Bitcoin’s hike in OI and fall in future liquidation say this about BTC’s present

BTC’s spot market might look a bit different, even a bit dull to be honest. Bitcoin [BTC], in 2022, has suffered intense corrections that saw its price slide below the $20k mark. Regardless of BTC’s press time price of $19,185, the futures market had a complete different story to tell here.

Have a look.

Here’s AMBCrypto’s Price Prediction for Bitcoin [BTC] for 2022-23

_________________________________________________________________________________________

I’m a sucker for this

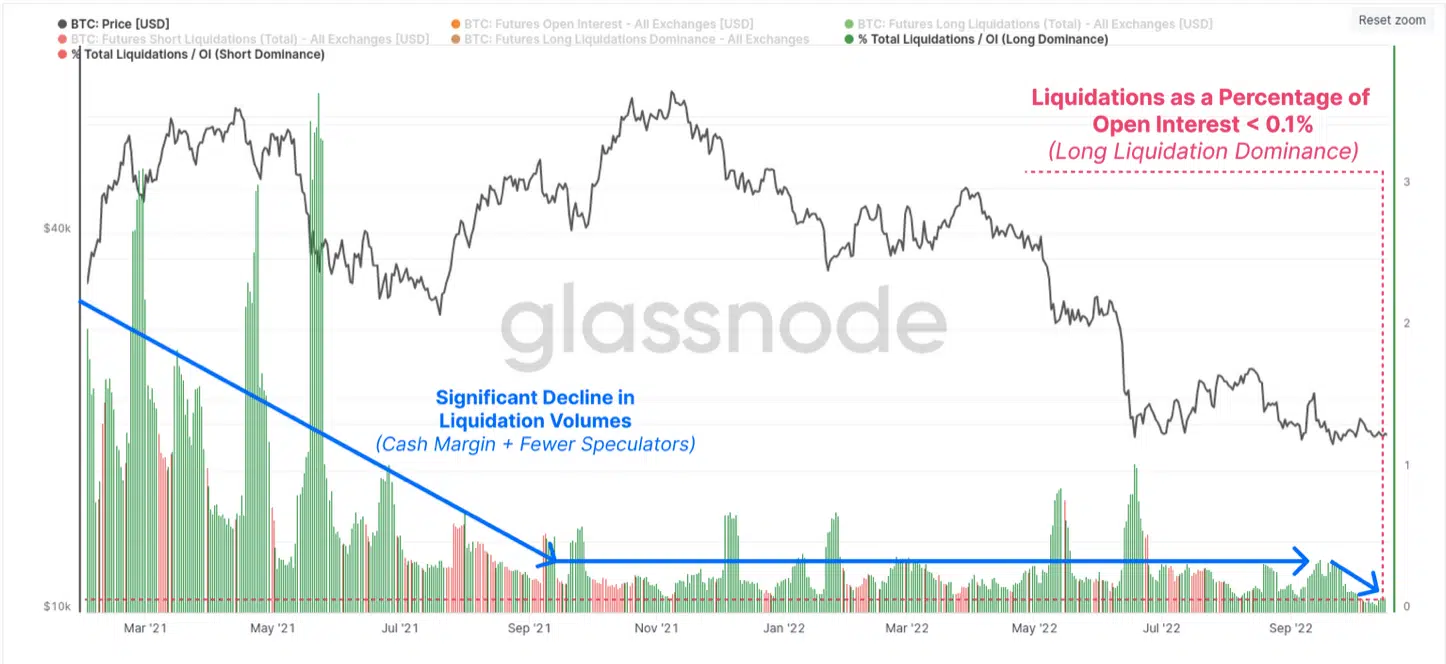

Bitcoin primed for volatility with liquidations at an all-time low and the open interest at an all-time high. Indeed a combination that could aid or rather bring in a much-needed relief for the king coin.

Messari’s latest insight shed some light on the same. The ratio of futures open interest (OI) leverage in the BTC market stood at the highest level on record.

“While a lot of unsecured and undercollateralized debt got wiped out in May, current futures leverage is over 3.5% of $BTC’s market cap”, the tweet added.

Bitcoin-denominated futures open interest reached a new all-time high of 633,000 BTC, an 80% increase since the collapse of the LUNA-UST project in May 2022.

Herein, open interest measured the number of outstanding (unsettled) option contracts for a financial asset. In that sense, it showed how leveraged the market was. Meanwhile, periods of low volatility liquidated fewer contracts and increased the amount of leverage in a market, which in turn pushed up the open interest.

Was that actually the case?

This could be the case as Bitcoin futures liquidations were at an all-time low. This meant that the percentage of liquidations to open interest stood at historical lows.

Next question: Could this lay a foundation for BTC at present to follow? That’s another possibility. Historically, significant drops in futures liquidations did end up with a violent price movement.

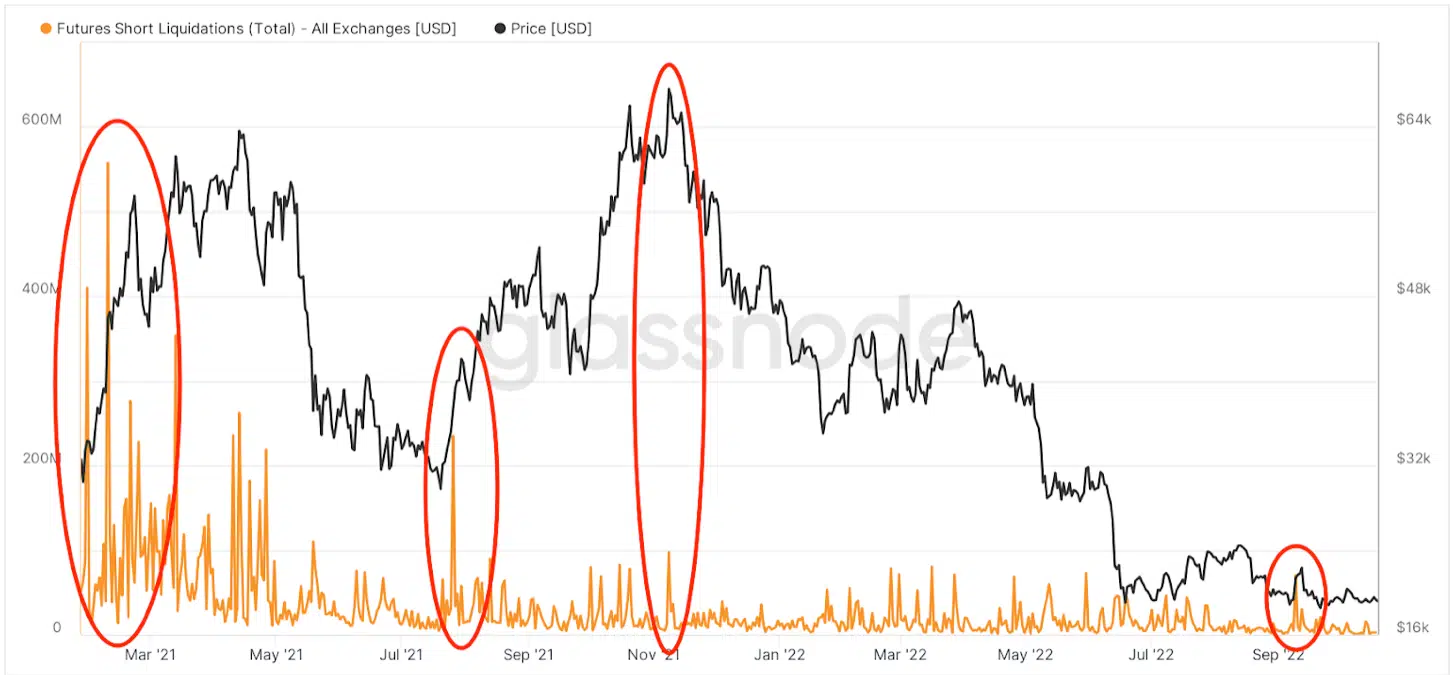

For example, in the past, whenever the number of short contracts piled up (or in other words, very few liquidations), they were ultimately liquidated with a strong Bitcoin rally.

In addition, the recent bearish positioning in the perpetual futures market suggested the scope for a “short squeeze” ahead. This could mean that bears can exit short positions on the first evidence of price stability, which may lead to a sharp rally.

But again, one HAS to maintain caution as things could change anytime here.