Bitcoin still needs ‘this’ to strengthen its inflation hedge narrative

Bitcoin, after facing a rather dramatic week, registered a quick comeback on the charts and was trading at $65,909, at press time. Over the past year, the crypto has recorded 311.43% ROI v. USD for its HODLers. In fact, despite the price consolidation, bearish months, and many FUDs, BTC’s narrative as an inflation hedge seems to be only growing.

Bitcoin – An inflation hedge?

So, is Bitcoin the inflation hedge that could save the day? Well, this question seems more relevant now than ever. The reason? The U.S government’s announcement that its consumer price index has soared by 6.2% from a year ago – The biggest 12-month jump since 1990.

Soon after the announcement, stock futures dropped while bond yields increased sharply. On the other hand, Gold, which has held the ‘inflation hedge’ badge for a long time, also increased. Interestingly Bitcoin followed suit, at least for the time being.

Source: IntoTheBlock

In fact, amid the news of rising inflation, BTC’s price saw a new all-time high of over $69,000 on 10 November. In addition to that, a Bloomberg report found out that Bitcoin has achieved 99.996% deflation over the past 10 years. Notably, the price of one Bitcoin in 2011 can now buy just 0.004% of a Bitcoin today. Meanwhile, the CPI has risen by 28% in dollars over the same timeframe.

So, while economists estimate that roughly half of Bitcoin’s price surge over the last few months has been driven by inflation fears and another half due to momentum trading, how much truth does the same hold?

Still lacks value

Looking deeper into capital markets, it can be observed that Bitcoin has, in fact, been increasingly correlated with inflation expectations.

Source: IntoTheBlock

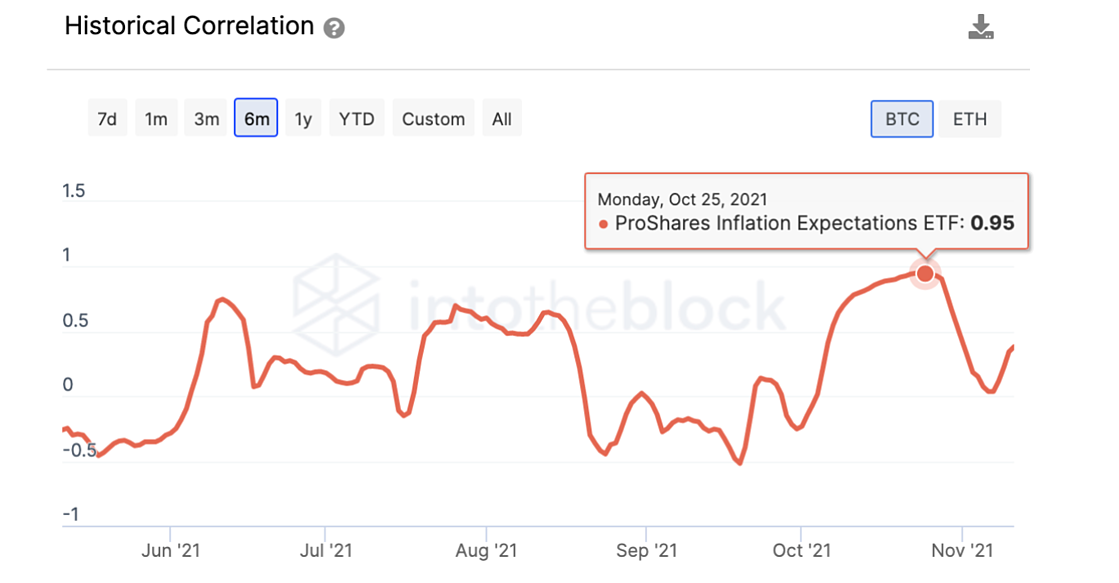

ProShares’ inflation expectations ETF (RINF) tracks the long-term break-even inflation, a widely followed measure of inflation expectations. Notably, BTC’s correlation with RINF hit an all-time high of 0.95 in late October, which highlighted how both Bitcoin and inflation expectations have been moving in tandem.

However, as Bitcoin’s price climbed by nearly 4% in the 2-hour period following the inflation report, it dropped by 8% just a few hours later. What did this mean?

Firstly, this move was indicative of how the traditional market’s disruption still affects BTC because its market capitalization isn’t large enough to absorb market anomalies just yet. In hindsight, it is notable that BTC’s market cap stood at $1.236 trillion, at the time of writing, while Gold’s market cap was $11.837 trillion. What this suggested was that Gold’s market size was 824.3% more than BTC’s.

Furthermore, while BTC’s limited supply makes it an ideal hedge for inflation, the market’s stance on this potential is still inconclusive. More so, since higher inflation may move ahead with an interest rate hike. That being said, while Bitcoin has achieved 99.996% deflation over the past 10 years, it is also important to note that “Bitcoin has yet to gain enough trust to be counted as a guaranteed inflation hedge.”

Maybe with time Bitcoin’s narrative as an inflation hedge can further strengthen. For now, looking at the stats, it does seem like BTC could be the next best bet to be an “inflation hedge.” And, there is good reason for such optimism. After all, BTC’s market cap is now just approximately two billion dollars off from Silver’s.