Bitcoin: This sudden increase could mean redemption for BTC but…

- CryptoQuant analyst suggests a possible reversal as UTXO volume hits sudden increase

- Historical data indicated that the reversal might take some time in the face of potential decrease

Bitcoin’s [BTC] potential to avoid significant trading lower than $16,000 might have been granted a big boost. Indeed, there has been discussion about the king coin hitting its lowest point of this cycle. However, not many seem concrete enough, as there had been contradictions.

Read Bitcoin’s [BTC] price prediction 2023-2024

According to CryptoQuant analyst Dan Lim, something that rarely happens in bear markets has been triggered. Lim, also an active crypto investor, pointed out that the one-week to one-month Unspent Transaction Output (UTXO) volume steeply increased for the first time since this market condition began.

Up from here if it was back in time

A possible explanation of this condition was that BTC had almost bottomed out. This was because a similar situation happened in the cycles of 2015 and 2018. When it did, the market turned bullish as shown by the image above.

However, Lim noted that the reversal was not immediate, and this time, it took a longer period of 1444 days. Hence, there was no assurance that the extreme market condition was almost over. Lim said,

“It took 1358 days in 2018, and 1444 days in 2022 to make this movement. Although bull markets were not started immediately, the section where this movement came out was the bottom from a cycle perspective. Now, I am not sure what will happen because of the macro issues. The split-buy(accumulation) approach from the long term perspective could still be the easy answer.”

But, were there other metrics in agreement? According to Glassnode, the Market Value to Realized Value (MVRV) z-score was -0.236. Interestingly, the z-score had been in the negative area since July 2022. The z-score evaluates the potential of Bitcoin to be at fair value or show it being oversold or overbought.

At the current state, the MVRV Z-score indicated that BTC had crossed below the fair value. However, since it has been in such a state for months, there was no guarantee that the UTXO condition would trigger its reversal.

History has its part to play

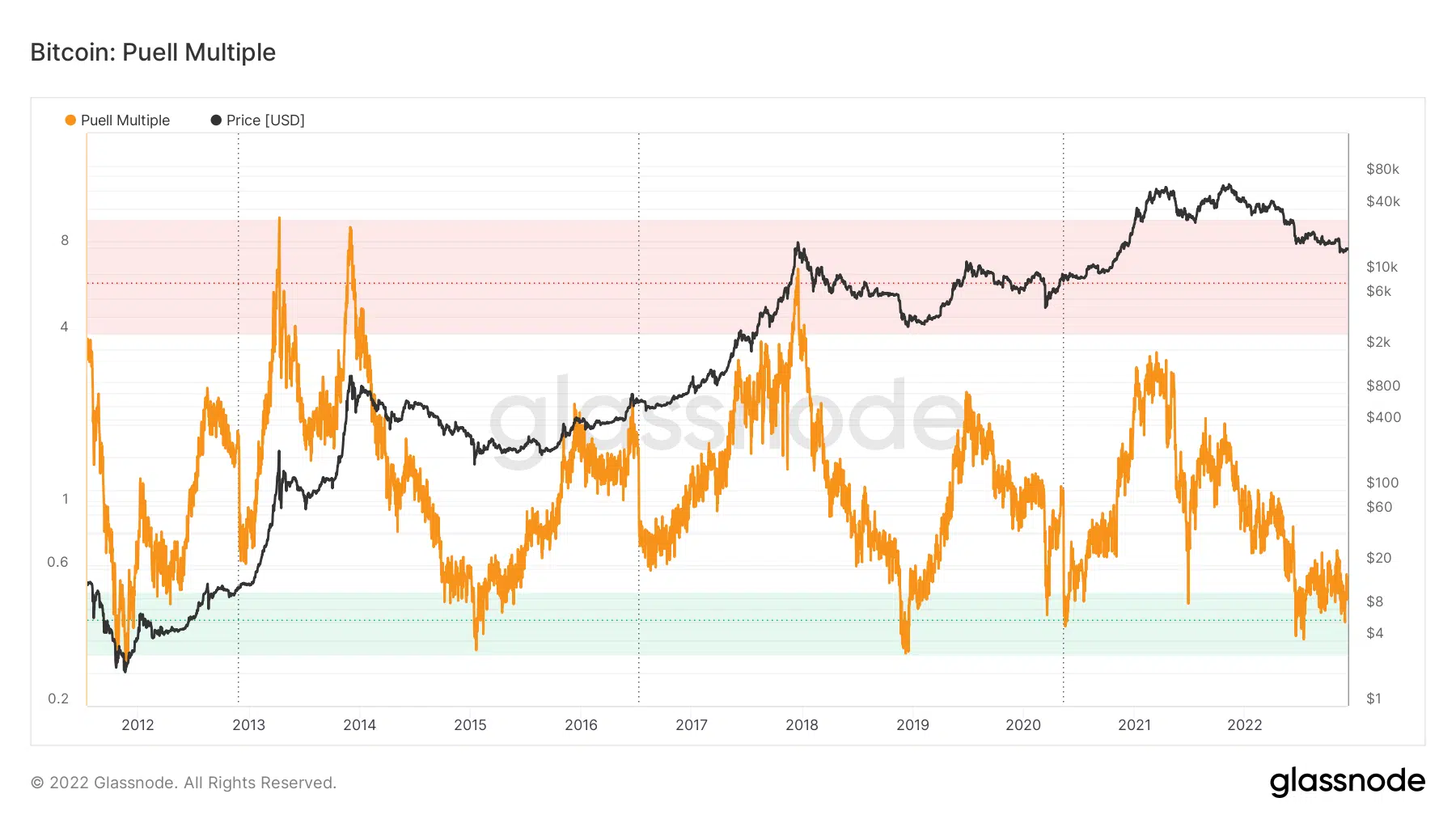

Additionally, the Bitcoin Puell Multiple was in the green zone at 0.469. For context, the Puell Multiple shows the status of the 365-day moving average in daily Bitcoin issuance.

In a case, where the value is between 4 to 8, it signifies market peaks or a red zone. Since, the current Puell Multiple was between 0.3 to 0,5, it implied closeness to the bottom. Also, this state could also indicate a price reversal.

Despite the bullish hopes, Bitcoin’s correlation with the stock market could hinder the reversal. As opined by another analyst, Ghoddusifar, the latter faced losing a trendline resistance. In the event that it comes to pass, BTC could fall further.