Bitcoin: This is what institutional investors are going to do in 5 years

Gone are the days when cryptocurrency was either associated with solely novice investors or illicit activities. With Bitcoin’s unstoppable bull rally and the rise of DeFi, the past year saw institutional investments in the ecosystem spike by unprecedented levels.

In fact, even those that have been erstwhile vocal critics of the space have now allocated millions of dollars to funding or investment activities. As inflation in the U.S.A. reaches levels last seen ages ago, the number of investors turning to crypto seems to be slated to only grow.

A recent study by Fidelity Digital Assets on institutional investor interest highlighted just that, with 70% of the respondents expressing their intent to buy or invest in digital assets in the near future. Moreover, almost 90% of those surveyed can be expected to add crypto to their companies’ or clients’ portfolios within the next 5 years.

The study surveyed 1,100 global institutional investors between December 2020 and April 2021 and for the purpose of the same, digital asset exposure was defined as including investing in cryptocurrencies directly, buying crypto-related company stocks, or exposure through other investment products.

The aforementioned finding is in line with other recent surveys that have pumped up investor interest in the BTC market. Earlier this month, a survey by Nickel Digital Asset Management showed that 82% of institutional investors are planning to increase their cryptocurrency exposure between now and 2023. On the contrary, a survey by Fidelity Investments was critical due to its position relative to the traditional finance market and its trillion-dollar AUM.

Here, it’s worth pointing out that the firm’s digital assets branch has been ramping up its functionality on the back of a recent announcement that increased its staff by 70%. This clearly was a sign that demand from institutional investors for crypto-services has only been increasing.

More significantly, the world’s biggest interdealer broker TP ICAP announced last month that it will launch a crypto-trading platform for institutional investors in partnership with Fidelity and others.

Finally, the survey by Fidelity also found that over half of the institutions that were polled already held allocations in digital assets. Additionally, investors from Asia were found to have more exposure to crypto-assets, with those from Europe and the U.S steadily catching up.

However, barriers to entry and skepticism remain prevalent among the surveyed investors. Along with market manipulation and lack of fundamentals, price volatility was cited as the primary deterrent for these investors to enter the crypto-market. The latter, in fact, has been cited as one of the primary reasons why a Bitcoin ETF hasn’t been approved in the United States by the country’s regulatory agencies.

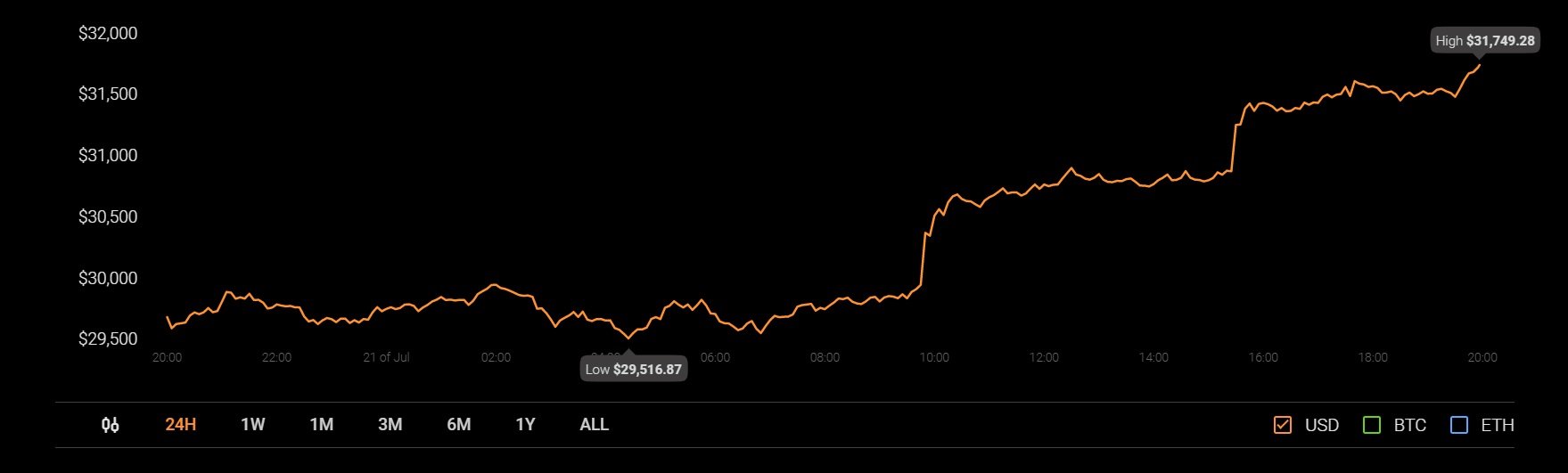

Source: Coinstats