Bitcoin: What does this mean for the ‘trapped bulls’?

![Ethereum [ETH] falls into the bear trap, becomes biggest loser among top 5 cryptocurrencies after BCH](https://ambcrypto.com/wp-content/uploads/2018/09/jeremy-vessey-311354-unsplash-e1538206337563.jpg)

Bitcoin, the world’s largest cryptocurrency has been bleeding for quite a while now as bears overtook the bull. As things stand, it was trading just above the $33k mark with a correction of about 2% in the last 24 hours. BTC witnessed a major decline in its volume as well, a 44.5% plunge within the same period. Earlier this week, Bitcoin plunged to a five-month low of $28,600.

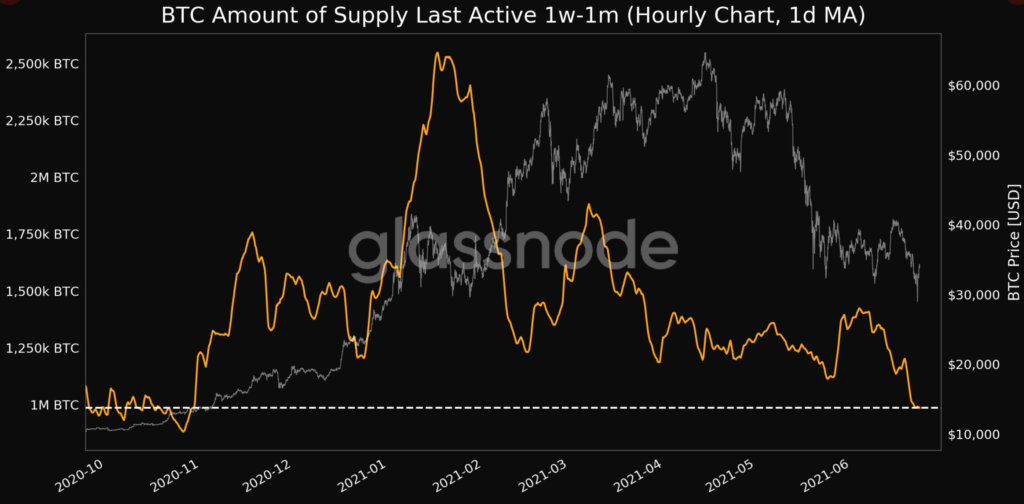

As per On-chain analysis platform Glassnode: ‘Bitcoin Amount of Supply Last Active 1w-1m (1d MA) just reached a 7-month low of 985,098.597 BTC.’

To add to this bearish sentiment, the ‘Big Short’ famed investor, Michael Burry recently tweeted a word of caution.

Trapped bulls often fall for the latest support. pic.twitter.com/qshcUvpEKQ

— Cassandra (@michaeljburry) June 24, 2021

Last week, to add to his bearish narrative, Burry warned his followers about the “mother of all crashes” in a now-deleted tweet.

Continuing the same thread, he added:

“All hype/speculation is doing is drawing in retail before the mother of all crashes. FOMO Parabolas don’t resolve sideways; When crypto falls from trillions, or meme stocks fall from tens of billions, MainStreet losses will approach the size of countries. History ain’t changed.”

Furthermore, he stated:

“The problem with Crypto, as in most things, is the leverage. If you don’t know how much leverage is in crypto, you don’t know anything about crypto, no matter how much else you think you know,”

Robert Kiyosaki, the best-selling author of ‘Rich Dad Poor Dad,’ too had similar speculations against the largest crypto token. According to his tweet, he cautioned his followers about the crash in world history. He stated: “The biggest bubble in world history getting bigger. The biggest crash in the world history coming…”

In contrast, Crypto bull, and analyst, Michael van de Poppe didn’t see any cause for alarm with the current scenario. He stated:

“Consolidation on the markets, that’s completely fine.”

Another crypto enthusiast, a few weeks ago published a post directed at Burry, contradicting the latter’s views.

![Here is what to expect from Virtuals Protocol [VIRTUAL] in 2025, should you invest?](https://ambcrypto.com/wp-content/uploads/2024/12/Ritika-1-11-400x240.webp)