Bitcoin needs to overcome this hurdle to make big strides in coming days

Bitcoin accumulation continued in the spot market, even amid consolidating prices, post the September 7 crash. With supply on exchanges for the top coin continuing to drop, the focus now shifted towards the derivatives market. Notably, the Futures and Options market presented some interesting observations about the market sentiment and expectations from the top coin.

This is how the market looks

After a very brief period of negative funding rates during the sell-off, perpetual markets returned to slightly positive funding rates suggesting that traders were still expecting an upward price momentum. The larger trend, however, looked neutral or as analyst Lex Moskovski said, the market may be in “disbelief.”

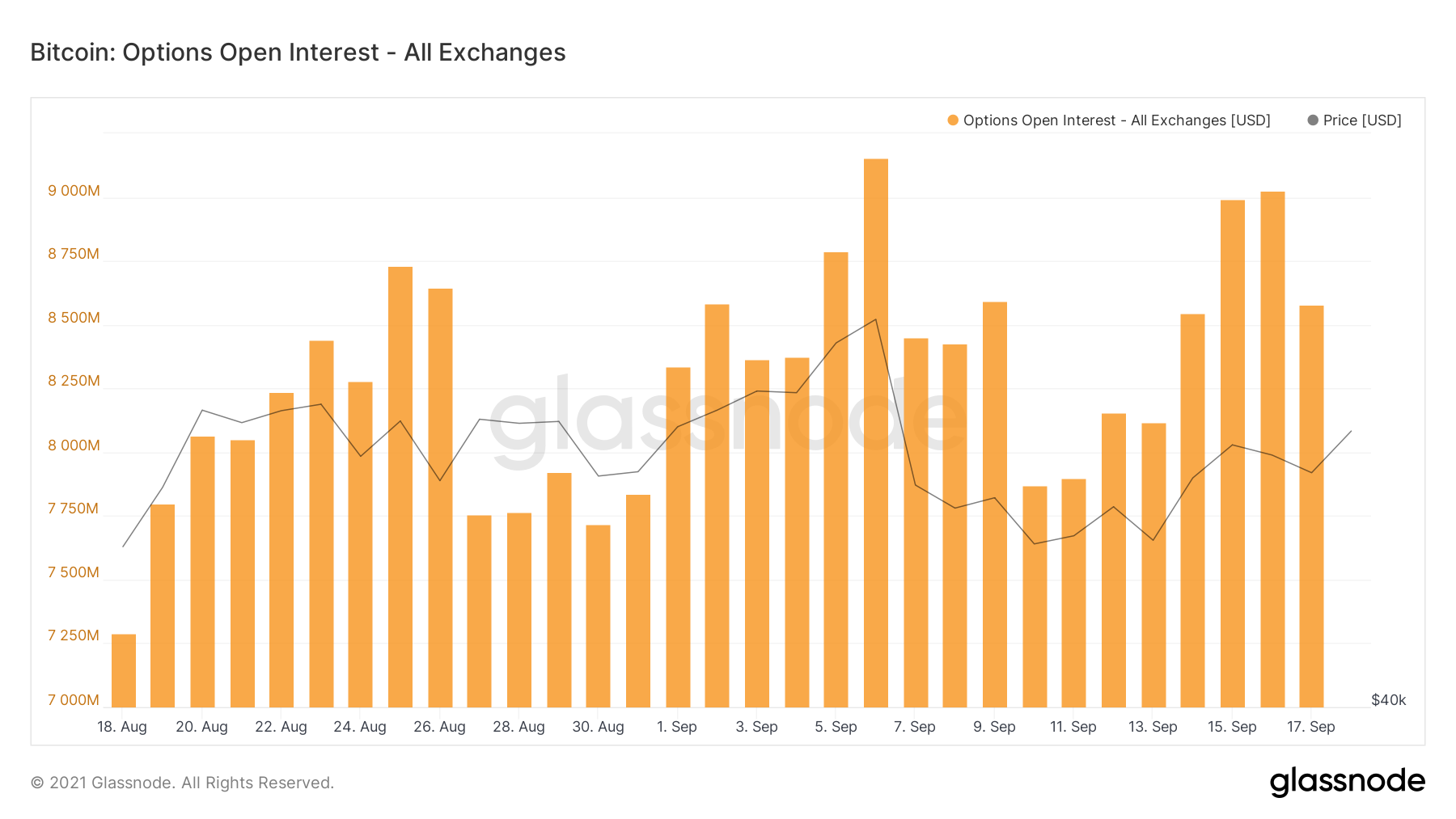

Further, the daily traded volume in the futures market remained comparatively low, after the flash crash even though the open interest (OI) started climbing up, after bottoming on September 10. Open interest on all exchanges for September 17 was around $8.57 billion which was lower than the $9 billion recorded a day prior.

Last week’s analysis by Ecoinometrics noted that purely in terms of trading activity, it isn’t clear if the trend of declining open interest and average daily volume had bottomed yet. This despite the open interest pushing up after the flash crash. In fact, a look at the CME Bitcoin options market tells that the sentiment hasn’t changed back to euphoria mode yet.

The market still long-term bullish?

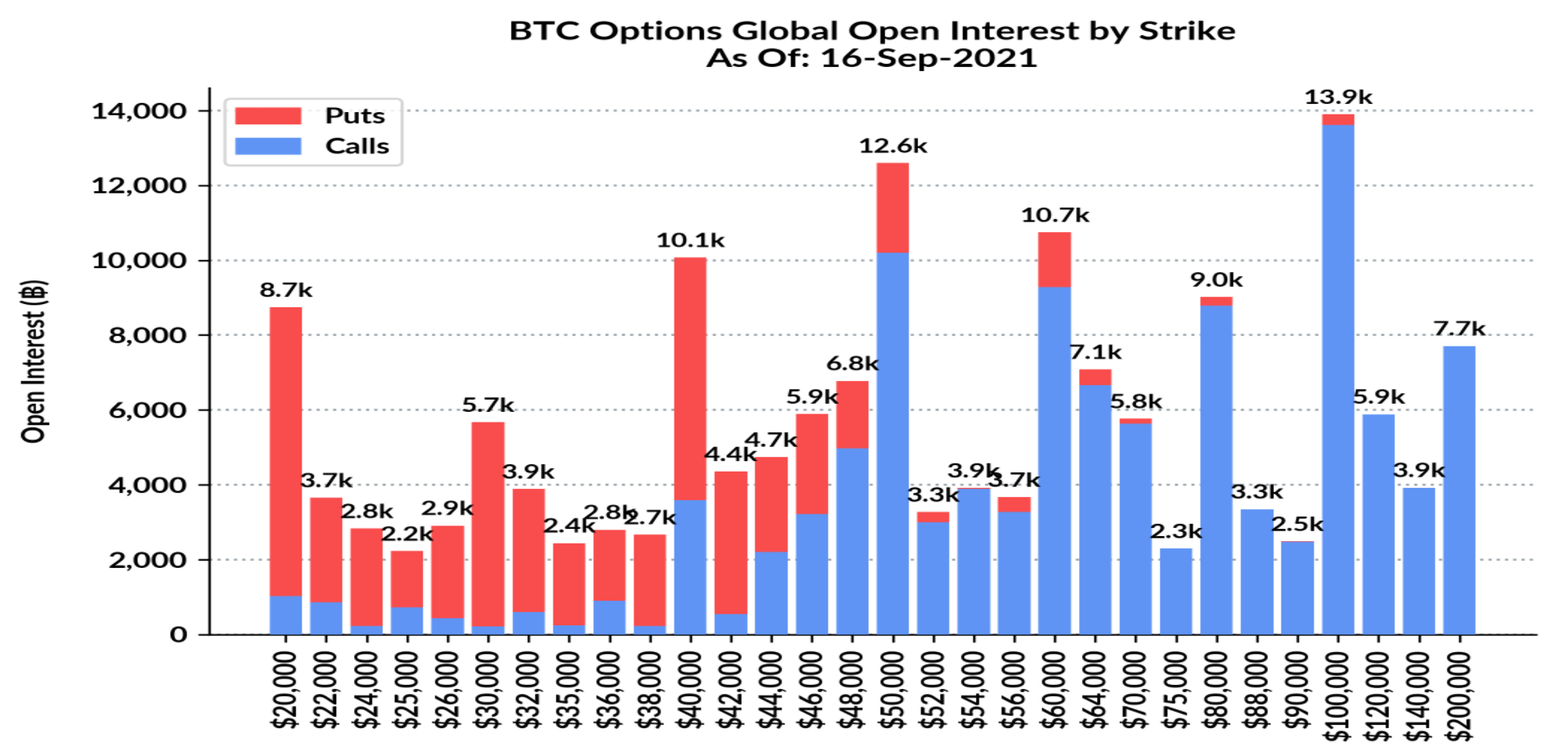

Even though BTC’s price consolidated in the spot market, options traders seemed to be long-term bullish on the king coin. Notably, the OI by Strike presented almost 10K Call contracts for $50k and around 9K Call contracts for $60K and $90K respectively.

BTC OI by strike shows bets for $50k | Source: Skew

These were good figures for a market, especially amid the spot market consolidation. Further, even the Implied Volatility to Realized Volatility spread seemed to be at its highest level of almost 1%, a level last seen around May 26. This high difference between IV and RV could be indicative of both strong price hikes in the future or sharp market changes. What was worrisome was the fact that this high difference in IV and RV came while prices were much lower than the May tops.

Where is BTC heading?

With the prices consolidating, short liquidations for all exchanges reached an all-time low which meant that the market was still in a dilemma about BTC price rise. Additionally, retail traders have been the most bullish on Bitcoin in the past but now the net amount of long positions held by the retail crowd it is still stuck at the 2020 baseline. Which is still 50% lower than at the peak in January, as pointed out by Ecoinometrics.

While the aforementioned isn’t all bearish, they haven’t hopped back on the trend either. However, options OI change for September 21 has almost 357DBT for $50K BTC, which means that the market does anticipate a move upward. But weekends have been harsh on BTC, so for Bitcoin to make some large moves over the coming week it needs to cruise through the weekend without shedding prices.