Bitcoin: Sats names witnessed success, but what’s in the name

- Sats name on the Bitcoin network saw massive interest after the introduction of Inscriptions.

- Meanwhile, traders turn bearish toward BTC after the OPEC announcement.

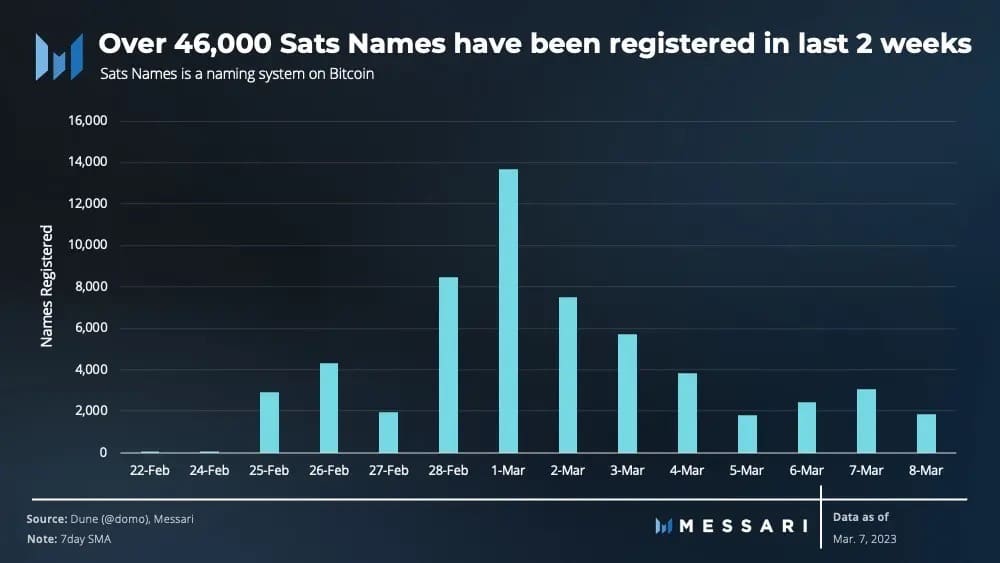

After the introduction of Inscriptions to Bitcoin, there has been a surge in the number of use cases of the Bitcoin network. One of the interesting use cases has come to be the Sats names- quite similar to ENS domain names on Ethereum.

Read Bitcoin’s Price Prediction 2023-2024

These naming systems allow users to assign human-readable names to their crypto addresses. According to Messari’s data, within two weeks, Sats names accounted for a total of 15% of the names that were registered by ENS in the 2022 Q4.

Bears alarmed?

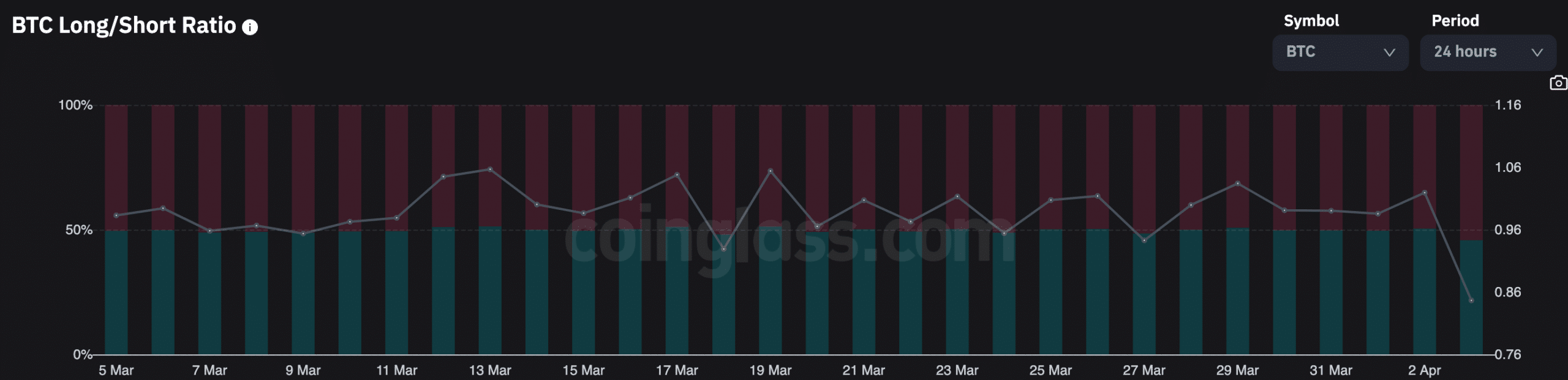

Due to the interest in Sats names, the overall activity on the Bitcoin network increased. Even so, traders’ sentiment shifted towards the bearish side.

According to coinglass’ data, the number of short positions taken against Bitcoin grew significantly in the last few days.

This spike in short positions could be due to OPEC’s (Organization of the Petroleum Exporting Countries) new announcement. As per OPEC’s words, there will be a reduction in oil output produced, which is expected to cause an increase in the price of oil soon.

If there is a sudden rise in oil prices, it may cause worldwide economic growth to decelerate, and as a result, investors might withdraw their investments from assets such as Bitcoin.

Despite the FUD caused by the announcement, the number of addresses accumulating more than 1 Bitcoin continued to increase and reached an all-time high of 992,134.

How much are 1,10,100 BTC worth today?

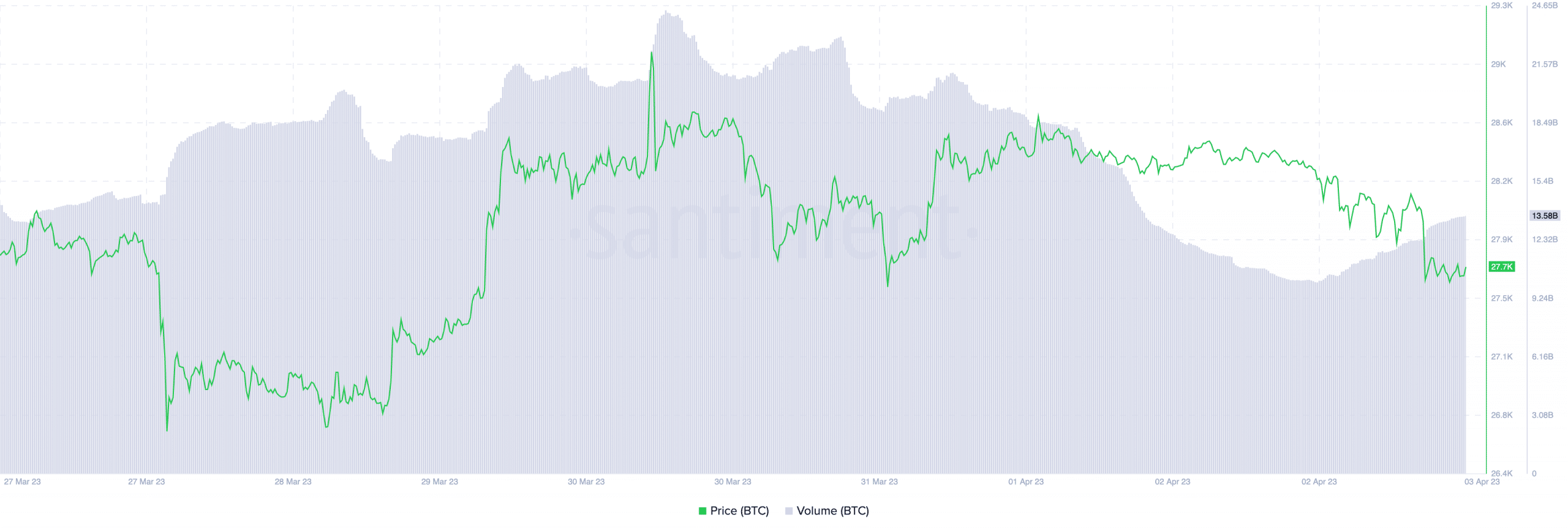

However, along with the holders, the MVRV ratio of Bitcoin surged. This implied that most of the addresses holding BTC were now profitable and there was more of an incentive for these addresses to sell their holdings.

? #Bitcoin $BTC MVRV (1d MA) just reached a 10-month high of 1.427

View metric:https://t.co/8kKvYmGpCW pic.twitter.com/pIKFUgooAd

— glassnode alerts (@glassnodealerts) March 31, 2023

Santiment’s data revealed that the combination of a high MVRV ratio and bearish sentiment around BTC caused a decline in its volume as well as in price. It is yet to be determined whether this trend will continue in the next few months.