Bitcoin: Miners, HODLers remain bullish, but will that be enough

Bitcoin’s tussle with the red candlesticks has continued for the last fortnight. Yet again, after faking a recovery track, Bitcoin fell below the $46,000-mark on 20 December. With BTC testing the low $45,840-level at press time, the global crypto market cap fell by 3.06% on the price charts.

Nonetheless, with the larger macro-structure still leaning towards the bulls, where do we really stand with the festive season knocking on our doors?

HODLers and Miners sailing the boat

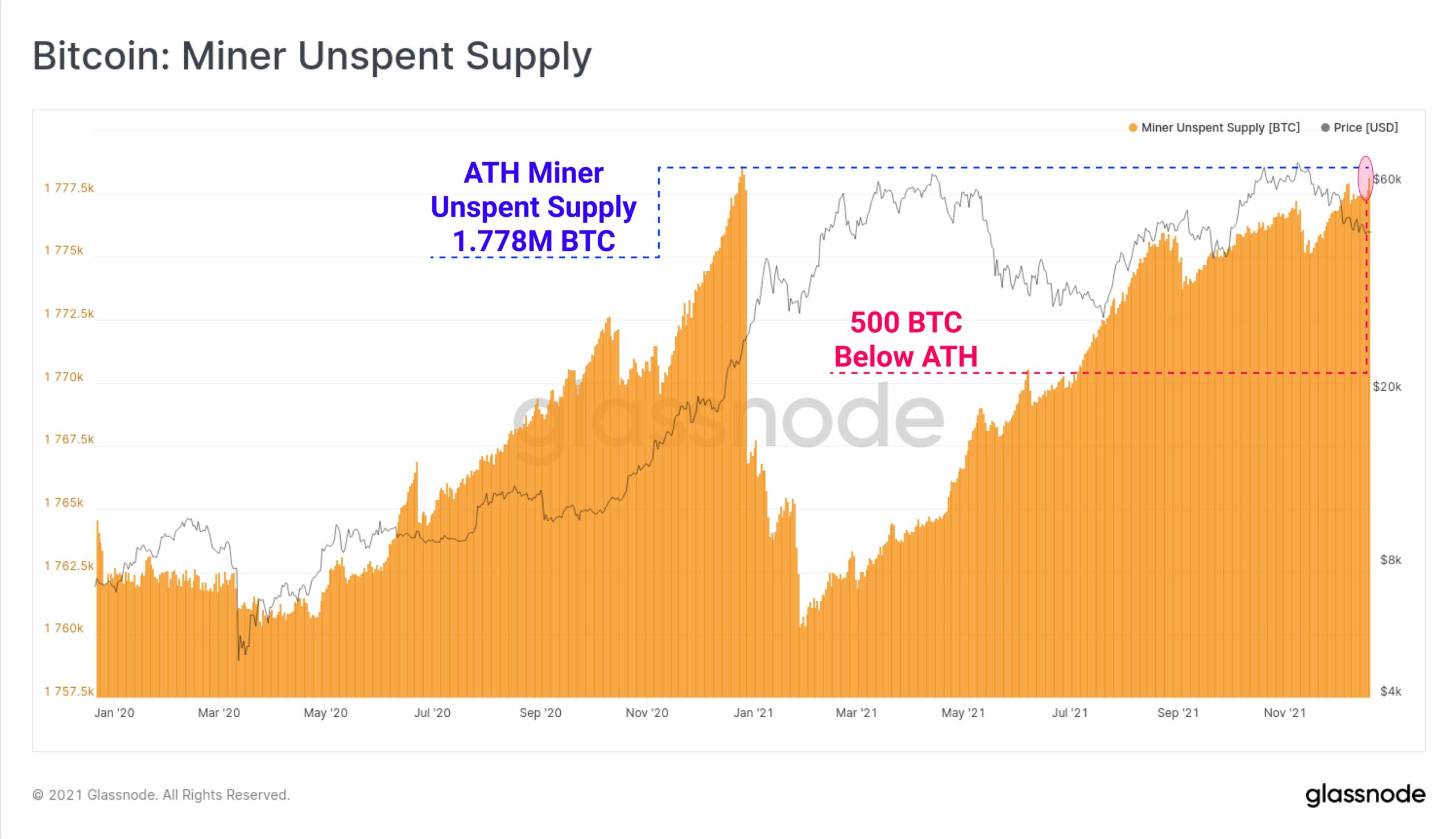

Bitcoin miner revenue, after dipping on 16 December, picked up yet again while the Bitcoin miner unspent supply was sitting just 500 BTC below the all-time high level. These coins are issued to miners as a reward for solving a block, but have never been spent on-chain.

Notably, miners have started HODLing significantly more BTC since March 2020 and the trajectory has been on an uptrend since November.

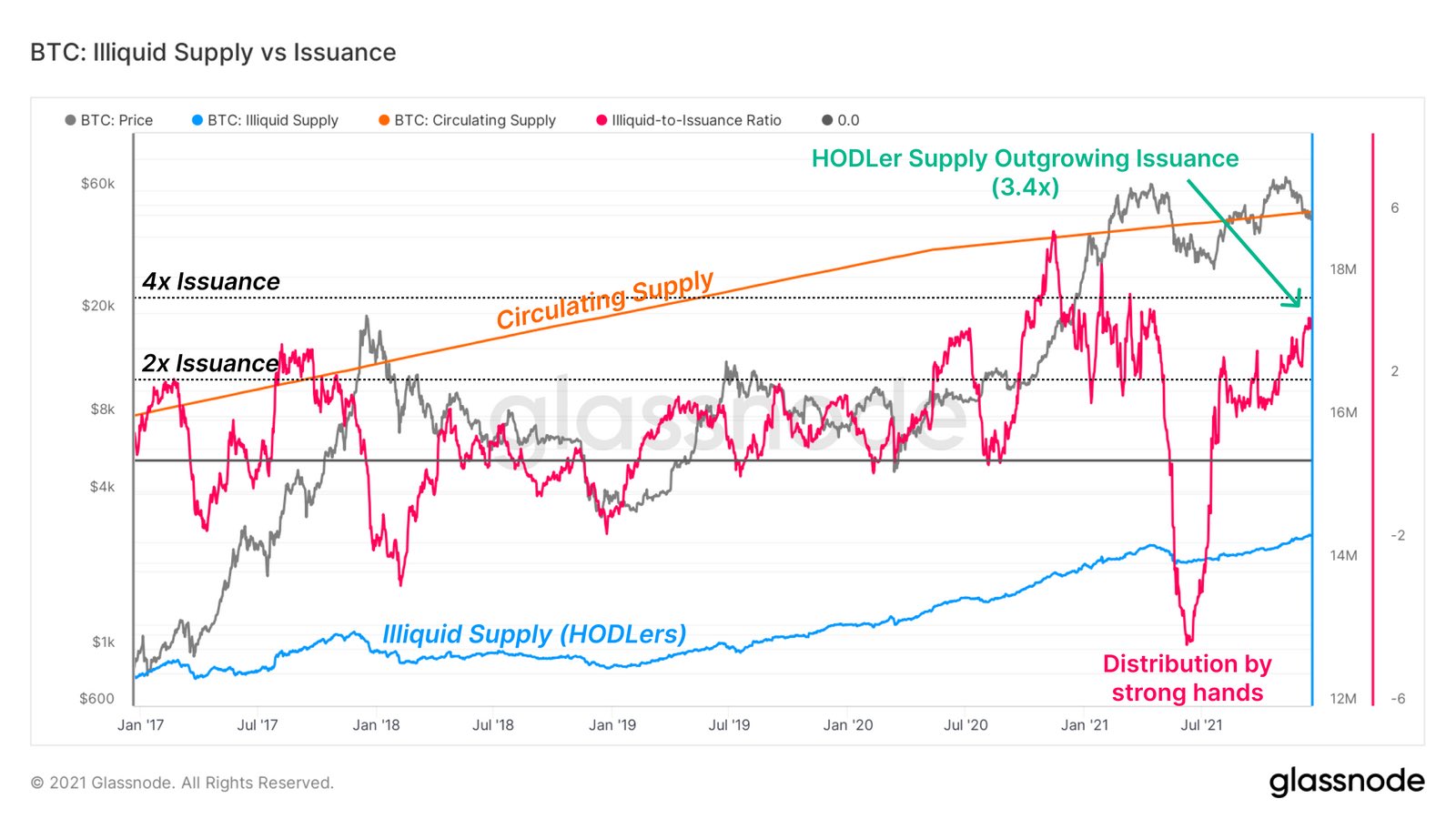

Furthermore, BTC’s Illiquid Supply, which presents the total supply held by illiquid entities, has been one of the remarkable narratives for Bitcoin in 2021 following the May wipeout.

Notably, these HODLers were the first to begin stacking again and at the time of writing too, the Illiquid Supply growth was outpacing coin issuance by a factor of 3.4x.

Source: TXMC

All in all, for Bitcoin, the supply side of the supply-demand equation seemed pretty decent as HODLers and miners remain in a phase of long-term accumulation. That being said, the last Bitcoin short squeeze was on 23 July, just a day before the price squeezed off the summer lows.

At the moment, the market is not there yet, but the setup looks like it might be heading towards a short squeeze.

So, is this the market bottom?

With Bitcoin’s price tracing its lower bounds yet again, would it be the right time to assess whether this could be the market bottom? While a Bitcoin bottom can never be accurately captured before it actually happens, the $45k-$46k range does seem like the bottom, especially since the same has acted as a strong support zone over the last couple of weeks.

However, in the past, key price bottoms in BTC have been accompanied by high volume panic capitulation. This hasn’t happened yet, so the possibility of a lower bottom too can’t be denied.

Source: Peter Brandt

Looking at the supply-demand dynamics, while it does look like a supply squeeze has been in the making, BTC’s price still needs a massive retail push or retail FOMO to trigger serious price action.

On-chain metrics flashed bullish signals, but with the price action looking rather weak, it would be better to hold your horses unless BTC pushes ahead of the $47.5k-mark.