Bitcoin mining difficulty soars to new ATH, here’s why

- The latest Bitcoin mining difficulty adjustment occurred at the 790,272 block height

- A quick glance at Bitcoin’s hash rate confirms that it registered a rise in the last three days.

Mining difficulty is an important aspect of the Bitcoin blockchain. As such, any significant changes that are undertaken with regard to difficulty might be worth looking into. Bitcoin just went through its latest difficulty adjustment, so let’s dive into it.

Read Bitcoin’s price prediction for 2023-2024

The latest Bitcoin mining difficulty adjustment occurred at the 790,272 block height and resulted in a 3.22% increase in mining difficulty. This is important because such changes are bound to trigger an impact not only on mining profitability but also on the network’s hash rate.

Bitcoin ushered in a mining difficulty adjustment at block height 790,272, and the mining difficulty increased by 3.22% to 49.55 T, breaking through a record high. The current average hasjrate is 354.55 EH/s. The recent popularity of Ordinals BRC20 has led to more mining…

— Wu Blockchain (@WuBlockchain) May 18, 2023

Higher difficulty means miners require the more computational capacity to remain profitable.

It may have a negative impact on profit levels. However, that may not necessarily be the case since miner revenue has been on the rise for the last three days.

This has more to do with the fact that the market’s overall hash rate has not been affected, or has countered the higher difficulty.

Will the higher difficulty cause a hash rate drop?

A quick glance at Bitcoin’s hash rate confirms that it registered a rise in the last three days. We did, however, observe that there were fluctuations in the last few days and the same trend is expected to continue. T

his is because the difficulty has been going up and is currently at its ATH. In other words, the higher mining difficulty will eventually place more pressure on miners and hence potentially have a negative impact on the hash rate.

? #Bitcoin $BTC Mining Difficulty just reached an ATH of 212,814,354,678,563,007,889,408

Previous ATH of 209,218,190,478,118,995,623,936 was observed on 04 May 2023

View metric:https://t.co/uH8dpKhxJ7 pic.twitter.com/XXLh3xL2SS

— glassnode alerts (@glassnodealerts) May 18, 2023

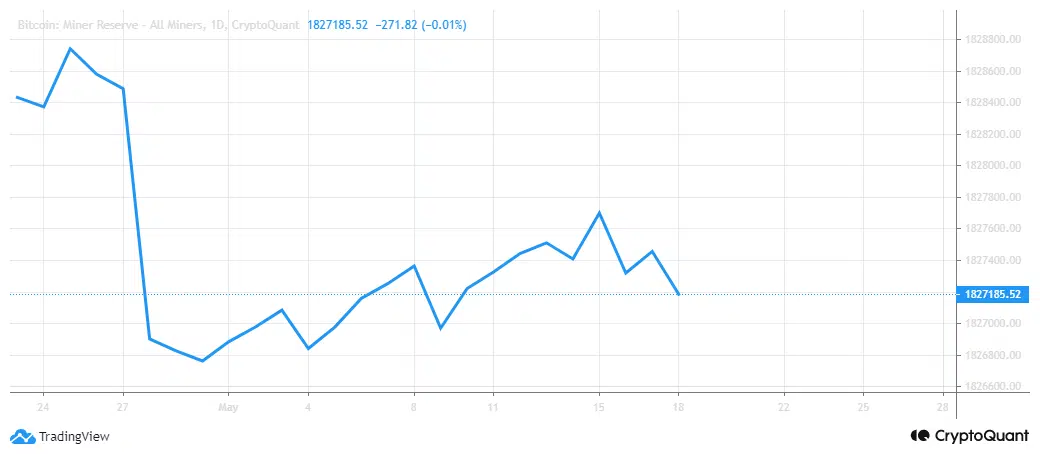

Although miner revenue grew, on-chain data revealed that miners have been averse to hodling in the last few days. Miner reserves have also taken a dive. This means these critical participants in Bitcoin are still not confident enough to hodl in the crypto market’s current state.

The lack of confidence demonstrated in Bitcoin reserves reflects Bitcoin’s price movements. Miners are not willing to hodl when unsure about the short-term potential upside.

Is your portfolio green? Check out the Bitcoin Profit Calculator

There are other factors that might be in play as far as Bitcoin mining is concerned. For example, the recent surge in Bitcoin ordinal inscriptions may still be contributing to higher miner revenue.

Nevertheless, BTC price action is still moving in a relatively sideways pattern, hence underscoring low demand, as well as low sell pressure.