Bitcoin holds as market reacts to SEC drama

- 3–6-month BTC holders join day and swing traders in sell-offs amidst SEC drama.

- Bitcoin sees minimal realized loss as it maintains its support range of $25,000 and $26,000.

The recent drama involving two major exchanges and certain tokens in the Security and Exchange Commission (SEC) suit has caused quite a stir, even though Bitcoin (BTC) itself was not directly involved. Nevertheless, Bitcoin’s response to this news has been noteworthy.

Read Bitcoin (BTC) Price Prediction 2023-24

As a result of these developments, certain groups of holders have chosen to sell their holdings. However, it is crucial to explore how this news and the actions of these holders have impacted other important metrics and the current market price of BTC.

Bitcoin witnesses some Long-term Holders dump

The recent developments surrounding Binance and Coinbase have had a noticeable impact on the price of Bitcoin (BTC), leading to a correction. Analyses of CryptoQuant’s recent charts revealed that the sell-off volume of BTC was primarily influenced by day traders, swing traders, and some long-term holders.

A closer examination of the Exchange Inflow Spent Output Age Bands provided interesting insights. On June 4, there was a modest increase in BTC inflow within the 0–1-day age band, with over 14,000 BTC entering the exchanges. This move was a regular occurrence based on historical data.

However, June 5 witnessed a significant spike in the inflow from long-term holders in the three to six-month age band. This sudden surge saw over 3,000 BTC deposited, indicating an uncommon sell-off by this particular category of long-term holders.

On the other hand, the six and 12-month holders seemed relatively calm in their sales. But June 7 saw an unprecedented flow of over 1,000 BTC, marking the highest level since March. These observations suggested that short-term holders were the primary drivers behind the recent fluctuations in BTC’s price. Long-term holders have generally held onto their coins.

Furthermore, the Exchange Inflow – Spent Output Value Bands shed light on the volume of Bitcoin sold by various traders, ranging from 1 to 10,000 BTC over the past 13 months.

Bitcoin realized losses stay minimal

As U.S. regulatory pressure intensified on major cryptocurrency exchanges Binance and Coinbase, the market witnessed a surge of high volatility, leading to substantial price swings. Despite these turbulent movements, recent data from Glassnode’s chart revealed that the total Bitcoin Realized Losses recorded On-Chain amounted to a relatively modest $112 million.

Interestingly, this figure represented a significant deviation of -$3.05 billion (-96.5%) from the largest recorded capitulation event. These findings suggested that market participants have displayed heightened resilience in the face of these regulatory challenges.

How much are 1,10,100 BTCs worth today

Current support level maintained

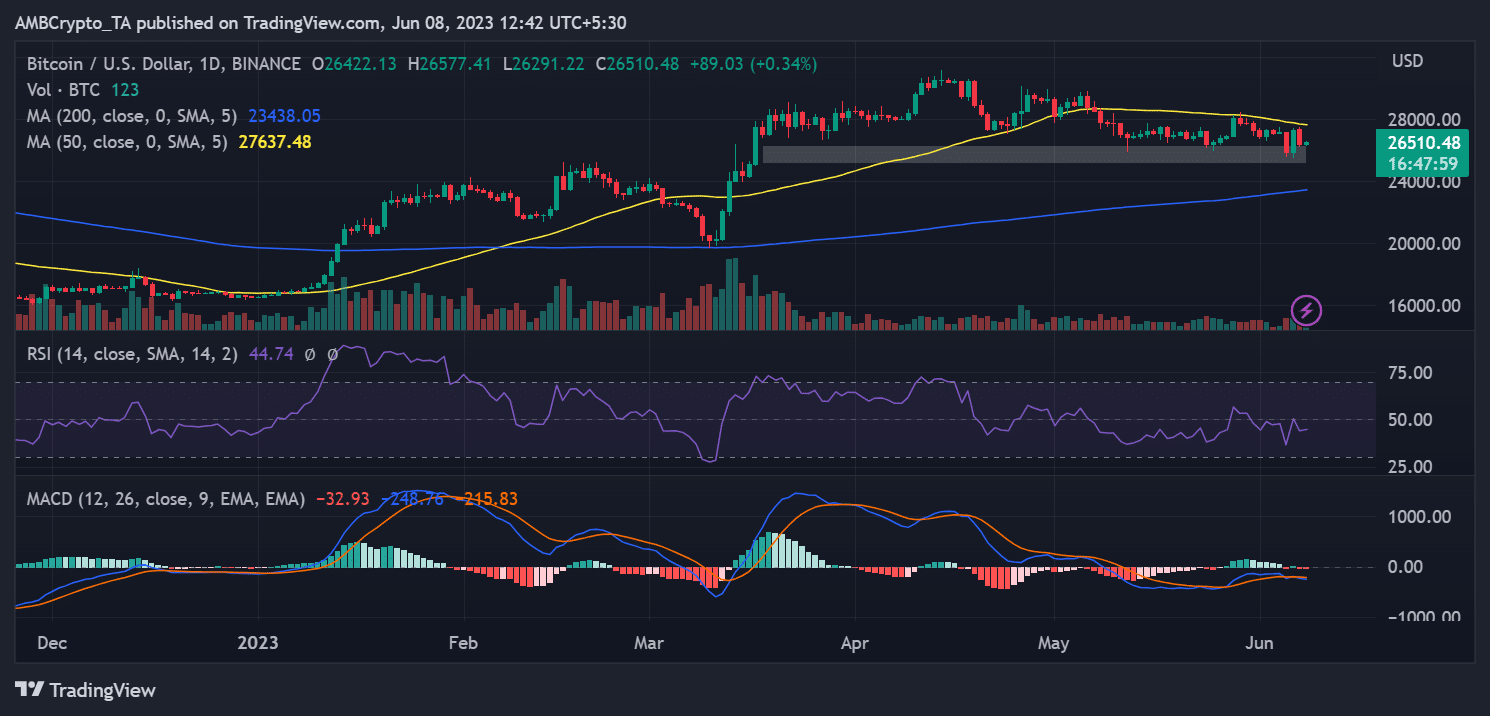

On a daily timeframe chart, Bitcoin’s price movement revealed a noteworthy trend that began on June 4. During this period, Bitcoin experienced substantial price fluctuations.

However, it managed to sustain its support range, hovering around $26,000 to $25,000. As of this writing, BTC was trading at approximately $26,500, indicating a slight increase and suggesting a modest gain in value.