Bitcoin, Uniswap and Chainlink Price Analysis: 23 June

As Bitcoin ricocheted off the $29,000-support and touched the $34,000-mark in the last 24 hours, the market’s altcoins too redeemed themselves to an extent. UNI, for example, accrued a 13.2% hike in market capitalization while LINK rose by 9% over the past 24 hours.

Bitcoin [BTC]

Source: BTC/USD, TradingView

Bitcoin‘s price climbed by 4.18% in the last 24 hours and it was trading in the green at $34,066.95, at press time. The cryptocurrency, at the time, had recovered convincingly after hitting a low of $28,900 just yesterday.

BTC had around the same price level between 7 June and 9 June, post which, the prices hiked somewhat. Going by the same trend, Bitcoin could again expect a price reversal. If Bitcoin’s prices fall further, it could find support above $20,000.

As the crypto’s price recovered, the Relative Strength Index climbed back into the neutral zone as buying and selling pressures evened out. The Awesome Oscillator pictured bullish momentum building up as the presence of green bars exceeded the red bars.

That being said, if Bitcoin manages to stay afloat above the $30,000 support level, the price could rise and re-test its next resistance.

The Bollinger Bands mostly remained parallel with a slight convergence, a sign of some price volatility.

Uniswap [UNI]

Source: UNI/USD, TradingView

UNI saw an 8.8% hike in valuation on the back of price corrections yesterday. The altcoin rebounded from the $14-support level and was trading at $17.92, before recovering even more.

The Relative Strength Index moved up north and pointed towards an uptrend as selling pressure reduced over the past few days. The indicator underlined neutral buying and selling pressure. However, at press time, the sellers slightly exceeded buyers.

The Bollinger Bands have remained diverged since the early hours of 22 June, demonstrating that the price could see changes over the next few trading sessions. If the alt continues to trade in the green, it could rise above the $19-resistance level to find support at the same.

Interestingly, the slight hike in the price of the alt corresponded with a bullish crossover on the MACD indicator.

Chainlink [LINK]

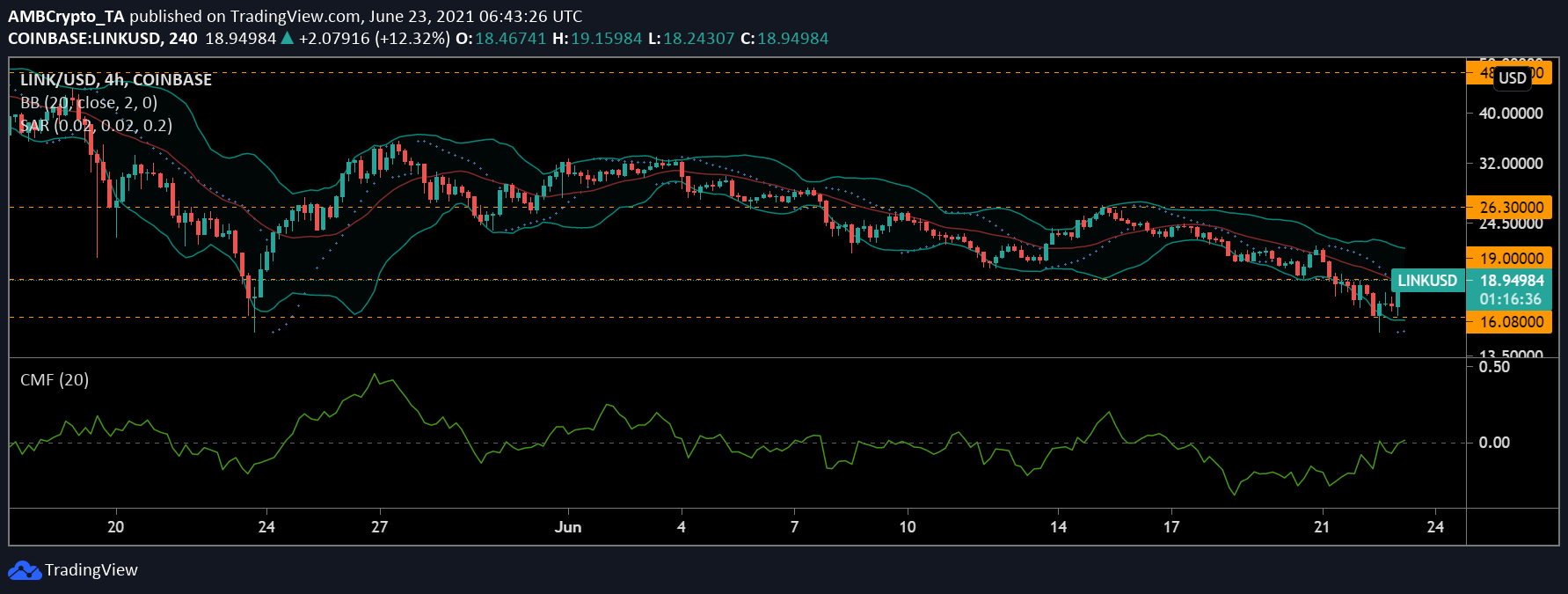

LINK/USD, TradingView

After LINK plummeted by almost 12%, it recovered by 7% in the last 24 hours at press time. On 22 June, the altcoin was available at $17.2, however, at the time of writing, the asset was valued at $18.87. The crypto could again move past the $19-mark to find that as a support level if the price escalates further.

The Chaikin Money Flow pointed to a modest increase in capital inflows over outflows.

The mouth of the Bollinger Bands expanded on June 22 and since then, price volatility could be spotted on the chart. At press time, the indicator highlighted the likelihood of further price fluctuations.

Finally, the Parabolic SAR had just begun to show signs of an uptrend as the dotted lines were seen below the candlesticks.