Bitcoin: Those who bought the dip are making profits and how

Bitcoin’s price dropped more than 50%, following the recent May-June price dip. Even though the market looked grim at the time, the chants of “buy the dip” didn’t fade away. In fact, many traders and analysts asserted that Bitcoin at $30K would be a steal deal.

Then, as a fairly good recovery began on July 22, analysts have compared this cycle to the previous bull cycles of 2013 and 2019, speculating whether recovery of the same magnitude will occur this time too.

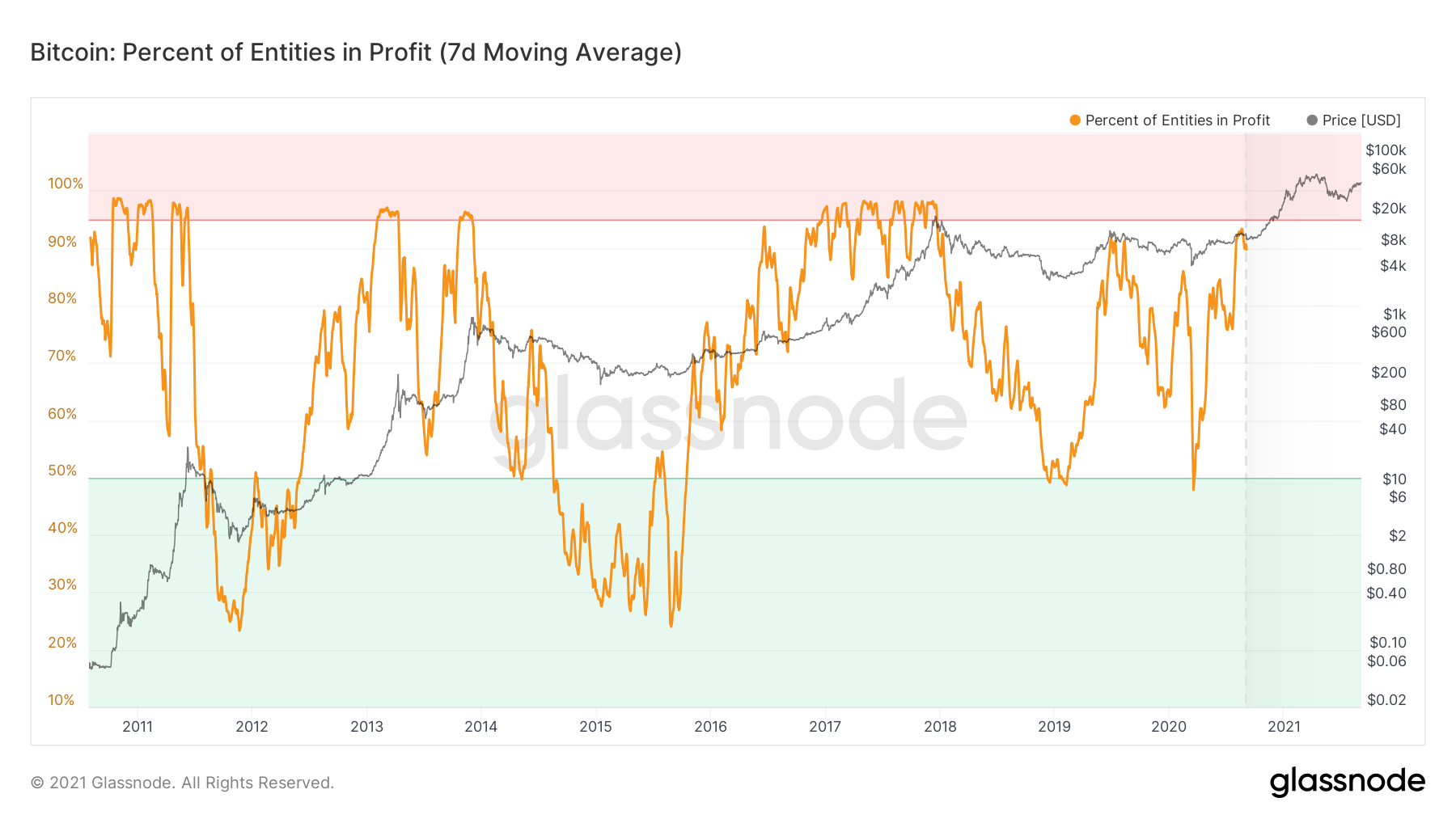

Bitcoin’s “Percent of Entities in Profit” denotes the percentage of unique addresses, the funds of which, have an average buy price that is lower than the current price. Notably, the percent of profitable entities were equivalent in January 2018 and May to September of 2019. In 2020 a run to the same level was seen but the same level wasn’t achieved. This time too, experts are anticipating BTC’s Percent of Entities in Profit to reach the 2017 levels.

Source: Glassnode

The percentage of entities that are profitable, relies on factors like HODLer composition, Bitcoin dominance, the number of active addresses, and transaction volume. With Bitcoin dominance reaching three-monthly low levels and its price oscillating close to the $50K mark, things didn’t look bleak for holders.

Calculating your profits

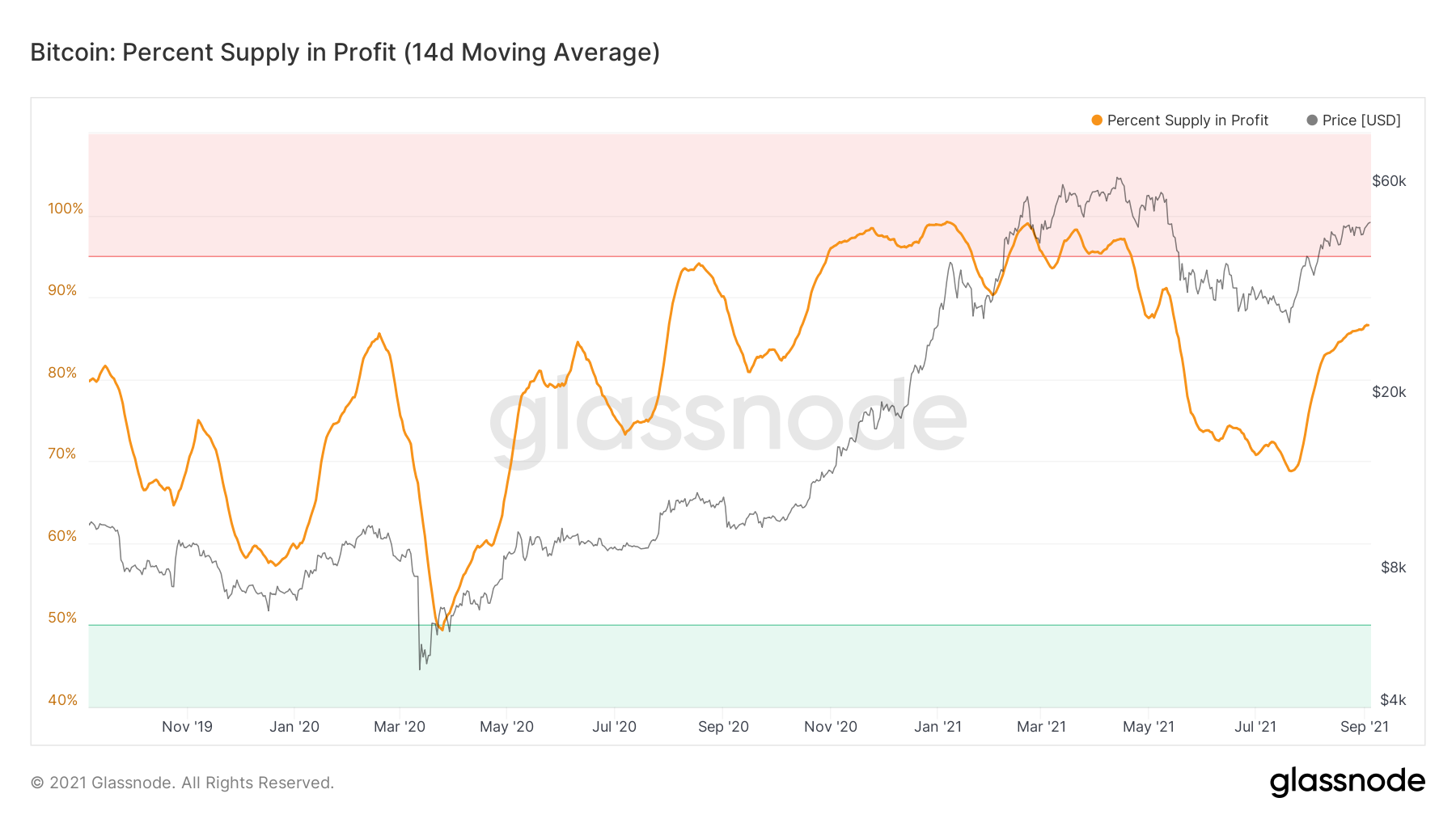

Bitcoin’s Percent Supply in Profit was still struggling to reach the red zone. Even though at the moment it was in an uptrend, if BTC maintained above $50K, then a hike in the metric could be expected. Likewise, BTC’s percent UTXOs in profit had also not reached the higher levels of May and its uptrend could be expected on a higher price level.

However, Bitcoin’s long-term profitability depends more on historic trends and movement of Bitcoins by large wallets, as well as traders calculating profits during recovery. Following a dip, the percentage of wallets that are profitable depends on HODLer composition or the time when they made the purchase.

Nonetheless, if you bought the BTC dip, things will look bright for you irrespective of the larger sentiment. For calculating profits on BTC, looking at the long-term and short-term ROI of Bitcoin, historically reflects the money made during that time.

Over the last week, last month, and the last three months, Bitcoin has generated positive ROIs. Before the recovery, ROIs were largely negative over longer time frames for BTC. That is, after the dip and the flash crash of May 2021. The ROI was +379% in the USD market, over the past year.

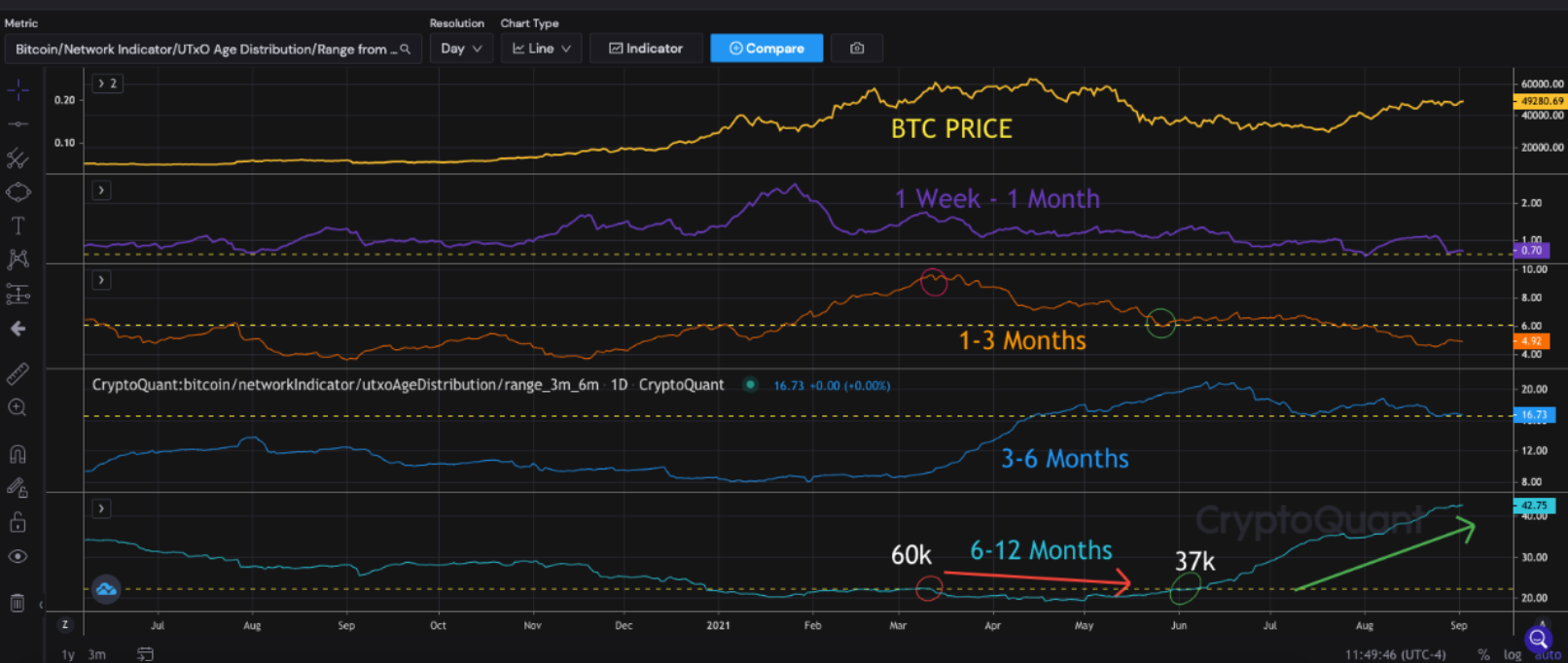

Since the May-June dip was roughly 3 months from press time, if someone bought the dip they must be pretty profitable by now. Further, a Cryptoquant analyst pointed out that 6-12 months aged coins keep increasing, meaning that younger coins mature into older ones and they are not getting spent which was a good sign. New participants took profit around $60k and while the rest panic sold around $30K, but they look like they’re re-entering the market.

For now, about looming concerns around consolidation, a big accumulation started at around $37K in June and is continuing. It seems like investors would want to hold their coins, especially the “dip buyers” who have their bags full at the time.