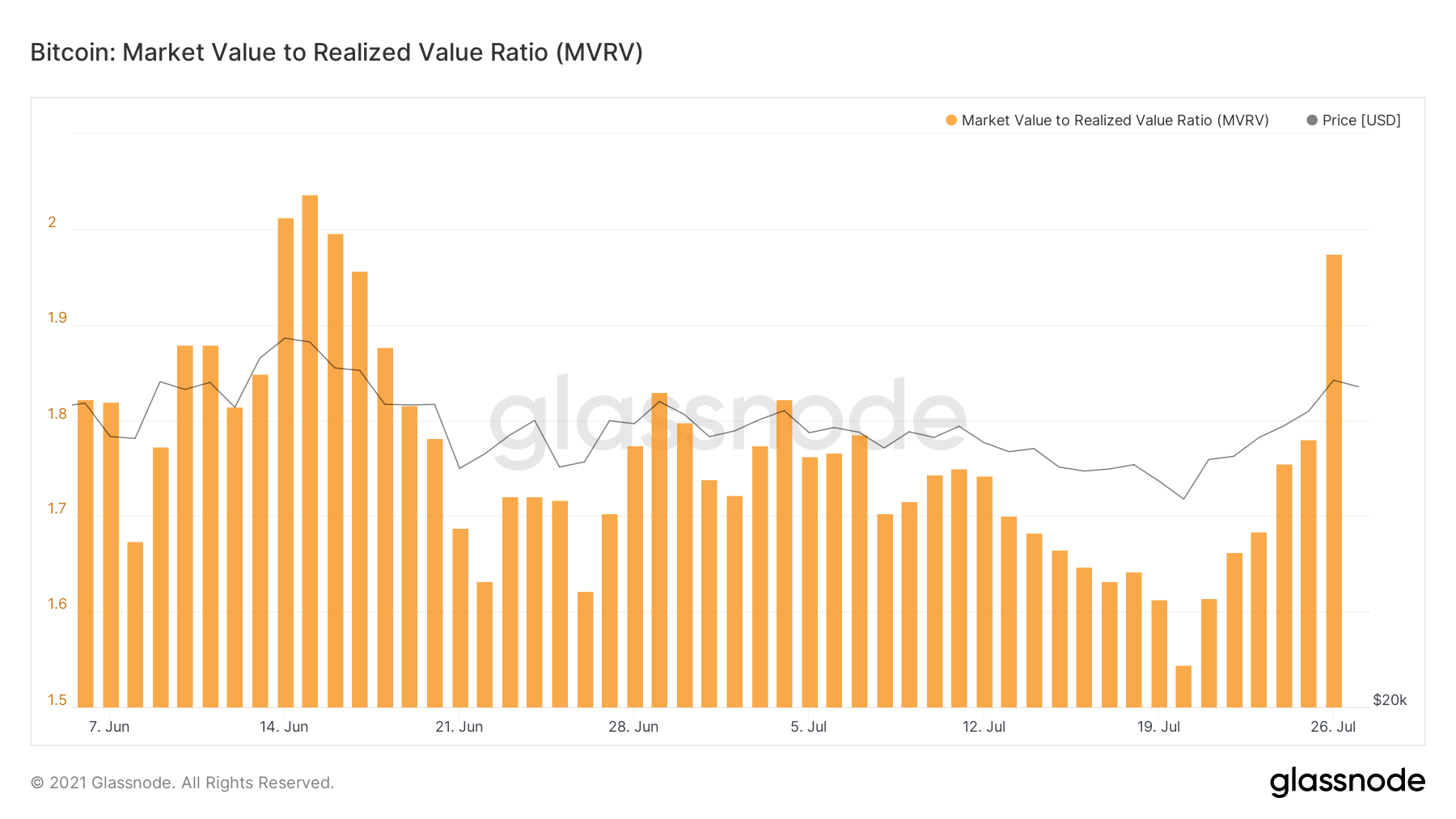

These many addresses were last observed to be active on July 3. Backing up this positive movement was the MVRV (Market Value to Realized Value) ratio which shows if the coin has a fair value or not. The indicator was at a 43-day high as Bitcoin seemingly became profitable.

Bitcoin MVRV ratio at a 43-day high | Source: Glassnode – AMBCrypto

All these factors are a clear indication of a short-term bull run. But what your targets for buy and sell should be are important as well.

Entry and exit points

Analyst Tone Vays in his recent analysis marked out the important zones which are important for Bitcoin as well as investors to make the most of this bull run. He specified 2 zones as such. The first being $40k, which was touched during yesterday’s trade. Once BTC closes above $40k, a consistent movement upwards can become possible for the king coin.

Secondly, the 200-day MA and the 50-day MA are both in a resistance position presently. In order to support this bull run, these 2 levels need to be turned into support. He closed his analysis reiterating,

“I see this as a bull market… Just like my Twitter says, I’m expecting a $100,000 by the end of year”

Bitcoin’s important levels | Source: Tone Vays