Bitcoin miner revenue faces downturn, but profitability holds strong

- Bitcoin miners weather revenue dip and remain profitable despite market sentiment.

- Negative netflow suggests miners and holders hold onto Bitcoin despite declining values.

Bitcoin miners experienced a downward spiral in their earnings as the prevailing market sentiment took a toll. Nevertheless, emerging reports indicate that miners managed to maintain a certain level of profitability despite the challenging conditions.

Read Bitcoin (BTC) Price Prediction 2023-24

Bitcoin miner revenue sees sharp plunge

June 14 witnessed a notable decline in revenue for Bitcoin miners. According to data from Blockchain.com, their earnings amounted to approximately $20.9 million that day. This figure starkly contrasted with the previous day’s revenue of over $24 million, indicating a significant decrease within a mere 24-hour span.

Although the current revenue level marked the lowest point in nearly three months, it remained higher than the lowest recorded throughout the year, which stood at approximately $16,000 in January. The prevailing sentiment around BTC and the general crypto market likely influenced the decline in miner revenue.

Despite this recent setback, it’s worth noting that miners still maintained overall profitability.

Bitcoin miner’s profitability stays intact

In light of recent data from Glassnode, it appeared that miners managed to maintain profitability despite the recent decline. Since the inception of Bitcoin’s open trading in 2010, miners have generated an impressive $48.8 billion in revenue.

On the other hand, their estimated production expenses total approximately $35.8 billion. This resulted in a net surplus of +$13.0 billion across the mining industry, leading to an all-time profit margin of 37%.

The profitability assessment is based on the Miner Thermocap and Cumulative Production Cost metric. The realized revenue for miners encompasses Thermocap and Transaction Fees, while Difficulty Production Cost represents the aggregate mining input expense.

Although miners have remained profitable, the data also indicated that profitability had been relatively tight since 2015.

Negative netflow persists

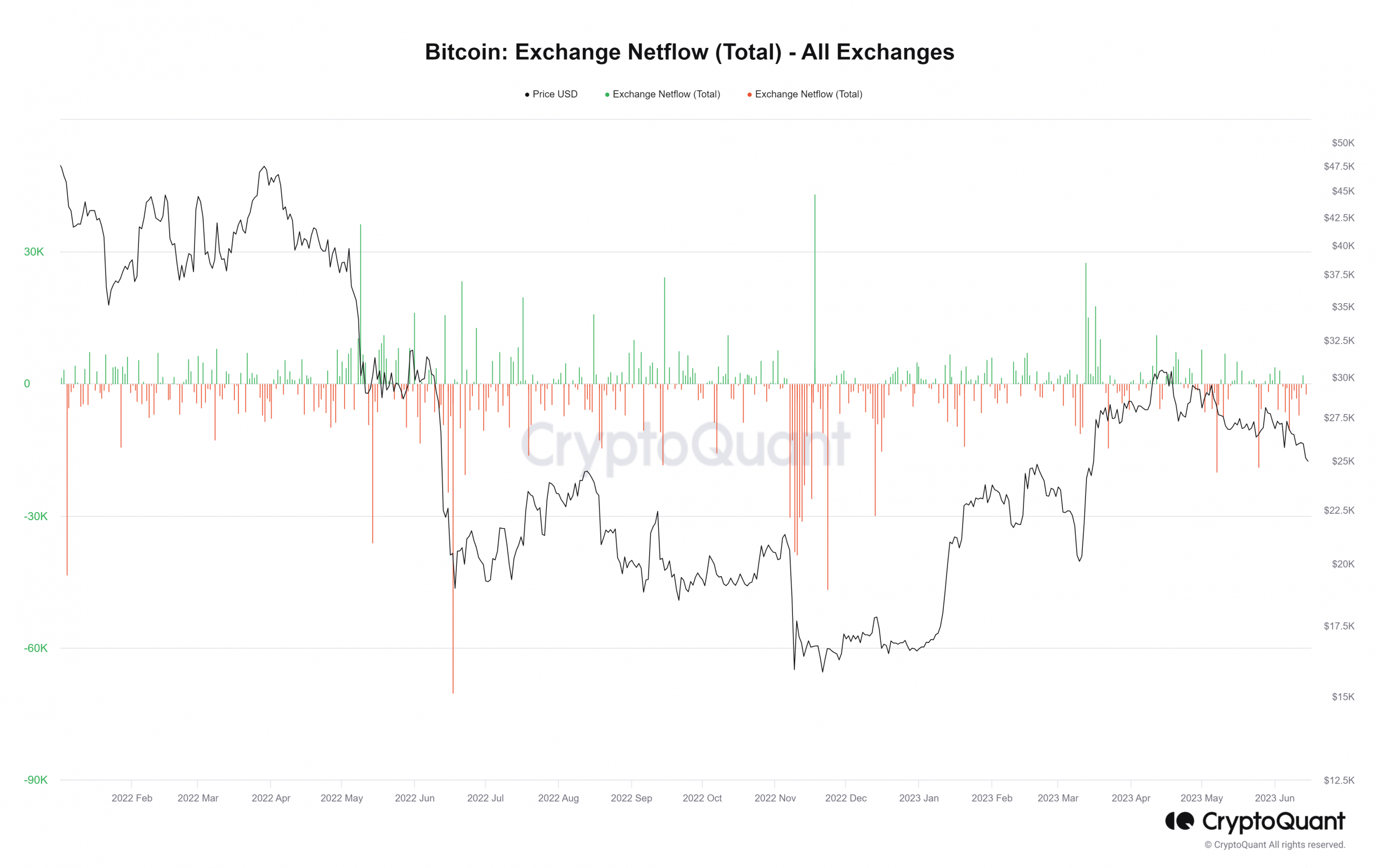

The Exchange Netflow metric is a valuable tool for monitoring potential sell-offs of Bitcoin holdings, particularly among miners. According to Santiment, despite the recent decline in revenue, miners were yet to show a significant inclination to offload their holdings in search of greater profits. There has been an observable trend of increased withdrawals of BTC from exchanges, leading to negative flows.

Although June 14 witnessed a minor positive flow, it was not substantial compared to the overall negative flows experienced. As of this writing, the net flow remained negative, with more than 2,000 BTC withdrawn from exchanges.

This suggested that miners and other holders have been holding rather than selling. Also, it showed that if there was any sell-off, it was not significant.

How much are 1,10,100 BTCs worth today

Furthermore, as of this writing, Bitcoin was trading at approximately $24,980, reflecting a decline of over 1% in its value.