Bitcoin mining difficulty reaches ATH despite liquidations worth over $292m

The entire cryptocurrency market at press time is bleeding profusely. The total market capitalization declined by almost 11% over the past 12 hours. The massive slump resulted in a loss of around $233 billion sending the total market cap. Thereby, plunging below $2 trillion for the first time since late September.

Liquidations across trading platforms (BTC + Altcoins) totaled $725 million, with BTC positions accounting for $292 million.

Source: CoinGlass

Bitcoin, the largest crypto is leading the fall with a loss of 7% over the past 24 hours. At the time of writing, it was trading just above the $39k mark. Somehow holding on to it…

Apart from this, the king coins also witnessed crackdowns across different mining hubs. For instance, Kazakhstan—one of the biggest hashrate countries saw political demonstrations due to price hikes. But Bitcoin’s hashrate took another hit. And of course, China. It plunged the difficulty by its largest share on record as miners in that country had shut down their equipment.

Road to recovery

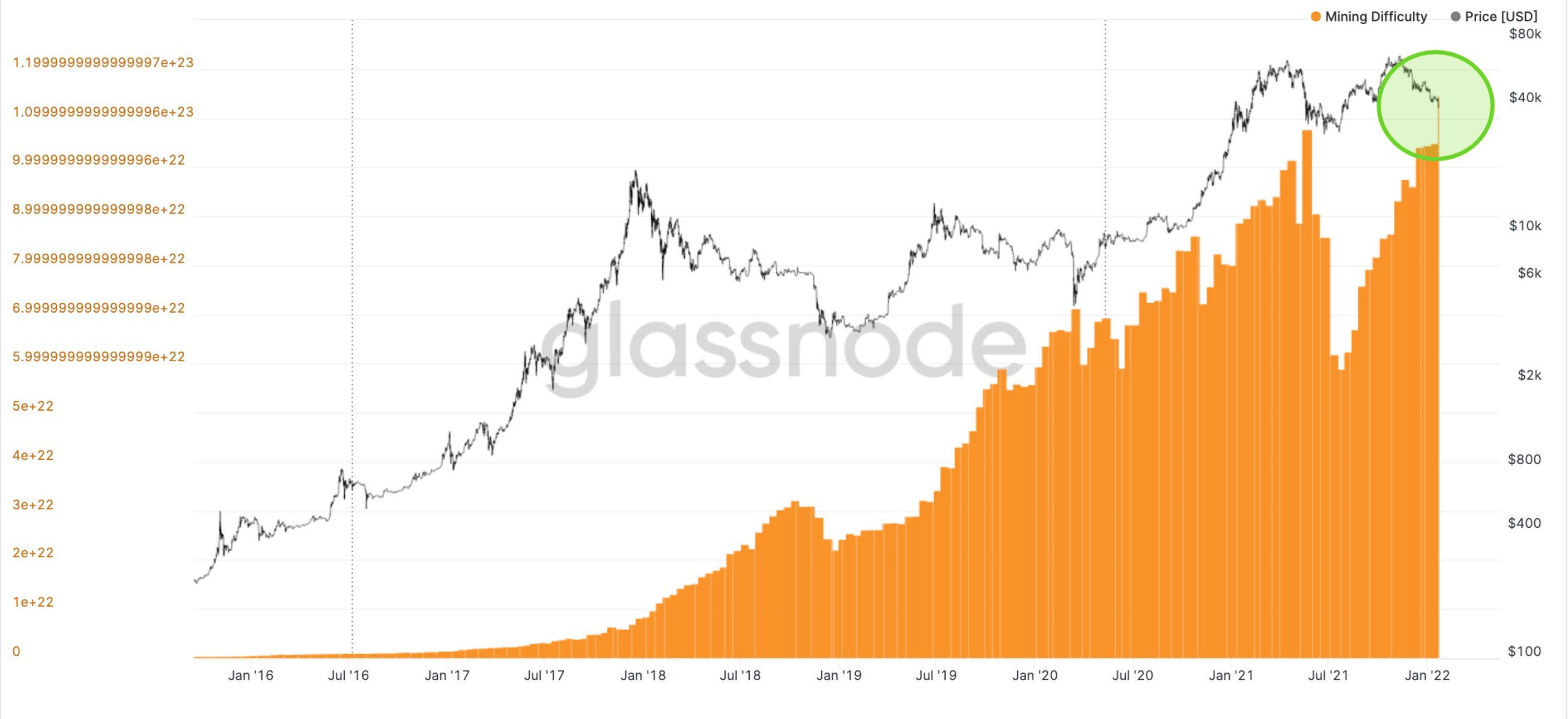

Having said that, Bitcoin mining difficulty showcased full recovery after this major mishap. Despite many countries cracking down on crypto mining, miners were resilient than many had expected. Metrics from various sources showcased that crypto mining hashrates had touched all-time-highs.

The difficulty is automatically adjusted based the amount of computational power on the network, or hashrate, to keep the time it takes to mine a block roughly stable at 10 minutes. The higher the hashrate, the higher the difficulty, and vice versa.

Source: Glassnode

According to Glassnode, Bitcoin mining difficulty increased by +9.3% today, hitting a new ATH. Today’s jump was the second thus far in 2022, following January 8’s 0.41% adjustment.

In terms of hashrate, the numbers reached impressive figures. As per Blockchain.com, total hash rate stood at 198.86m TH/second or 198.8 EH/sec. This increased by about 18 EH/s since 11 December.

An independent crypto researcher Kevin Rooke had reiterated the entire scenario in a tweet. Thereby portraying his bullish narrative considering the flagship coin despite the current fiasco.

6 months ago, Bitcoin mining difficulty was down 45% in the wake of China’s mining ban.

Today, it’s officially back at an all-time high.

Incredible display of resilience. Bullish on Bitcoin. pic.twitter.com/cxHLv8SslM

— Kevin Rooke (@kerooke) January 21, 2022

In addition to this, analysts and industry insiders expect the trend to continue into 2022. This could happen as North America, Russia, and Europe are scheduled to deploy more machines for such operations.