Bitcoin vs Ethereum: These assets offer highest profits to certain types of traders

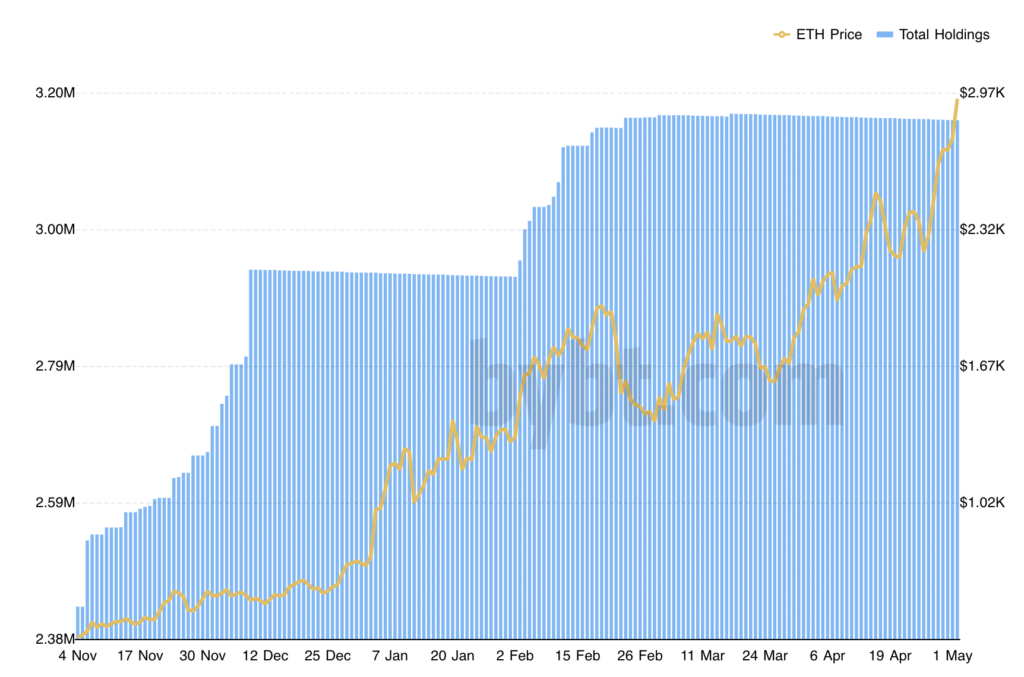

Ethereum offers high profitability to short-term HODLers and that makes it popular with retail traders. Institutions like Grayscale are known to HODL ETH, which is held in their AUM. Currently, Grayscale’s ETH Holdings have remained largely the same, close to the 3.2 Million level based on data from Grayscale. The price has no visible relationship with the total holdings and this is different for retail traders.

ETH Holdings Grayscale || Source: Bybt

This makes it the retail traders’ altcoin. The way institutions have been noted to make profits from HODLing and trading in Bitcoin, ETH is profitable for retail traders. There are several fundamental and technical reasons supporting the argument. Since ETH dwarfs every blockchain in terms of fees paid, and data shows massive demand for ETH across exchanges. This demand may not be institutional, but it exists.

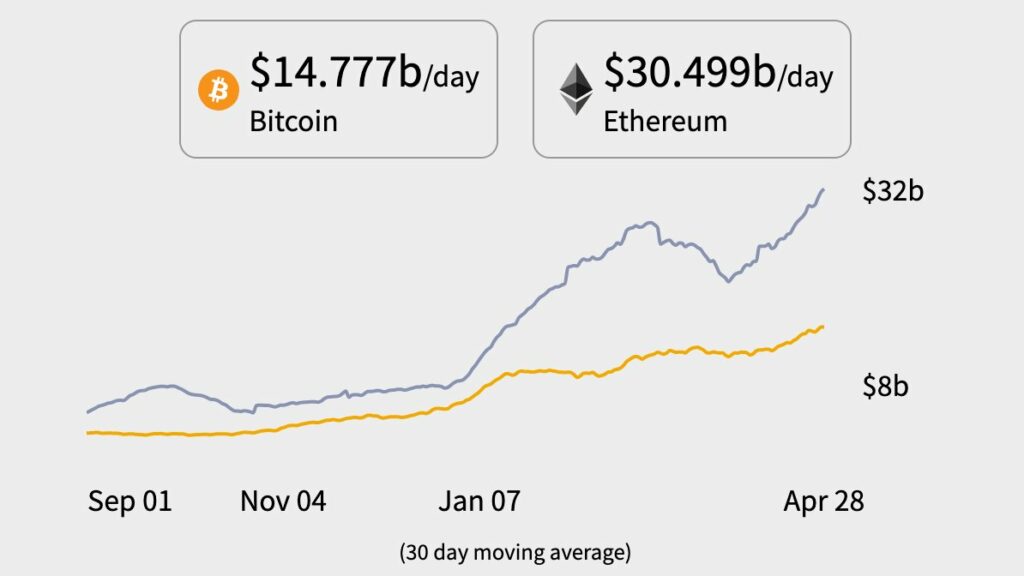

The ETH network settles $30.5 billion worth of value per day, far more than what Bitcoin registers. Though a high percentage of ETH’s transactions are directed from DeFi and NFTs, the altcoin is largely popular.

ETH transactions on the network vs BTC || Source: Twitter

Ethereum now has 625k daily active addresses, and climbing every day, at the ATH price level. Retail traders are expecting the altcoin to kick into discovery mode.

With $65 Billion worth of ETH locked in top DeFi projects, ETH is institutional grade, however, it manages to offer profit booking opportunities to retail traders at the same time. There are over 500k daily unique senders on the ETH network and that is just an example of the increasing number of unique and active users. What’s more, Bitcoin is being increasingly represented on ETH in the form of WBTC, making it a massive attraction for crypto assets, Bitcoin, DeFi and NFTs.