BNB Chain’s revenue takes major hit: Examining the root cause

- Daily revenue decreased as well as the coin’s price.

- The sentiment and social data suggested that BNB could be set to recover.

BNB Chain’s revenue took a hit after it recently announced an impressive Quarter-on-Quarter (QoQ) hike.

For those uninitiated, BNB Chain is the blockchain network that supports smart contracts and decentralized Applications (dApps).

It should not be confused with Binance Coin [BNB], the exchange cryptocurrency of Binance. According to Artemis, the revenue recorded on the 15th of April was $62,500.

This figure was one of the lowest the chain had hit since February.

Network activity drops

The principal source of the network’s revenue is trading fees. While fees might vary depending on the volume, a surge in demand for BNB triggers a revenue increase.

Therefore, the recent decline could be linked to decreasing activity on the decentralized protocol. Furthermore, the DEX volume showed proof of the declining activity as it was less than $1.5 billion.

For most of March, the volume surpassed $2 billion at different intervals. Concerning Binance Coin’s price, CoinMarketCap showed that the value had decreased by 6.72% in the last 24 hours.

This price was a reflection of the bearish market condition and decreasing demand for the coin. If the price of BNB continues to fall, it might be challenging for the chain to register a surge in revenue.

However, if prices bounces, BNB Chain might have a shot at keeping the revenue at the same pace as March’s trajectory.

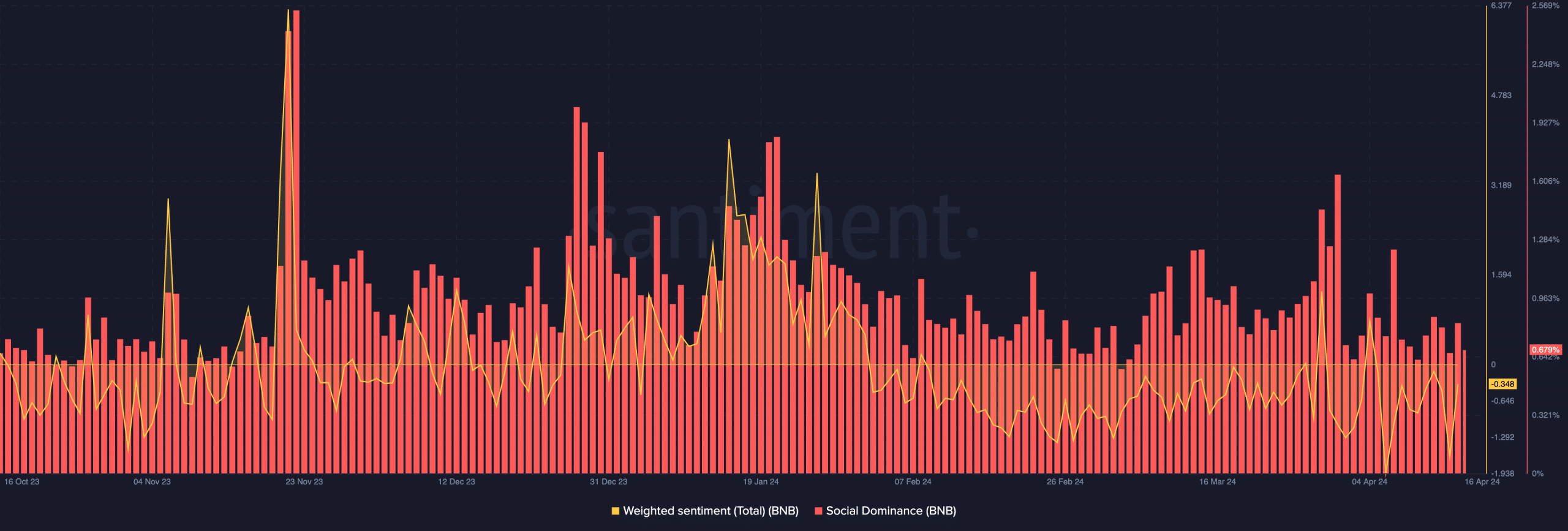

Meanwhile, on-chain data revealed that the Weighted Sentiment around the cryptocurrency was negative.

Is everyone overlooking the coin?

At press time, the metric was -0.34, suggesting a broader bearish perception around the coin. However, one thing, AMBCrypto observed was that the sentiment trended higher.

Should the reading rise to the positive area, then BNB’s price could take a shot at recovery. However, failure to cross into the green area might disprove the bias.

In terms of social dominance, Santiment showed that the reading fell. An increase in social dominance might have signaled a surge in BNB’s popularity among traders.

If this was the case, then the coin would have been close to a local top.

However, the decrease suggests that discussion about the coin was low when compared to others in the top 100. Hence, Binance Coin was within reach of its bottom.

Historically, this offers a buying opportunity. However, the market exhibited a high level of volatility over the last few days.

Therefore, traders might want to ensure that there is some calm so they would not be caught off guard.

Is your portfolio green? Check out the BNB Profit Calculator

Going forward, the price of BNB might increase. If this is the case, then the revenue might also join the trend. But this forecast depends largely on the movement of the broader market.

Thus, participants should be on the lookout.