Bitcoin will not replace gold, but is it trying to?

On the back of growing confidence in the Bitcoin market, the price of the world’s largest cryptocurrency has been hitting one peak after another. However, as its value grows, so is the skepticism around it. The crypto, popularly dubbed as “digital gold,” has been compared to gold endlessly, but Bitcoin has so far managed to establish its own niche in the financial market.

Despite its progress, there are people from the mainstream financial market who have claimed that Bitcoin may not be able to replace gold. Agnico Eagle Mines Ltd’s Chief Executive Officer Sean Boyd is the latest to do so. In a recent interview, while he highlighted the increasing competition posed by cryptocurrencies, Boyd reiterated that he did not consider the asset class an immediate threat.

He stated,

“I think you have to have those conversations, but you look at the liquidity in bitcoin. It’s a small market. Sure, you may get other cryptocurrencies, but there still are issues around cryptocurrencies as far as security goes. So, we don’t see Bitcoin dislodging gold and gold’s importance.”

However, this begs the question – Does it even want to replace gold?

In 2020, when the COVID-19 pandemic hit global markets, gold and crypto were the first to bounce back. Instead of competition, we saw a hike in the correlation between the two digital assets, something that had been seen a decade ago as well. In fact, one can argue that the pandemic affirmed that the two were ideal hedges for the market and can co-exist.

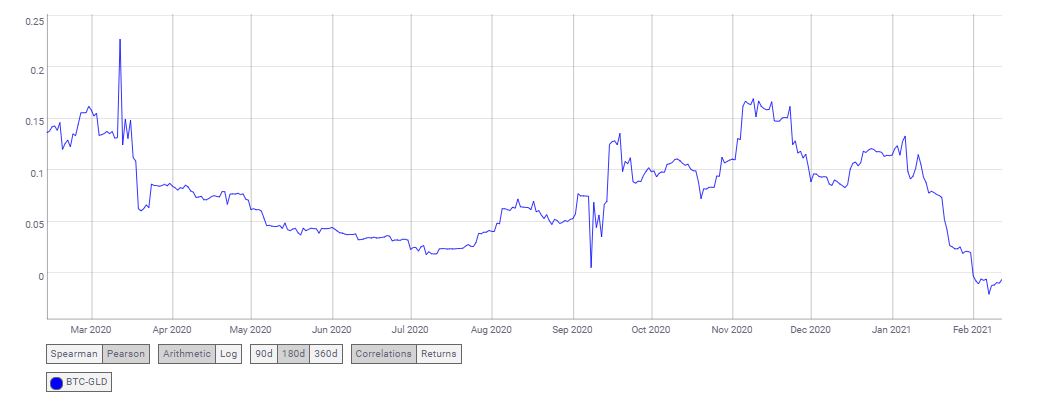

Source: CoinMetrics

According to the attached chart, the peak in the correlation between Bitcoin and Gold was 0.2266 after the March fallout. Although the correlation has dropped under zero, the two assets have been a part of the same journey over the past couple of years.

However, a skeptic of Bitcoin like Peter Schiff has alleged mainstream media to be biased and “doing everything it can” to promote Bitcoin. He added,

“On the other hand, the media doesn’t want anyone buying #gold. Gold is a threat to the fiat monetary system. Bitcoin is only a threat to the people who buy it.”

Positive or negative, people are focusing on Bitcoin. While some speculate that a bubble is in the making, many believe that the narrative has reversed and Gold can act as a hedge for the current crypto-volatility. This included Schiff who said,

“Traditional fiat currencies and Bitcoin derive their market value primarily from confidence. Some losing confidence in fiat are buying Bitcoin. But what happens when people lose confidence in Bitcoin? If you’re buying #Bitcoin to hedge fiat you need to buy #gold to hedge Bitcoin.”

Bitcoin will not replace gold, but the two together can replace the traditional finance system that has remained dominant for the longest time.