Bitcoin’s correlation with precious metals rally as investors seek…

- Recently, there was a spike in BTC’s correlation with precious metals.

- On a daily chart, BTC’s selling pressure outweighed buying pressure.

Bitcoin’s [BTC] correlation with precious metals such as gold and silver has experienced a noticeable surge recently, data from IntoTheBlock showed.

1/ #Bitcoin and precious metals have shown a noticeable increase in correlation recently?? pic.twitter.com/PLFro4OVa3

— IntoTheBlock (@intotheblock) May 19, 2023

Read Bitcoin’s [BTC] Price Prediction 2023-2024

This indicated that the price movements of BTC, gold, and silver were more closely aligned as investors and traders alike began to perceive the similarities between these asset classes causing them to move in tandem.

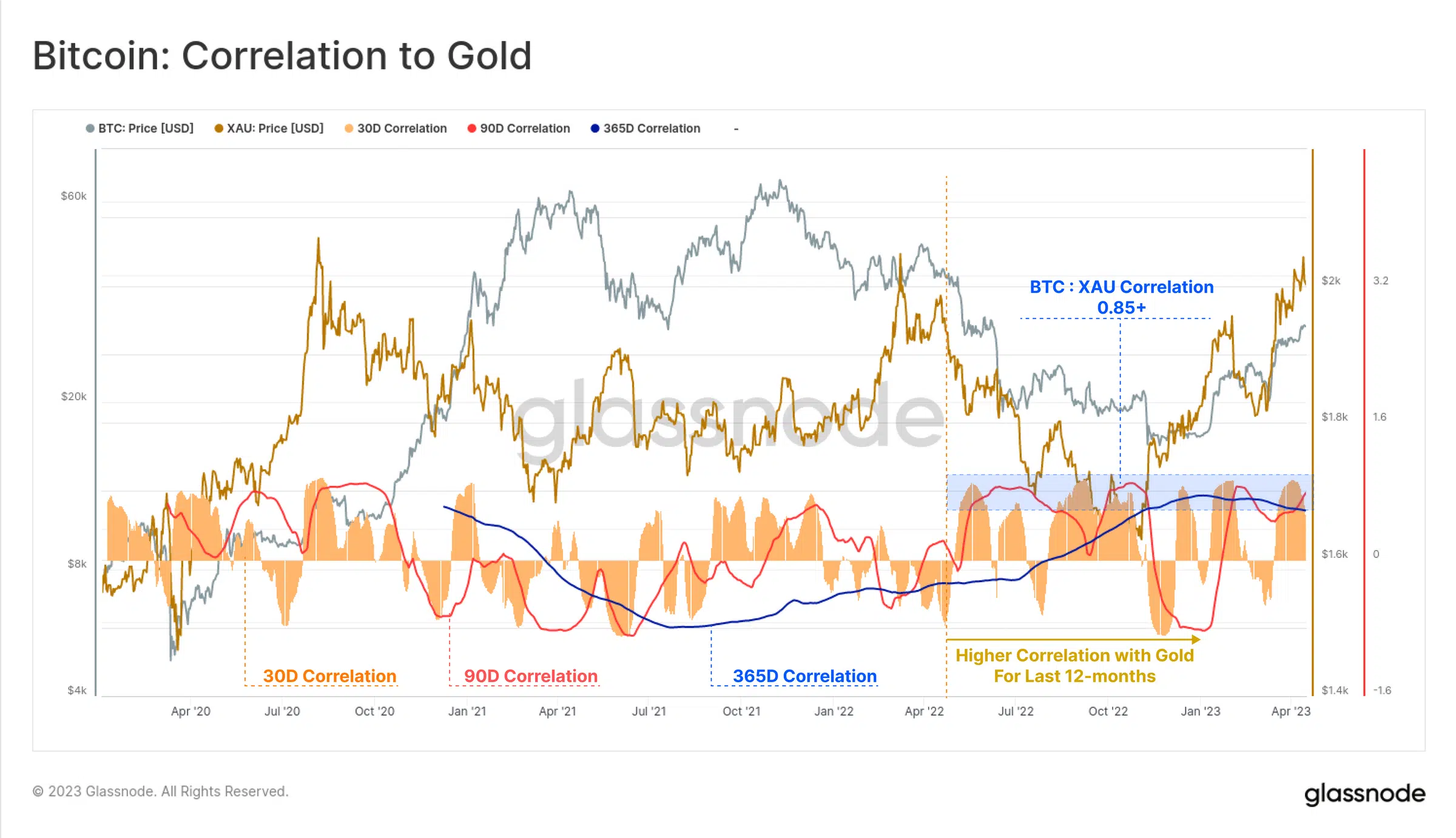

In a report by Glassnode published on 17 April, the on-chain data analytics firm noted that over the past year, the “correlation between the performance of BTC prices, relative to Gold, the traditional sound money safe haven” increased.

According to Glassnode, an observation of the positive correlation on various time timeframes, such as 30 days, 90 days, and 365 days revealed that the link remained elevated during the recent banking crisis in the US.

Glassnode noted,

“This does suggest that an appreciation for both sound money and the realities of counter-party risk are increasingly front of mind for investors.”

In a 26 April tweet, cryptocurrency market data provider Kaiko said that on a 30-day average, BTC’s correlation with gold experienced a surge since March to stand at its highest level in about two years.

Bitcoin 30-day rolling correlation with gold has surged since March and now stands at 57% – its highest level in almost 2 years.#BTC #Gold #correlation pic.twitter.com/l7N5eYAgEl

— Kaiko (@KaikoData) April 26, 2023

BTC struggles to entice buyers

Falling to the $26,000 price mark two days ago, BTC’s price has since oscillated within a narrow range. An assessment of the coin’s price movement revealed that the king coin has since traded with $26,800 and $26,900 price marks.

At press time, it exchanged hands at $26,862.52, logging a 30% decline in trading volume in the past 24 hours and a 0.19% fall in price during the same period.

With the coin’s weighted sentiment pegged at -0.566 as of this writing, data from Santiment confirmed investors’ lack of interest in accumulating BTC.

As indicated by key momentum indicators on the coin’s daily chart, it has caused selling pressure to outweigh accumulation.

Is your portfolio green? Check out the Bitcoin Profit Calculator

BTC’s Relative Strength Index (RSI) was 40.48 at press time, positioned below its 50-neutral position. Likewise, its Money Flow Index (MFI) was positioned in a downtrend, inching closer to the oversold position at 30.13.

Further, BTC’s price approached the lower band of its Bollinger Bands indicator at press time. This suggested that the coin’s price was nearing a potential support level or a period of consolidation.