Bitcoin to $20k or $40k? Why ‘this setup is different…’

![Bitcoin [BTC] bulls to fizzle out of the FOMO rise, correction imminent, claims Peter Brandt](https://ambcrypto.com/wp-content/uploads/2019/05/stairs-1209439_960_720-e1558940198624.jpg)

Can Bitcoin surge and break the resistance? Can it cross the $40k mark? These are some of the many speculations that have been going around. Well, on the flip side, there have been a couple of bearish projections as well about the largest cryptocurrency in the world.

At the time of writing, Bitcoin was trading just above the $36k mark with a correction of about 1.5% in the last 24 hours.

This Veteran trader and analyst had an interesting projection, both bullish and bearish, with regard to Bitcoin.

Peter Brandt had this to say regarding a potential uptrend.

I still believe in the long-term narrative that takes BTC to $100k

— Peter Brandt (@PeterLBrandt) June 7, 2021

Even after recent setbacks that Bitcoin had in recent times, Brandt reiterated a similar vote of confidence, he stated:

“When BCL (Bitcoin Live) began in late 2018 I thought BTC had a 50% chance for $100,000, $1 million, whatever, and 50% chance for zero. I am much more constructive now. Call it 70%/30%, but the job of the bull is to shake out FOMO (fear of missing out) buyers.”

He also gave his take on the extent of the correction that bitcoin could see.

Big picture perspective on owning $BTC in appropriate size with money you can afford to lose

Market topped $64,7kf

Market corrected to $30,0k

Worst I can envision is $21,0kWhy would someone bail out of non-leveraged longs when the market already had 80% of worst case drop?

— Peter Brandt (@PeterLBrandt) June 2, 2021

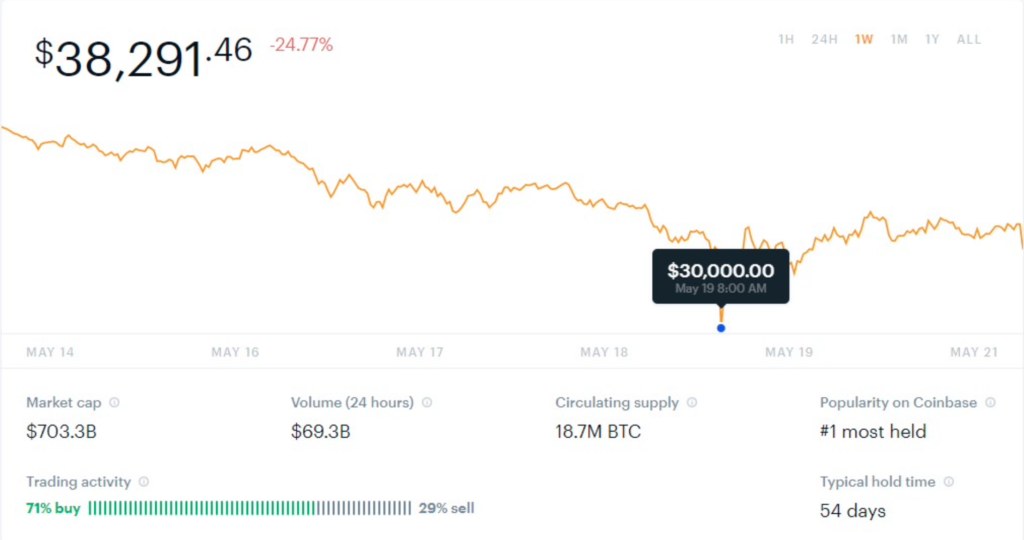

As per the tweet, Bitcoin, after a price consolidation at the $30k mark, could see freefall to around $21,000 in a worst-case scenario. This narrative comes right after Bitcoin peaked at $64,854 on Apr 14 but it then retraced all the way back to $30,000 on May 19.

Source: Coinbase

Brandt even posted a challenge to all the crypto proponents in the community on his Twitter feed. He stated:

“In the past 10 years (since May 2011) please identify a single (even one) instance:

1. When a 50%-plus correction did not lead to at least a 70% correction

2. When a 50%+ correction made a new ATH within 7 months”

Here’s how the community responded.

All drops of that scale with long recoveries was from a starting point where price was over extended above fundamental valuation.

This setup is different in that price is BELOW fundamentals.

As a guide, the COVID dump dropped below fundamentals and therefore recovered quickly.

— Willy Woo (@woonomic) June 1, 2021

Continuing the same thread, many BTC enthusiasts such as Rekt Capital posted their analysis on Bitcoin’s current trajectory as well.