‘Bitcoin price is manipulated’ isn’t an argument against it

Replying to a Twitter user who called Bitcoin a Ponzi scheme, Stephen Palley, a digital currency lawyer at Anderson Kill, made a strong case for the popular crypto today. The lawyer said that Bitcoin at large could not be dubbed “a Ponzi.” and said:

That’s as dumb as claiming it’s not manipulated […] If you’re going to argue against it [Bitcoin] use better arguments & legal theories.

According to Palley:

Bitcoin is "literally" not a Ponzi scheme. Ponzis are an investment fraud where fraudsters pay old investors w/ new investor $$, unknown to either. Also, $25 million a day in investor cash "literally" does not go to miners.

Maybe dumb for you to spend $$ on, but not a Ponzi. https://t.co/H9aM80KnKA

— Palley (@stephendpalley) December 28, 2020

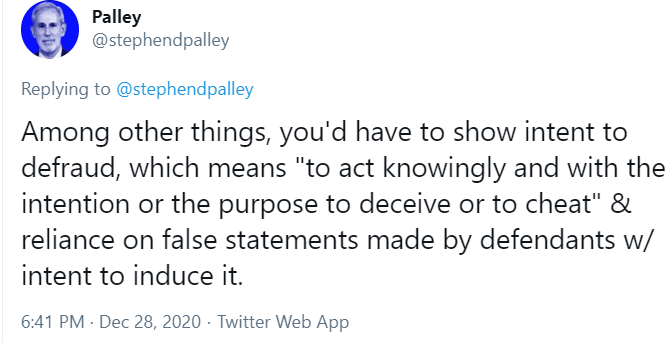

Palley further said that even though some people thought Bitcoin was “heavily manipulated,” it still does not meet the “definition” of a Ponzi scheme and argued:

Image Source: Twitter

Even (hypothetically) working under the assumption that Bitcoin price is indeed manipulated, Palley claimed that there were several other commodities whose prices were manipulated and said:

Hell, we have an entire statute devoted to Onions in the US, just for this reason.

Recently the lawyer took to Twitter to analyze the SEC lawsuit against Ripple. Calling the complaint brutal for a “non-fraud” case, he found that SEC believed the distribution of XRP was clearly centralized and said:

Ohhhh, they also got legal advice that it was probably a securities offering (and thus need to be registered). Curious to know how that memo came into the hands of the SEC. That’s an ouch…

This was all pretty damn centralized, distribution-wise, in the SEC’s eyes, netting Ripple and its execs more than $700 million in profit.

![Sei [SEI]](https://ambcrypto.com/wp-content/uploads/2025/06/Erastus-2025-06-29T145427.668-1-400x240.png)