Bitcoin’s post-ETF prices spark discussions, yet accumulation persists

- Accumulation of Bitcoin continued despite price declines.

- BTC has kept on with its decline for the third consecutive day.

The period leading up to and following the approval of the spot Bitcoin ETF witnessed significant volatility, prompting discussions about price movements and holders’ behavior. Despite the price fluctuations, there has been a sustained accumulation of Bitcoin by various entities.

Bitcoin’s Accumulation Trend Score hovers around one

An analysis of the Bitcoin Accumulation Trend Score on Glasnode showed a remarkable consistency over the past four months. The score has consistently hovered close to one and reached one each of these months.

This level of stability in the trend score is noteworthy. It marked the first time it has exhibited such consistency in years, as indicated by the chart analysis.

This consistent trend score gains added significance considering the increased volatility observed in Bitcoin’s price during this period.

The Accumulation Trend Score serves as an indicator reflecting the proportional size of entities actively accumulating coins on-chain. A score closer to 1 suggests that, on average, larger entities or a significant portion of the network are accumulating Bitcoin.

Bitcoin in profit and holders drop despite accumulation

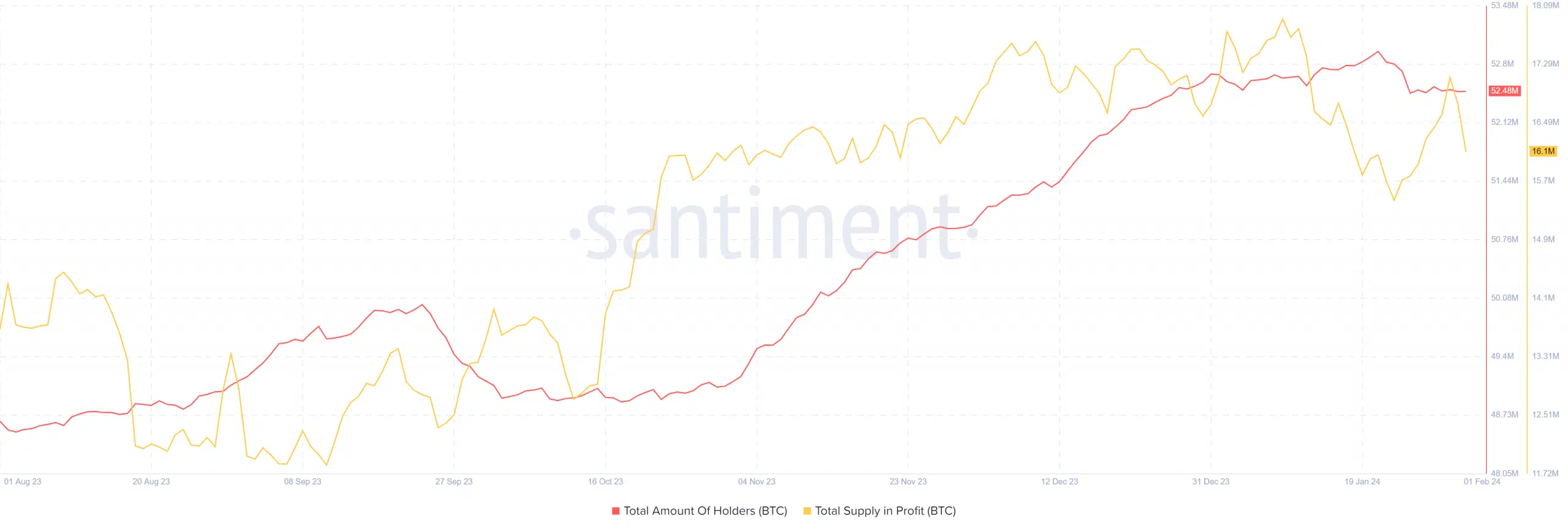

An examination of the total number of Bitcoin holders through Santiment showed that the figure remained consistently above 52 million.

However, a slight decrease occurred in recent days. Around 21st January, the number dipped from around 52.9 million to about 52.4 million. As of the current moment, this metric has stabilized at the 52.4 million level.

Furthermore, an assessment of the supply in profit showed a notable reduction. The chart showed that, as of 30th January, the supply in profit was over 17 million.

By the conclusion of 31st January, this number had decreased to around 16 million. At the time of this writing, the figure stands at 16.1 million. This decline also corresponds to a decrease in the percentage of the supply in profit, dropping from around 86.7% to about 82%.

How much are 1,10,100 BTCs worth today

BTC dances on its neutral line

Analyzing Bitcoin on a daily timeframe showed a trend of decline over the past three days. Despite these declines, each day’s decrease has been less than 1%, and Bitcoin has managed to stay above the $42,000 mark.

At the time of this writing, it was trading at around $42,200, experiencing a decline of less than 1%. Also, the slight declines have pushed Bitcoin slightly below the neutral line on its Relative Strength Index (RSI).