Bitcoin: What Wikipedia won’t tell you about BTC’s recovery to May levels

Bitcoin [BTC] is back above $23,000 for the first time since 13 June, thanks to a strong bullish performance in the last seven days. Eagle-eyed BTC enthusiasts may have noticed that the latest rally pushed Bitcoin out of its narrow range where it had been locked for four weeks.

The next critical level for BTC to contend with is above $28,000. However, are market conditions in favor to drive the coin to its next critical level? Let’s find out.

Bitcoin’s latest performance suggests that investors are now dealing with the ‘fear of missing out’ on Bitcoin.

Additionally, the Fear and Greed index was at 31, which still stands in the fear territory, but can be considered a massive improvement from last month.

For context, the same index was in the extreme fear territory and stood as low as nine roughly four weeks ago.

However, an improvement in the score doesn’t necessarily mean there is enough demand to push BTC back to previous levels.

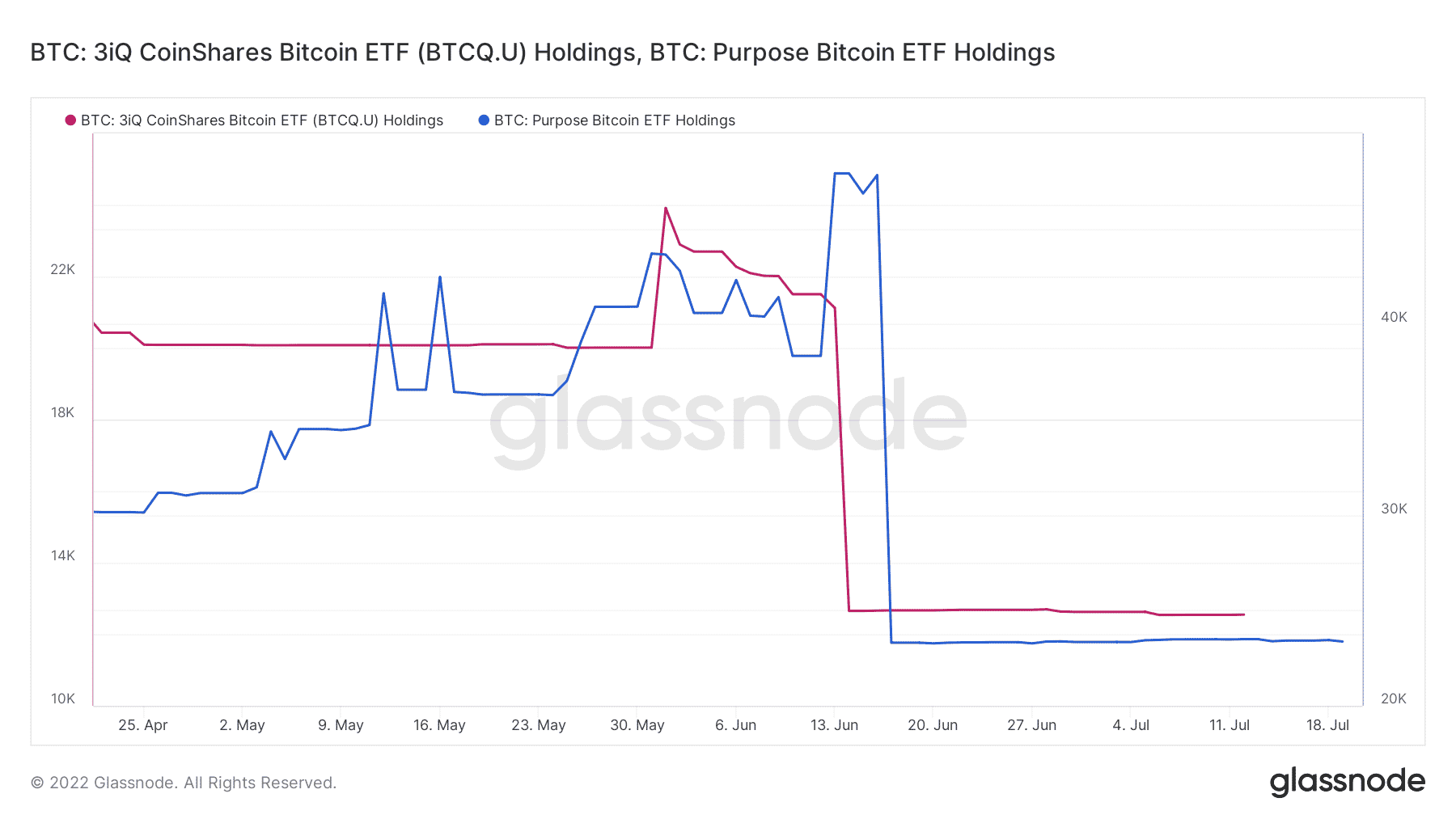

ETFs are still sitting on the sidelines

There were heavy outflows from 3IQ Coinshares and Purpose BTC ETFs during Bitcoin’s sharp crash in the second week of June. The same ETFs have maintained relatively low activity since then, but their accumulation would likely fuel recovery to May levels.

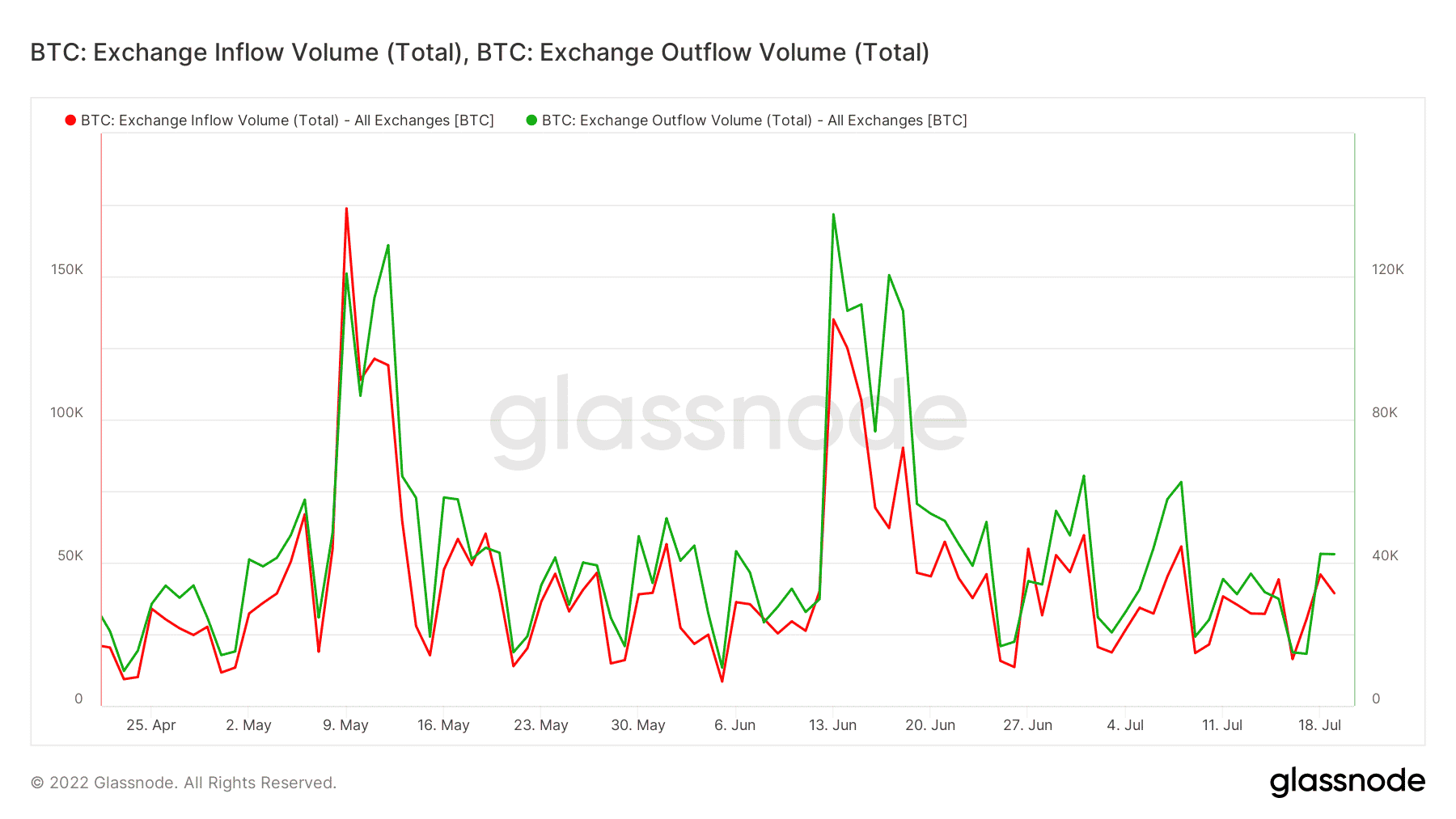

We have to factor in that strong demand may also come from elsewhere. Exchange inflows and outflows may provide a rough idea of the level of demand for Bitcoin currently in the market.

As per data from Glassnode, exchange outflows increased from 14,542 BTC to 42,390 BTC between 16 and 19 July. On the other hand, exchange inflows increased from 16,313 BTC to 39,329 BTC during the same period.

Exchange outflows have notably been higher than inflows. However, the gap between exchange inflows and outflows was relatively small at press time.

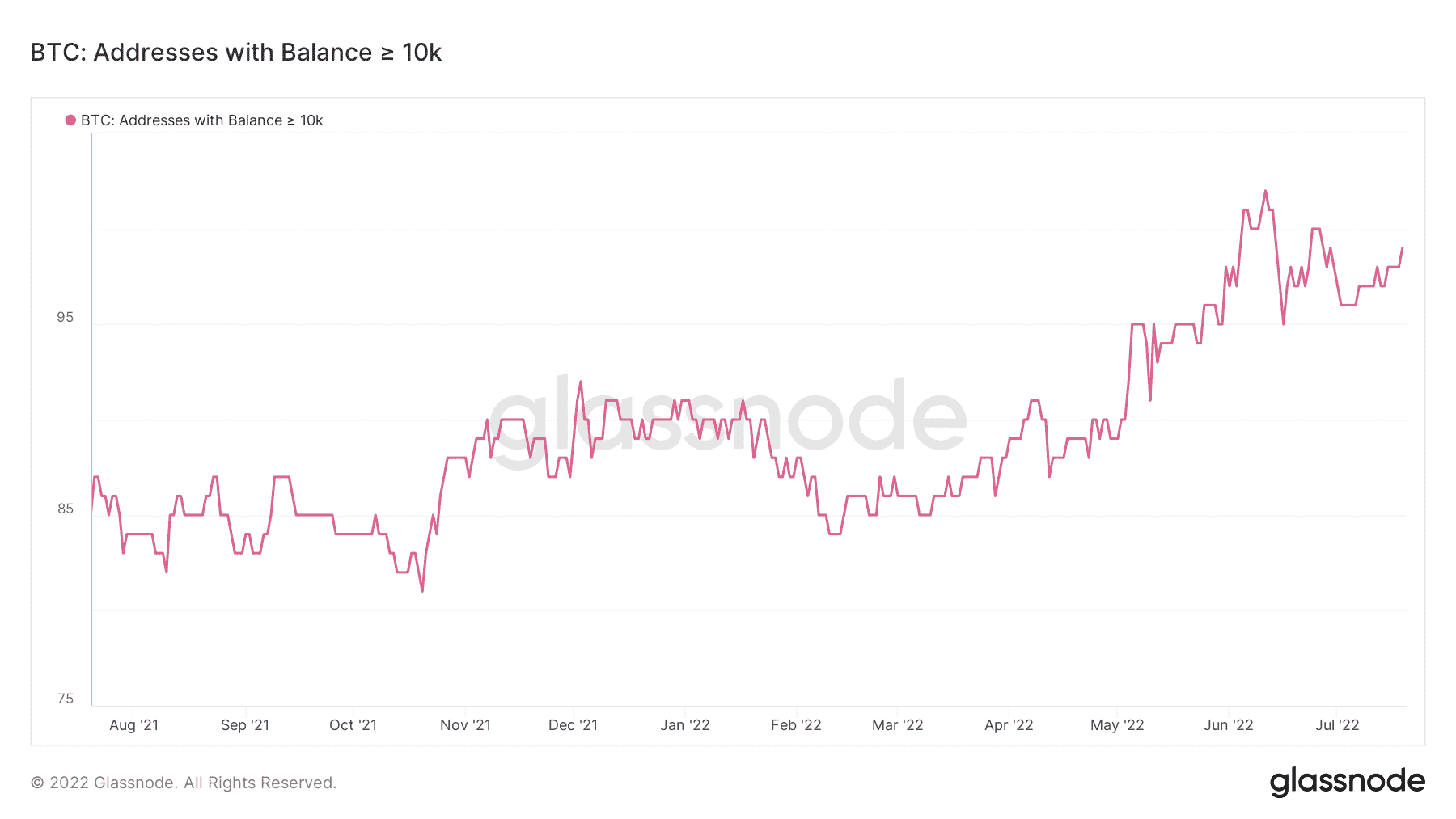

This suggests that BTC’s demand might not be as pronounced. Despite low demand, the good news is that whales have been accumulating Bitcoin in the last few days.

The number of addresses holding more than 10,000 BTC stood at 99 addresses as of 19 July. This represents an increase of three addresses from 4 July.

The only time that Bitcoin had a higher number of addresses worth over 10,000 BTC addresses was during the mid-June dip. Perhaps this is a sign that whale sentiment is improving at current price levels, likely after waiting for the worst to pass.

However, Bitcoin still has a lot of ground to cover to get back to May levels, even after its latest rally. There is bound to be some profit taking along the way.