Bitcoin needs to do THIS to continue its bull rally

Bitcoin’s chart, at press time, was picturing green candles for the tenth straight day, despite some corrections yesterday. Even at the time of this report, the crypto was trading in the green at $41,758.13. This short-term bull rally brought in a ton of profits for investors.

However, now the important question is this – Can the market sustain this run? And if it can, what price targets are we looking at? On-chain metrics might have an answer to these questions.

Where is the market at right now?

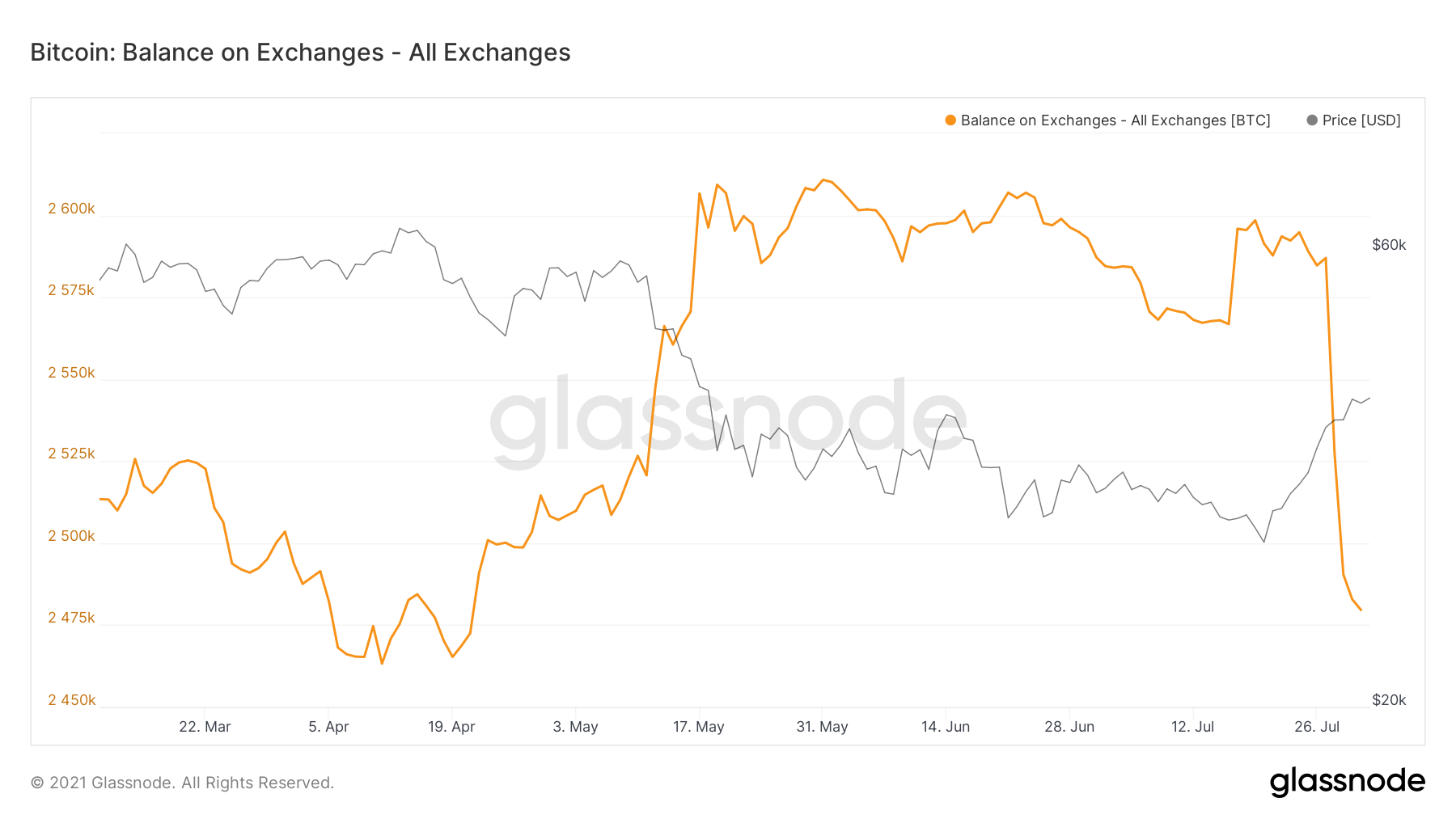

Looking at Bitcoin’s balance on all exchanges, it appears that the weeks-long accumulation trend is still continuing. In just over 4 days, nearly 110,000 Bitcoins have left exchanges. This amounted to around $4.5 billion worth of BTC. Such heavy accumulation accompanied by the 13.3% hike is where the need for steady movement comes into play.

Bitcoin balance on exchanges | Source: Glassnode – AMBCrypto

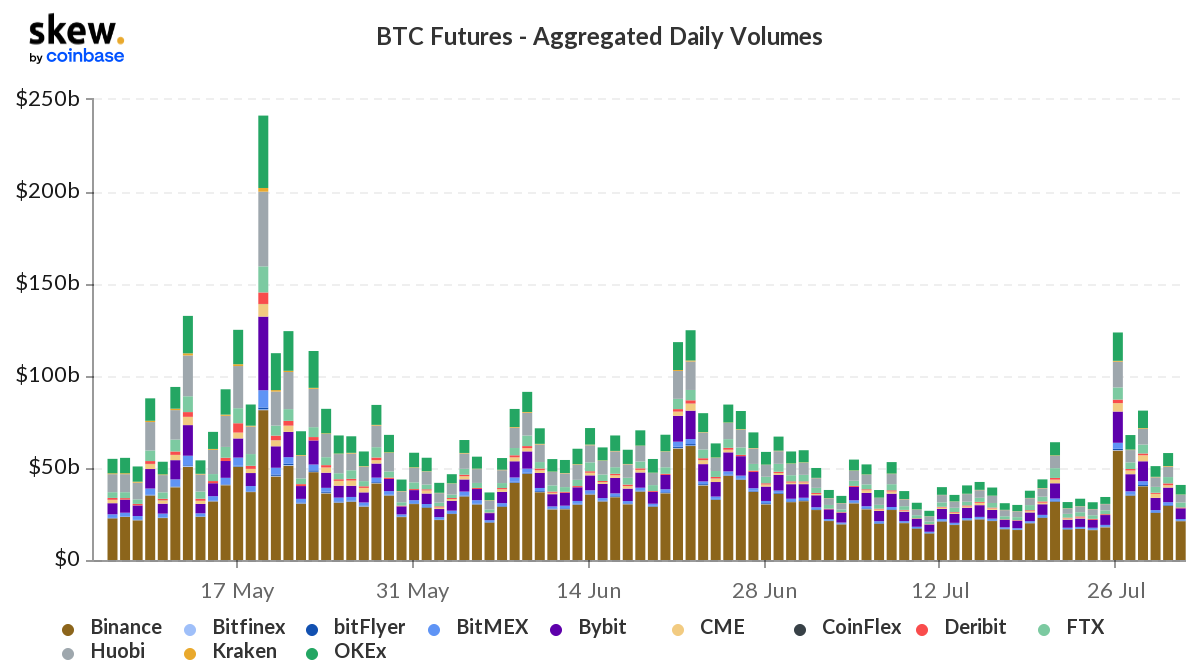

Additionally, at the moment, spot trading is slipping too after the stellar growth observed over the week. In order for Bitcoin to have consistent growth, spot trading needs to pick up the pace again.

What’s more, despite its strong performance, daily volumes were back in the consolidation range which won’t do much for the king coin. Volumes need to be maintained above $50 billion, at least, to push BTC anywhere close to its April price levels.

Bitcoin Spot Trading | Source: Skew – AMBCrypto

Necessary future conditions

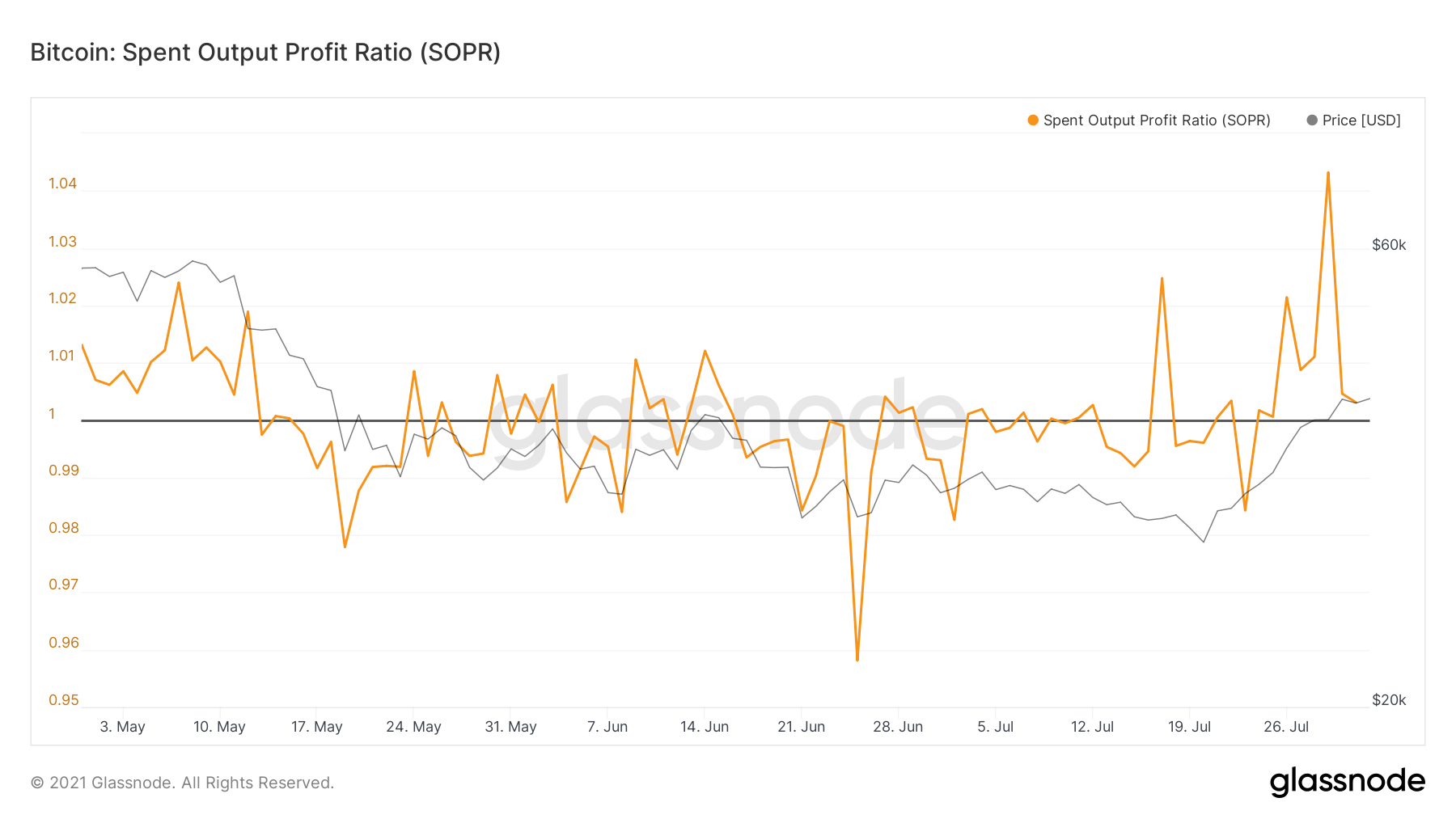

Here, SOPR is an important metric when it comes to understanding current profit levels. Simply put, the SOPR above 1 is a bullish confirmation whereas under 1 is not so good for BTC. After touching highs of 1.04, the indicator came back down yesterday. This is good since the correction can now help stabilize the SOPR above 1. That is exactly what’s needed for a consistently strong market.

It should not fall back under that black line again as it will be a relatively bad sign after a strong week of profits. This brings us to the status of profits.

Bitcoin SOPR | Source: Glassnode – AMBCrypto

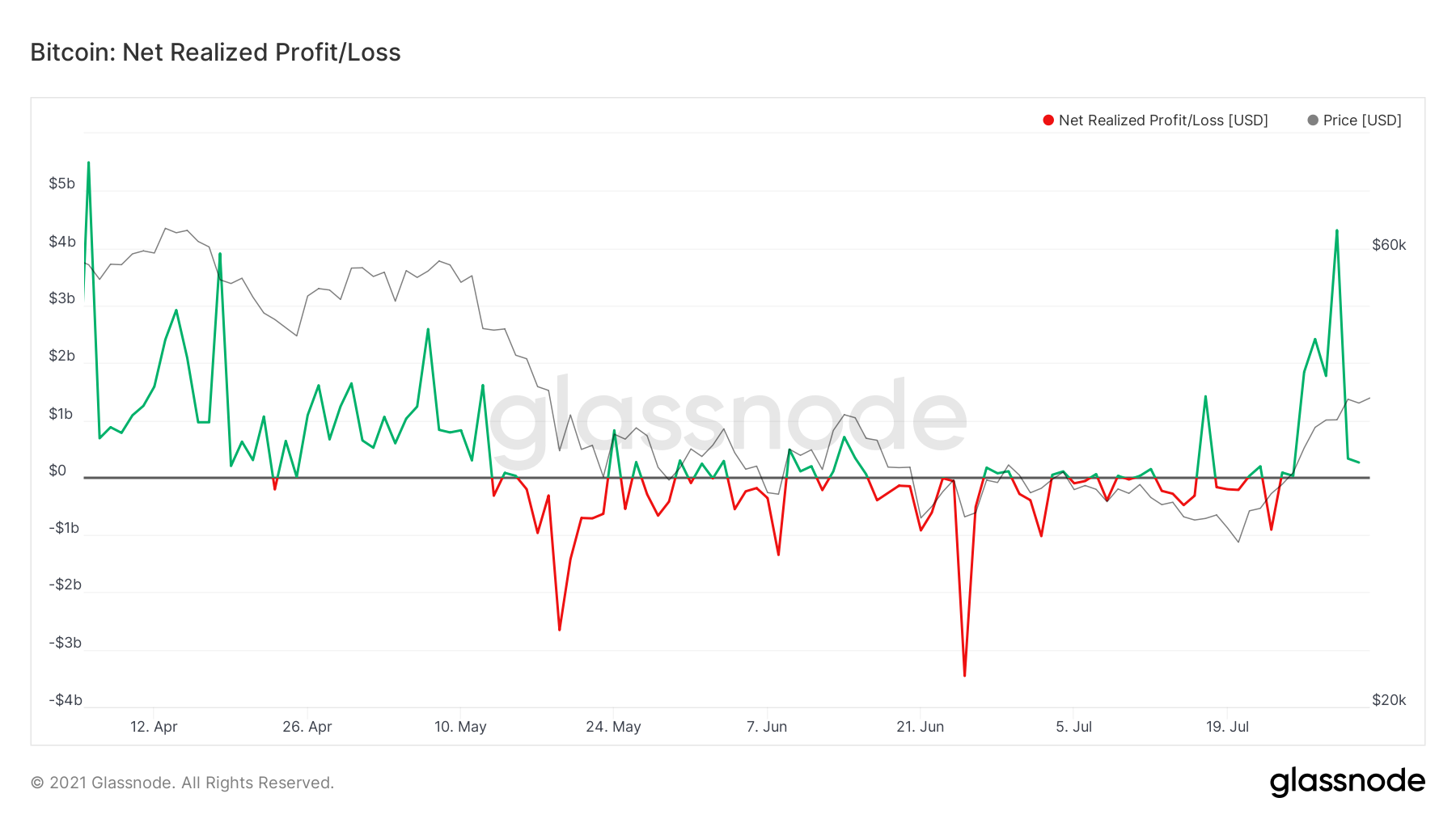

Realized profits/loss show that the profits, after touching $4 billion, fell down to $200-$300 million. Considering the historical performance of this metric, the profit/loss ratio must maintain stable profits as it did during the April rally.

The likelihood of BTC climbing above $50k will only be greater when investors participate more and that will happen only when the market shows profits.

Bitcoin realized profit/loss | Source: Glassnode – AMBCrypto

These are the market conditions required for Bitcoin to continue its rally on the charts. Now, will it? That, perhaps, is the subject of another article.

![Ethereum's [ETH] 11% rebound - Is greed fueling a bottom or is fear driving a trap?](https://ambcrypto.com/wp-content/uploads/2025/04/Ritika-8-400x240.webp)

![Will Chainlink's [LINK] retest flip support into resistance?](https://ambcrypto.com/wp-content/uploads/2025/04/Renuka-57-400x240.webp)