Bitwise’s latest declaration about Uniswap could turn the tide for UNI holders

- Bitwise predicts Uniswap to surpass Coinbase in trading volume Q3 2023

- Uniswap’s unique users and fees increase while pool value and active users fall

In a recent prediction made by Bitwise, it was stated that Uniswap would be overtaking Coinbase in terms of trading volume. According to Bitwise, this event would happen in Q3 of 2023.

This prediction was based on the fact that Uniswap already managed to overtake Coinbase in the past. In November 2022, after the FTX debacle, many people from the crypto community had lost faith in centralized exchanges (CEXs) and have moved on to DEXs. During this period, Uniswap witnessed high activity.

However, soon after that, Coinbase regained the top spot against Uniswap. According to Bitwise, Uniswap would soon be taking over the number one spot in terms of trading volume and it will remain at the top for a longer period of time.

Read Uniswap’s [UNI] Price Prediction 2023-2024

This prediction from Bitwise was supported by data from various analytics platforms. For example, in the DEX arena, Uniswap was the dominant protocol as it had taken up 65.7% of the market share in terms of volume.

Another indicator of growth for the DEX was the increasing number of unique users. According to data provided by Messari, the number of unique users on Uniswap increased by 44% over the last month as well.

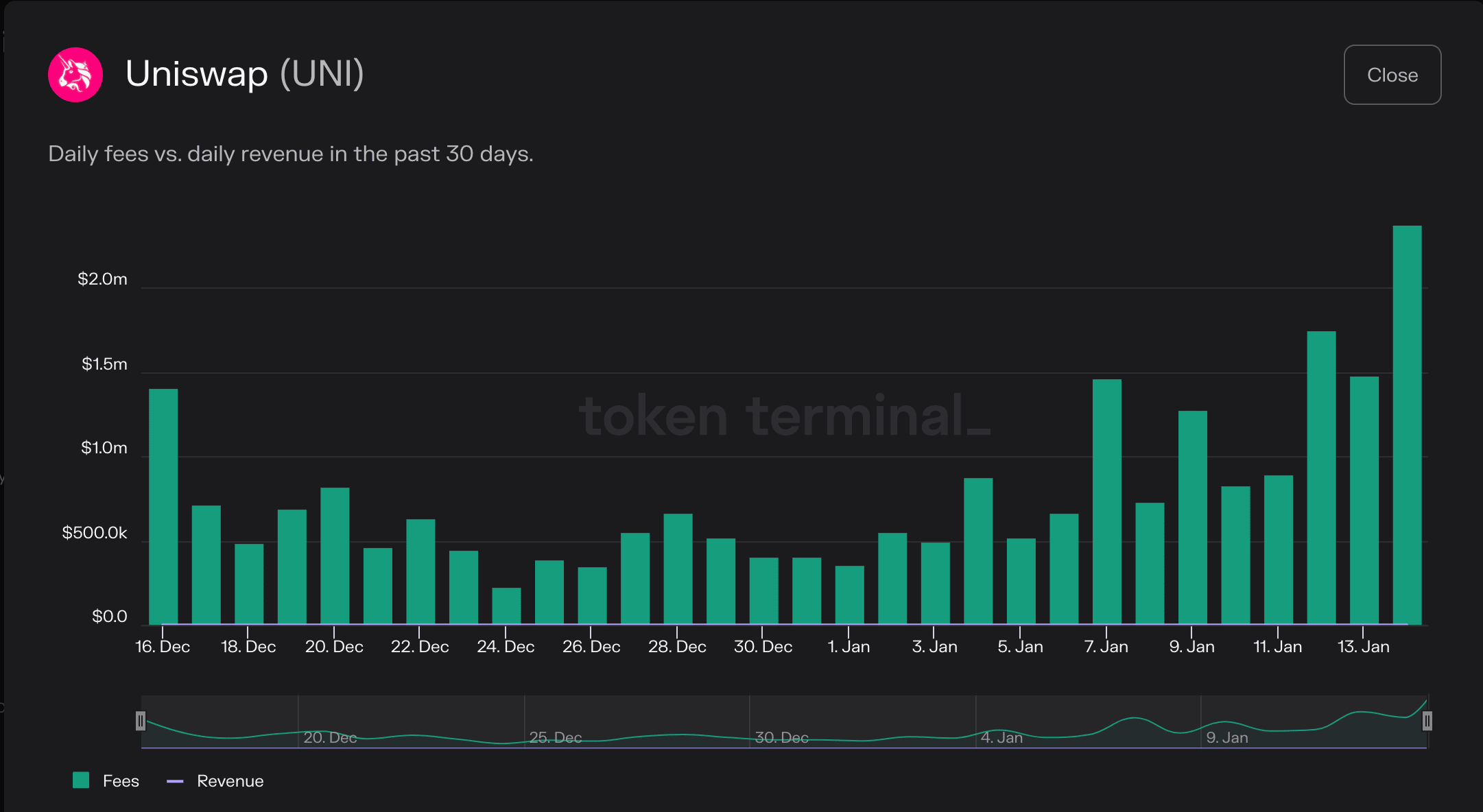

This spike in the number of unique users contributed to Uniswap generating fees. Based on data provided by token terminal, the fees generated by Uniswap increased by 89.2% over the last week.

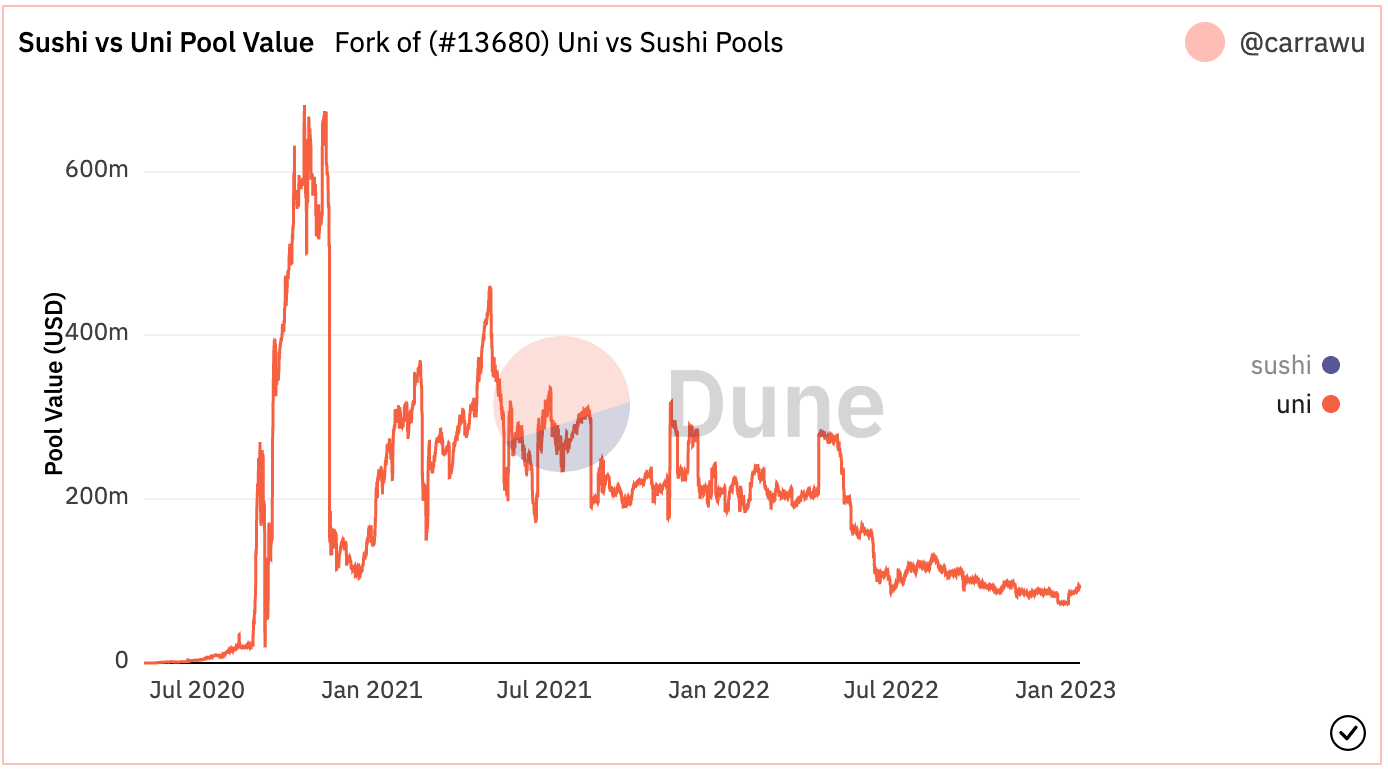

However, it was not all sunshine for Uniswap. The pool value of Uniswap also declined materially according to Dune Analytics. This decline in pool value could be a sign of decreasing interest from liquidity providers and traders.

Whales lose interest

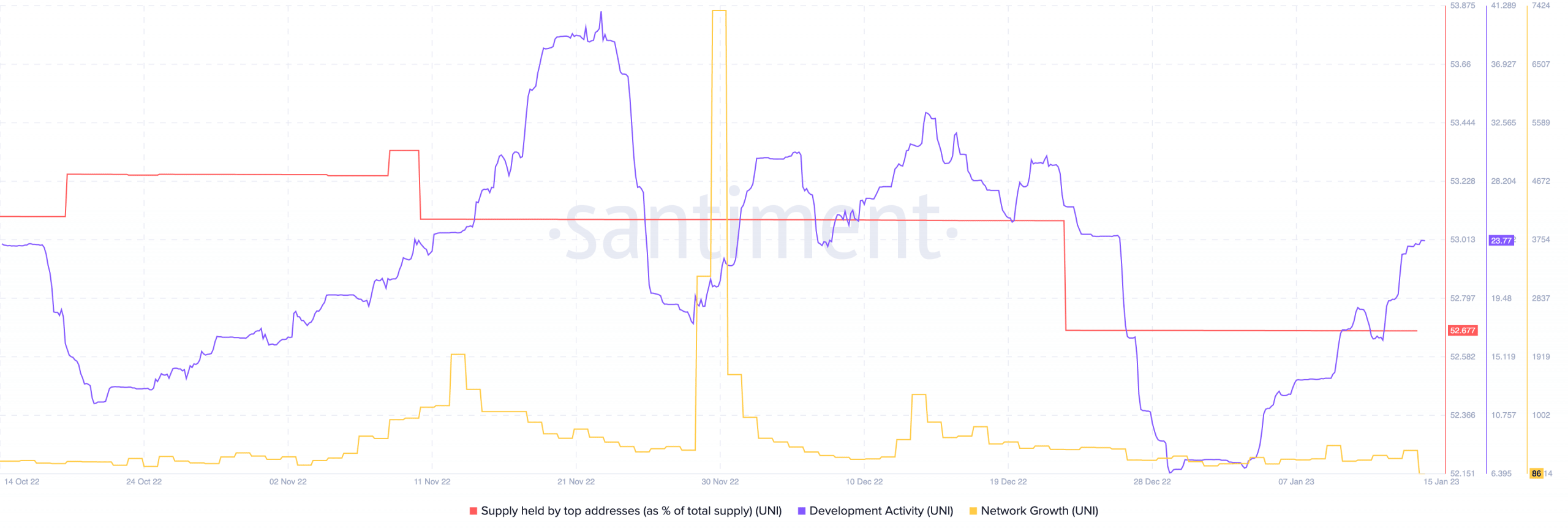

The state of the UNI also reflected some of these trends. Whale interest in UNI was declining according to data provided by Santiment. Along with that, there was a decline in Uniswaps network growth too. This decline in network growth indicated decreasing interest from new users.

Realistic or not, here’s UNI’s market cap in BTC’s terms

However, growth was observed in Uniswap’s development activity, which suggested that new updates could be launched on the network. These could help in regain interest from whales and new users.

Additionally, Uniswap’s growing popularity and increasing trading volume could also attract more liquidity providers and traders to the platform.

The price of UNI at press time was $6.44, which fell by 2.20% in the last 24 hours.

![Chainlink [LINK] price prediction - Watch out for a defense of THIS key level!](https://ambcrypto.com/wp-content/uploads/2025/04/Evans-17-min-400x240.png)