Bitcoins worth $35 million move after 12 years: What’s cooking?

- The stash was acquired in July 2021 when BTC was valued at just $7.57.

- An analyst attributed such incidents to sell-side liquidity crisis.

About 500 Bitcoins [BTC], inactive for nearly 12 years, were transferred to multiple new wallets recently, piquing the curiosity of the broader cryptocurrency market.

According to Lookonchain, the stash, worth $35 million at press time, was acquired in July 2011. At that time, BTC was valued at just $7.57.

No conclusive information was available about the entity and nature of the transfer as of this writing.

However, if one were to go by the populist belief that the wallet preparing for a sell-off, they would probably end up profiting by a whopping 9247x.

A broader market trend?

AMBCrypto investigated further and noticed a broader trend of dormant coins becoming active lately.

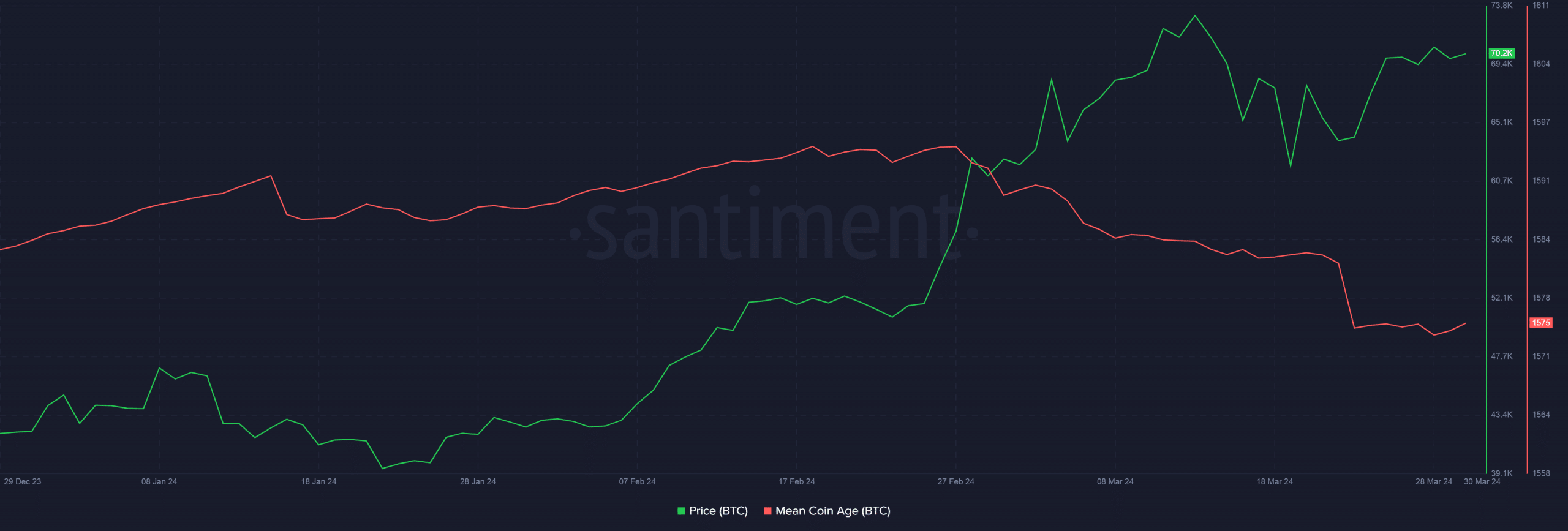

Santiment’s Mean Coin Age indicator — which measures the average amount of days all BTC tokens stayed in their respective addresses — dropped steadily throughout March.

What could be the reasons?

There could be multiple factors behind really old Bitcoins moving on-chain suddenly.

Firstly, it could be possible that wallet holder was locked out of their BTCs due to loss of private keys or the cold wallet. Once they retrieve the keys, they start moving Bitcoins.

However, examples like these are few and far between.

Secondly, a lot of long-term holders (LTH), who patiently waited for Bitcoin’s price to soar exponentially, could finally decide to sell and lock in gains.

Ki Young Ju, CEO of on-chain analytics firm CryptoQuant, attributed the recent incidents of old coins movement to Bitcoin’s sell-side liquidity crisis.

For the uninitiated, a sell-side liquidity crisis occurs when there are not enough Bitcoins to be bought. This typically happens when demand strongly exceeds supply.

With the introduction of spot ETFs, Bitcoin’s demand, especially from institutional investors, has been unrelenting.

Read Bitcoin’s [BTC] Price Prediction 2024-25

On the other hand, Bitcoin’s production has failed to match this demand, causing a shortage of supply available for trading.

Due to this, old coins could start moving, hoping to capitalize on the heightened demand.