Bitcoin: PnL index and NUPL metric suggest that BTC bottom is…

- The PnL and NUPL metrics position suggested a possible further decline for Bitcoin in 2023.

- Investors taking long positions on BTC were currently dominant.

Several forecasts have been made about ‘when the bear market would end,’ and in most cases, this coincided with a rally in Bitcoin’s [BTC] price. A glance at several important measures can help point one in the correct way when trying to make sense of the rumors and theories surrounding the king coin and its future move.

Read Bitcoin’s [BTC] Price Prediction 2023-24

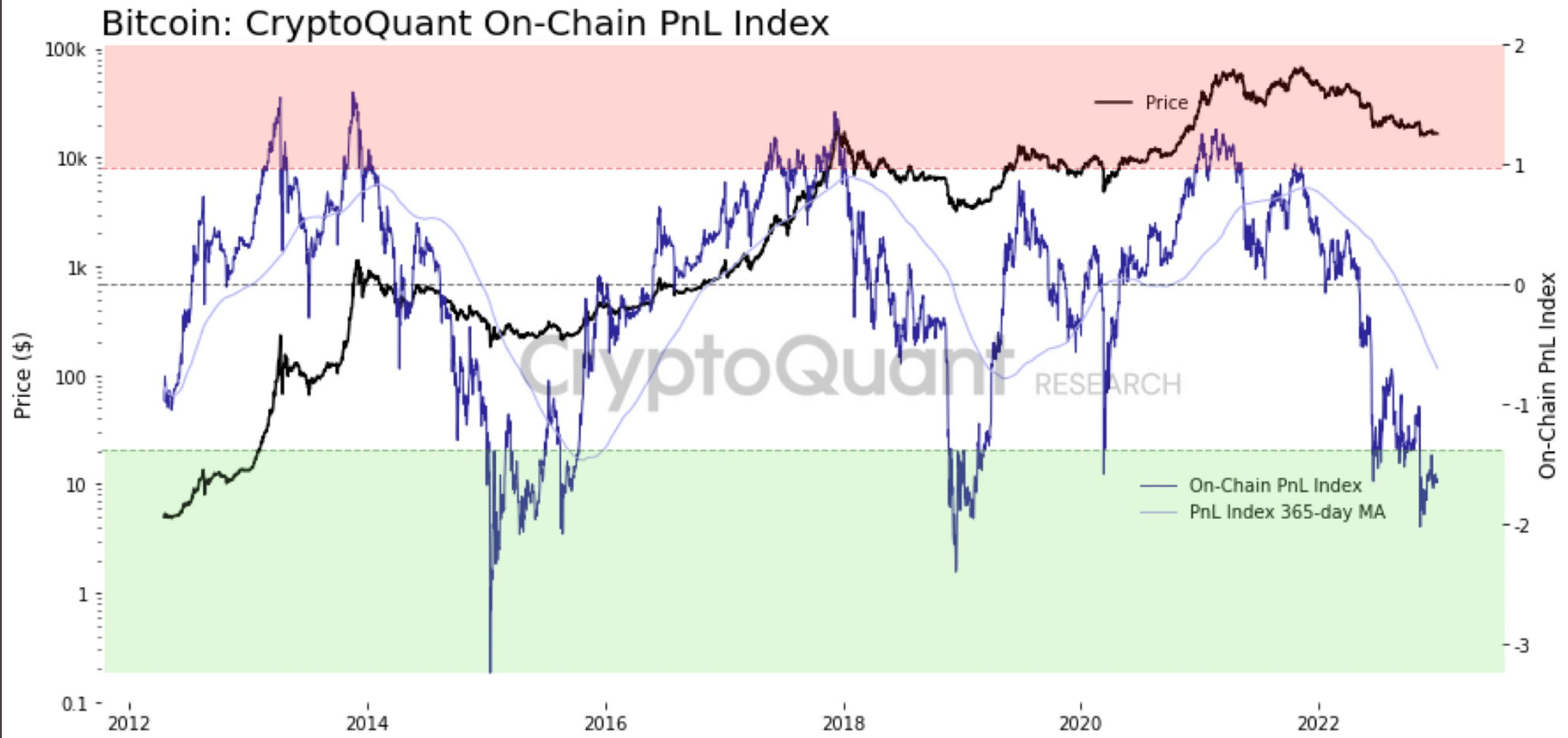

PnL Index suggests bottom is not in

When discussing the behavior of prices, the term “bottom” refers to the point at which prices have dropped to their lowest before beginning to move upwards again.

There have been a lot of rumors and guesses about where the bottom of Bitcoin will be, and a recent post from CryptoQuant stated that king coin’s bottom is yet to be reached.

According to the chart of the Profit and Loss Index (PnL), Bitcoin began the year in the undervalued zone; nevertheless, it could not cross above its 365-moving average. The placement of the metrics suggested that the price of Bitcoin may continue to decline even more.

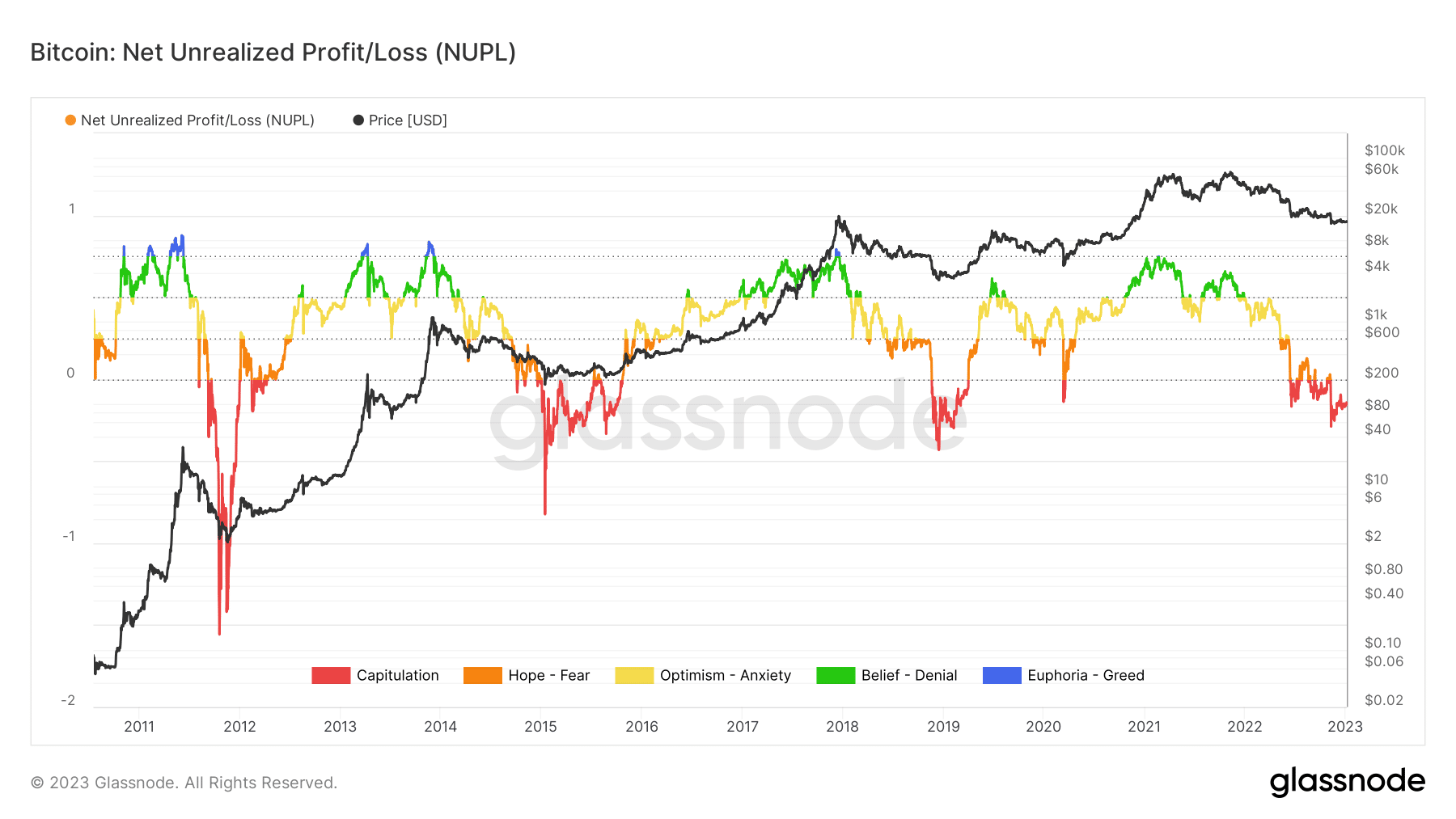

Positive NUPL but capitulation in play

Net Unrealized Profit or Loss (NUPL) is another significant indicator that might be used to access Bitcoin’s (BTC) genuine condition. It is calculated by dividing the difference between the respective unrealized gains and losses.

A negative value indicates a losing market, whereas a positive one indicates a profitable one. Whether the market is profitable can be determined by looking at the NUPL on-chain indicator.

Examining Glassnode’s NUPL metric revealed that the currency was below zero, signaling a loss in holdings.

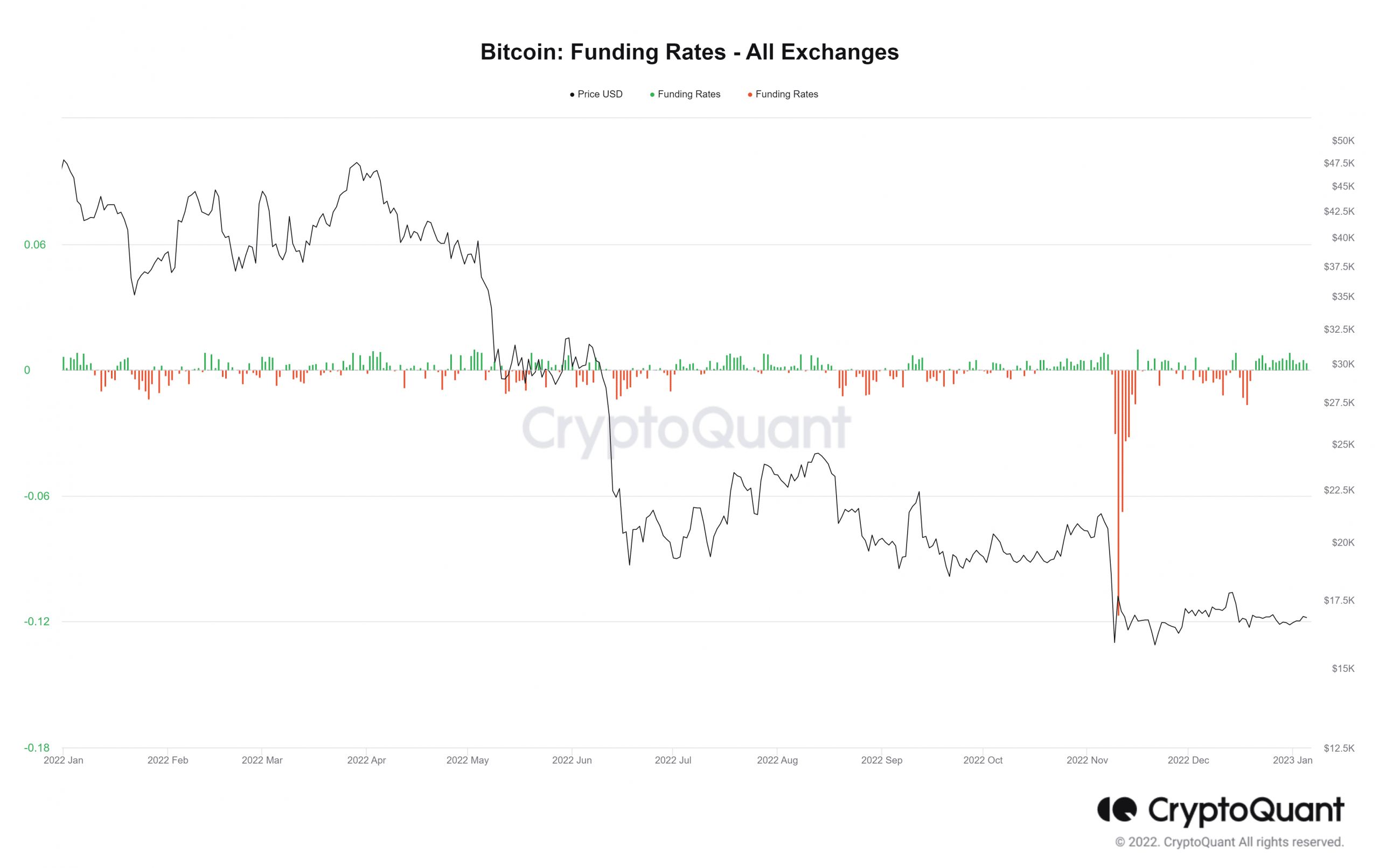

Long-position investors stay dominant

Even though the PnL and NUPL charts presented what appeared to be a gloomy view, investors continue to be optimistic about a price increase for BTC.

The Funding rate chart on CryptoQuant indicated that the measure was positive. Given the position of the metrics, it was clear that investors were banking on a sustained increase in the price of Bitcoin over the long run by establishing a long position.

Are your holdings flashing green? Check the BTC Profit Calculator

When it comes to BTC, it would appear from a glance at the PnL and NUPL measures that the market is yet to reach its bottom. As of this writing, the price of the coin was hovering at about $16,000; it could not stage a recovery that would allow it to return to the region around $20,000, where it had been in prior months before its decline.

Nevertheless, investors appear to be optimistic about a price rise in the future, which is always the case once the bottoms have been established in a market.