Bitcoin’s hash rate surges, but what’s up with miner fees?

- The hash rate of the Bitcoin network has increased.

- BTC retained a trend above $50,000.

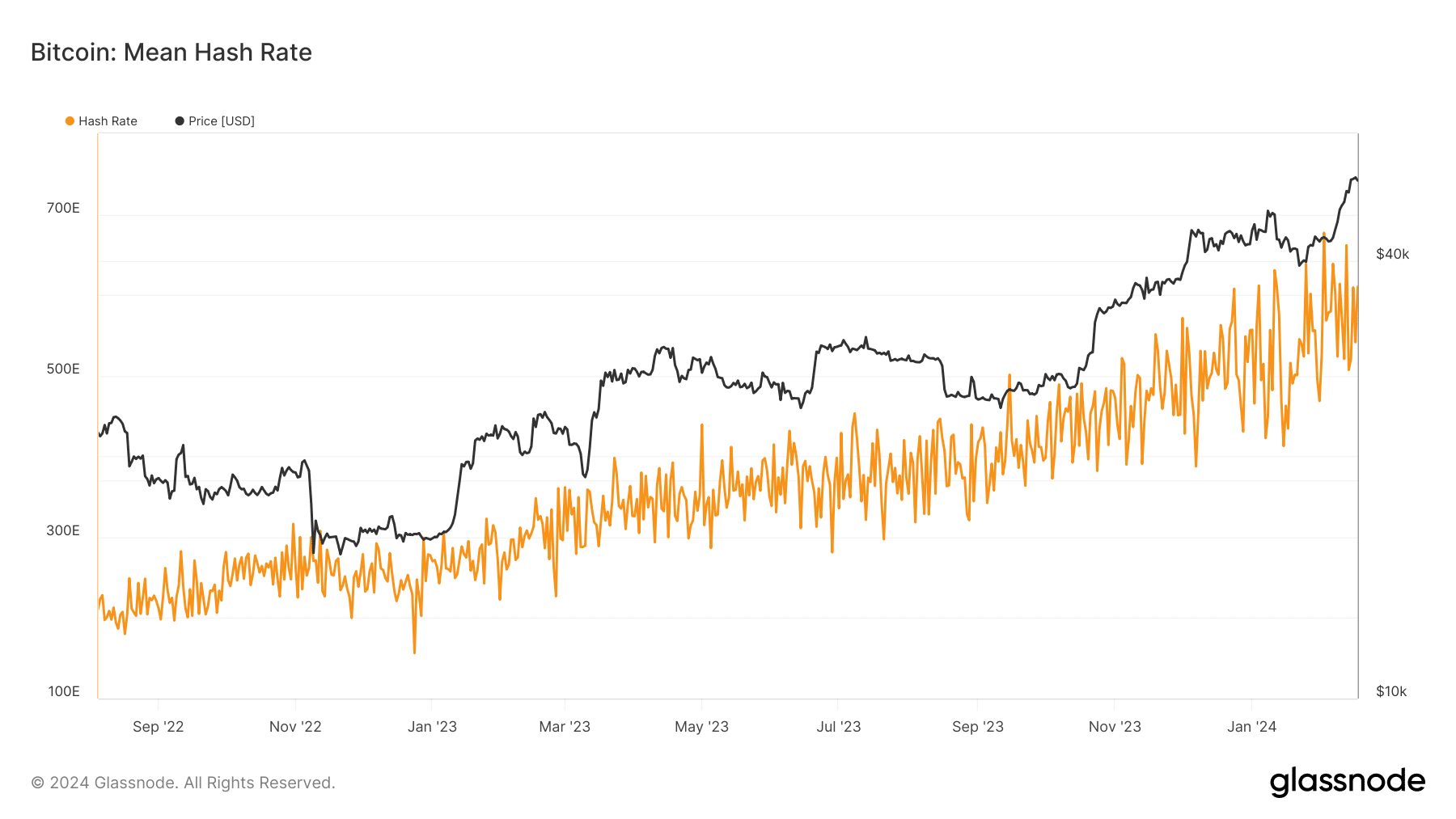

Recent data indicated that the rise in Bitcoin’s [BTC] prices has notably affected both network difficulty and hash rate. How have these changes influenced miner revenue?

Bitcoin difficulty heightens

AMBCrypto’s examination of the Bitcoin hash rate showed a surge corresponding to the recent increase in prices.

At the time of this writing, Glassnode’s data showed that the hash rate was over 610 trillion. While not the highest recorded hash rate, it stands among the peak levels observed in recent months.

The heightened hash rate has also contributed to increased network difficulty. AMBCrypto’s analysis of the difficulty chart indicated a substantial climb in recent days, reaching its highest level in months.

Bitcoin miner fee falls to lowest in the year

While Bitcoin’s network difficulty and hash rate experienced an increase, the miner fee did not exhibit a corresponding upward trend. An analysis of miner revenue fees showed a recent decline.

Starting the month at over 5%, the fee peaked at over 15% at one point. However, at the time of this writing, the fee had decreased to around 3%, marking the lowest point in the year thus far.

It’s worth noting that this current fee is not the lowest observed in recent months — a range of 1.6% was recorded between July and October 2023.

BTC maintains a trend above $50,000

Bitcoin’s price trend, analyzed by AMBCrypto on a daily timeframe, exhibited an almost 1% decline on the 17th of February. Despite this downturn, it sustained above $50,000 for the fifth consecutive day.

It was trading at around $51,800 at the time of this writing, with an increase of less than 1%. The short moving average (yellow line) acted as a support level, around $44,300.

This signified that the price will likely remain above the yellow line in the event of a decline.

Is your portfolio green? Check out the Bitcoin Profit Calculator

The bullish trend was also evident in the Relative Strength Index (RSI), which, at the time of this writing, was slightly below 80, indicating a robust bull trend.

To witness an increase in the miner fee, additional network activities would be required in conjunction with these other metrics.

![Aptos [APT]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-12-1-400x240.webp)