Bitcoin: Price growth can’t be expected unless this condition is met

- BTC is significantly correlated to the traditional financial markets.

- For its price to grow, there has to be a decoupling.

While Bitcoin’s [BTC] price might have rallied by 32% on a year-to-date (YTD), the continued growth in the price of the king coin, in the face of prevailing macroeconomic conditions, is largely contingent upon its ability to detach from traditional financial markets, two CryptoQuant analysts have found.

Pseudonymous analyst Grizzly assessed BTC’s 200-day moving average and its realized price and found a pattern previously observed in market bottoms.

Is your portfolio green? Check out the Bitcoin Profit Calculator

This pattern, which suggests the formation of a long-term bottom, is characterized by the crossing or overlapping of the 200-day moving average and the realized price, moving from the top to the bottom. This pattern was observed in 2019, 2015, and 2012, after which BTC experienced a long-term upward trend.

According to Grizzly, in these highly inflationary times, the predicted long-term upward trend might follow if BTC detaches from assets such as equities and acts as a store of value.

Another analyst Baro Virtual considered BTC’s Net Unrealized Profit/Loss ratio (NUPL). The analyst found that the current market situation was similar to the NUPL index movement in the spring of 2019 when it broke its 365-day moving average and BTC experienced strong bullish momentum.

However, after encountering rejection at the medium-term resistance range of 0.15-0.25, BTC’s NUPL index tested its 365-day moving average, which served as support.

According to Baro Virtual, a successful hold of the 365-day MA and overcoming the resistance range could lead to solid bullish momentum.

For the upward break to happen, BTC’s price has to “decouple” from the broader financial markets, Baro Virtual opined. He further stated,

“Also very important is the question of whether there will be a final decoupling of Bitcoin and the US stock market in the current cycle or whether Bitcoin will become a hostage to traditional macroeconomic indicators.”

BTC market refuses to cut ties with traditional markets

On 1 February, the Federal Reserve raised interest rates by a quarter of a percentage point, marking the smallest interest rate adjustment since March. On this news, BTC’s and ETH’s prices fell slightly by 0.2% and 0.3%, respectively.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

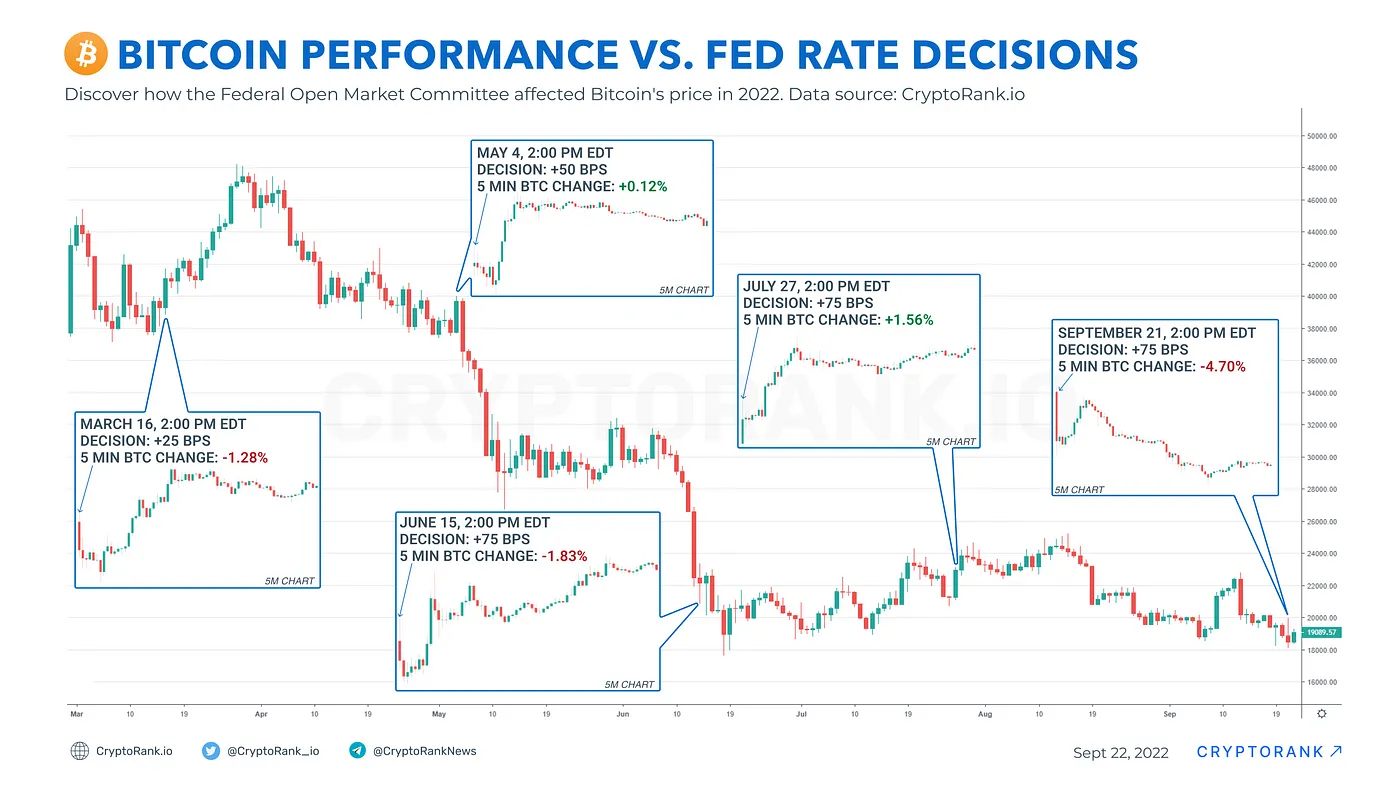

It is no longer news that BTC’s price exhibits high sensitivity to announcements such as inflation data or changes in Federal Reserve interest rates.

In fact, in the last year, BTC’s price reacted each time interest rates were hiked.

During the recent Federal Reserve meeting, the Fed Chair, Jerome H. Powell, indicated that “a couple more” interest rate increases were being considered to ensure that inflationary pressures are effectively contained.

If history is anything to go by, one can expect BTC’s price to react to any further interest rate hikes as the year progresses.