Bitcoin may be at an inflection point, but is it ‘big enough to be unstoppable’

MicroStrategy’s founder Michael Saylor is considered one of the most vocal and enthusiastic proponents of the cryptocurrency. His supportive words have also translated into action over the past year, with his company going on to acquire 114,042 BTC in a series of buying sprees that began in August last year.

Since his holdings have almost doubled in value during this time, it makes sense for the CEO to continue espousing the digital asset publicly. In a recent interview, Saylor lamented that not many investors understand his affinity to the coin, although that might not entirely be a bad thing for him. He said,

“In fact, I like the fact that people don’t understand it, don’t agree with it, or are afraid of it because I couldn’t afford to buy it if they all agreed with me.”

Saylor continued,

“I believe we’re at that inflection point for Bitcoin where it’s big enough to be unstoppable. But it’s still new enough that there are 10,000 billionaires and maybe five of them out of ten thousand get it and so the catalysts are all to the upside and most of these risks they’ve been worked out over the last decade.”

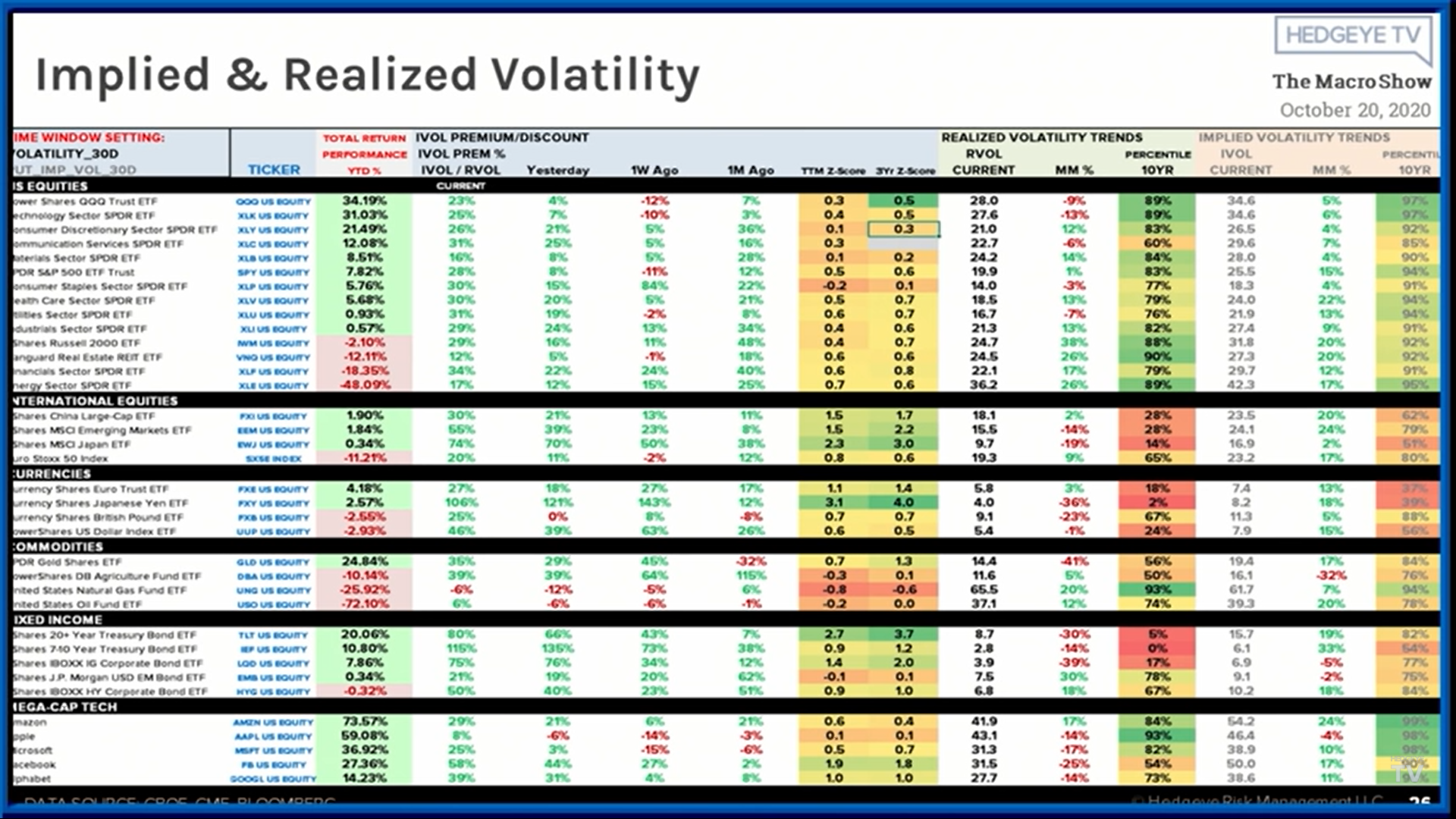

One of these perceived risks is the asset’s price volatility, something that has tainted Bitcoin’s image and credibility over the past decade. While Saylor agreed that Bitcoin’s first decade was marked with “a lot of volatilities,” he argued that the past 90 days have seen it go lower than what has been recorded for traditionally ‘safer’ investments such as Nasdaq, Russell 1000, 10 or 30-year Treasuries, swaps, big tech companies, silver, and gold.

He added,

“My unscientific view is on every single day at least half of those assets are more volatile than Bitcoin and on a lot of volatile days I’ve seen 80 to 90 of them be more volatile than Bitcoin.”

This dedication is, in fact, true in some sense, as pointed out by the show’s host and Hedgeye CEO Keith McCullough. According to McCullough, Saylor’s “observations are an empirical fact.”

As can be seen from the chart above, Apple’s implied volatility has been nearing 50, as “when something goes down it starts to realize volatility.”

In fact, due to a recent rise in government bond yields, shares of big tech companies including Apple, Amazon, and Netflix have seen a decline in prices, leading to greater volatility.

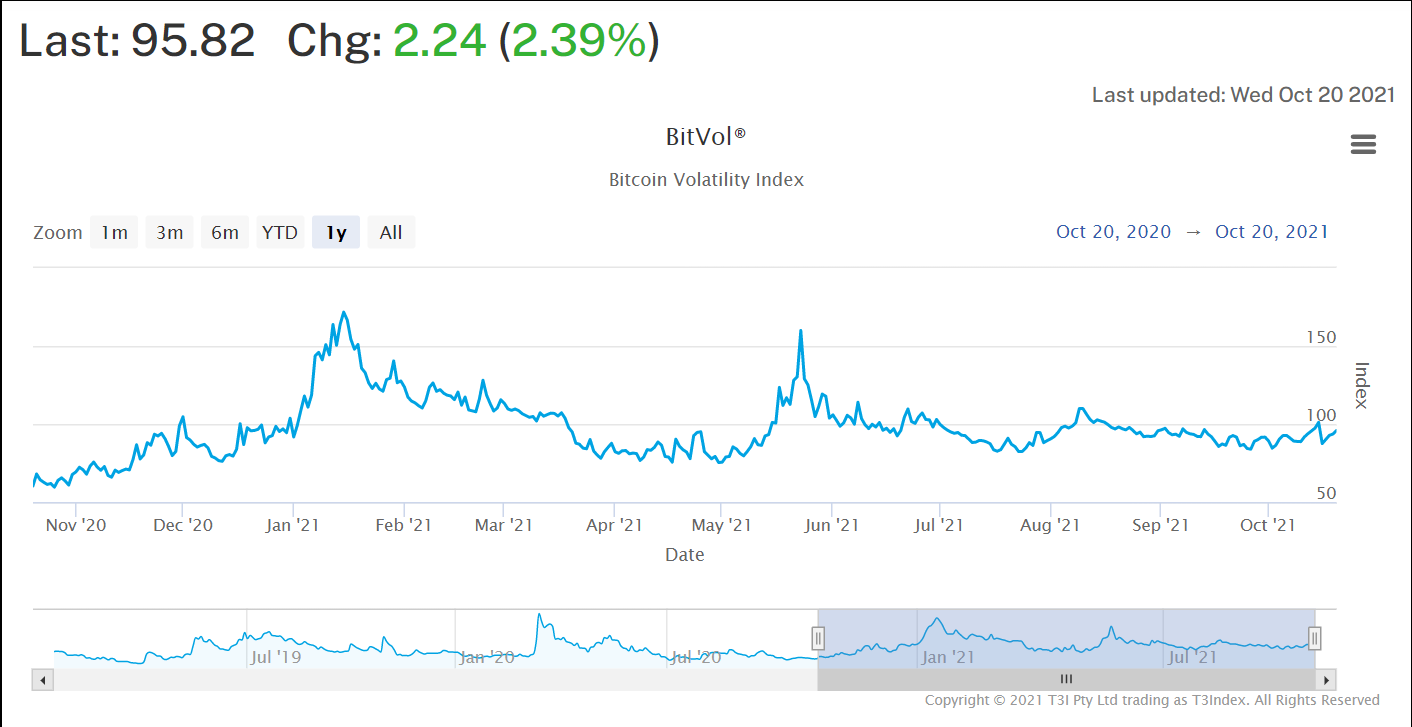

Source: t3index.com

On the contrary, Bitcoin has surged in price over the past few weeks on the back of growing inflation fears and the much-awaited ETF approval. Since the market crash in May, Bitcoin’s volatility has seen a major correction, as its expected 30-day implied volatility fell from almost 160 to 95 during this time.

The billionaire went on to explain that as the U.S. government is increasing its monetary supply, people are looking for a store of value, with many choosing Apple stocks as favorable candidates. In his view, however, this preference for big tech stems from misinformation and the skewed image of BTC’s volatility.

While Saylor’s company continues to be the biggest public holder of Bitcoin, the launch of the ProShares ETF could have great ramifications for its investors. Many are claiming that the ETF is potentially better exposure to Bitcoin than MicroStrategy, which basically acts as a proxy Bitcoin investment.

In any case, MTSR stocks have seen a hike in valuation over the past few days after BTC hit a new ATH on the back of $BITO’s success.