BNB holders are unphased by market conditions; the reason might impress you

- BNB’s price immediately rallied from $325 to $388 after CZ’s tweet

- Buying pressure had waned significantly at press time

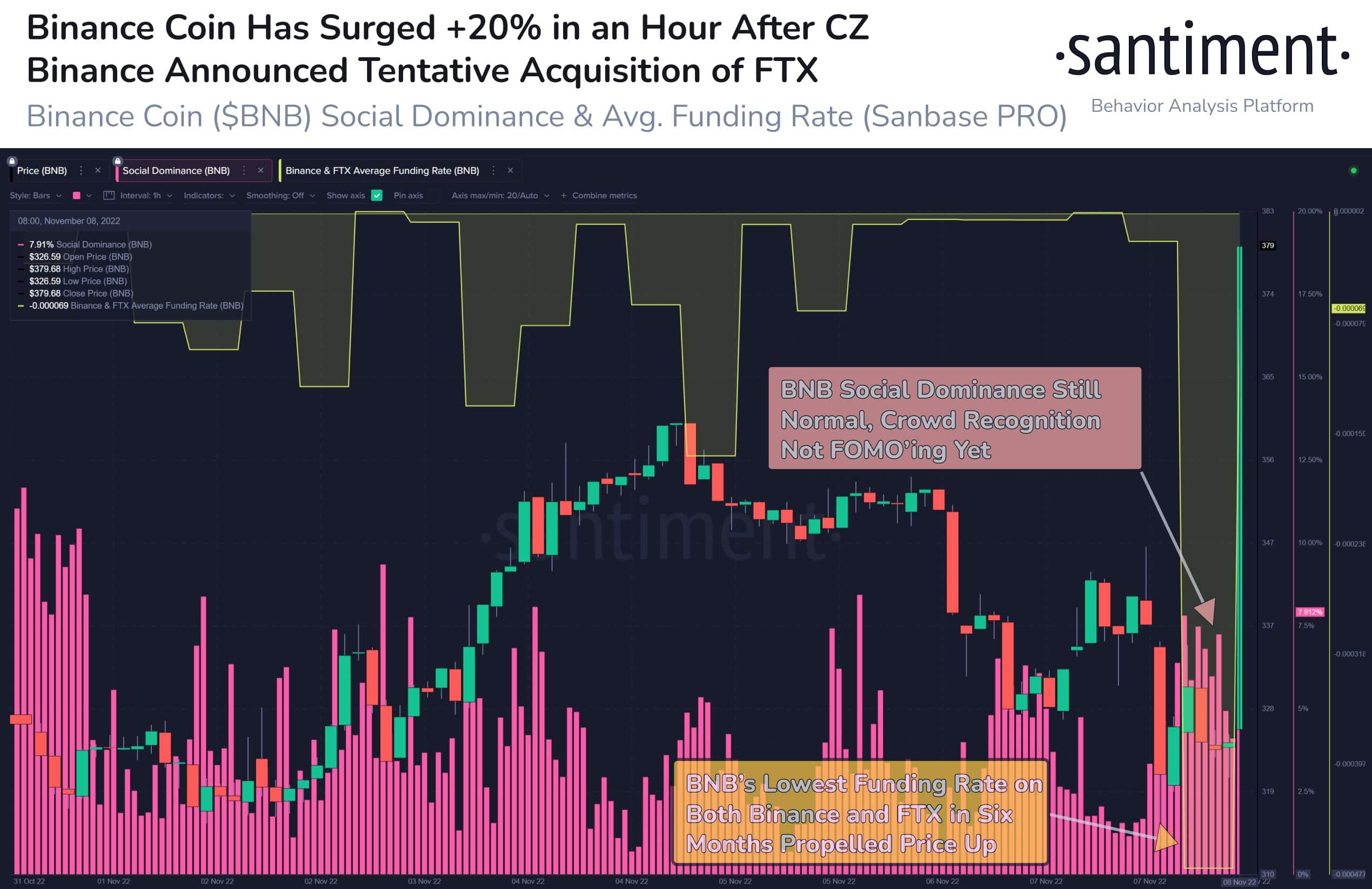

Following Binance CEO Changpeng Zhao’s confirmation of the existence of a non-binding Letter of Intent to acquire cryptocurrency exchange FTX, BNB’s price immediately surged by over 20% post short liquidations, data from Santiment revealed.

Read BNB’s Price Prediction for 2023-24

According to data from cryptocurrency price tracking platform CoinMarketCap, BNB’s price immediately rallied from $325 to $388 after CZ’s tweet. In addition, as per Santiment, BNB’s funding rate on Binance and FTX dropped to six-month lows, leading to the quick price surge.

However, as uncertainty grew about whether Binance would eventually go through with the acquisition, BNB’s price started to correct. Shedding all of its gains, it traded at a low of $304 three hours after trading at a high of $388.

Streets are not smiling

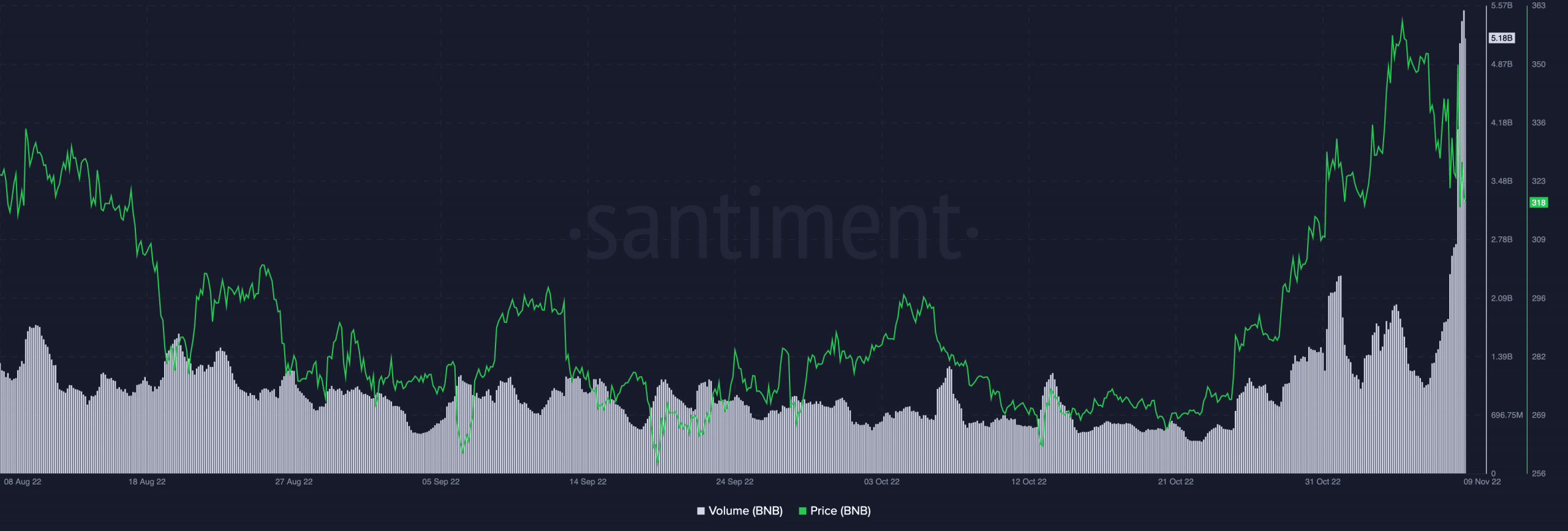

At press time, BNB traded at $315.41, having declined by 2% in the last 24 hours. Trading volume was, however, up by 132% within the same period.

According to data from Santiment, with $5.18 billion worth of BNB tokens traded in the last 24 hours, the altcoin recorded its highest daily traded volume in the last 90 days.

The lack of a corresponding growth in the asset’s price within the same time revealed that sellers had control of the market, and the price might continue to plummet in the short term unless investors’ conviction changes.

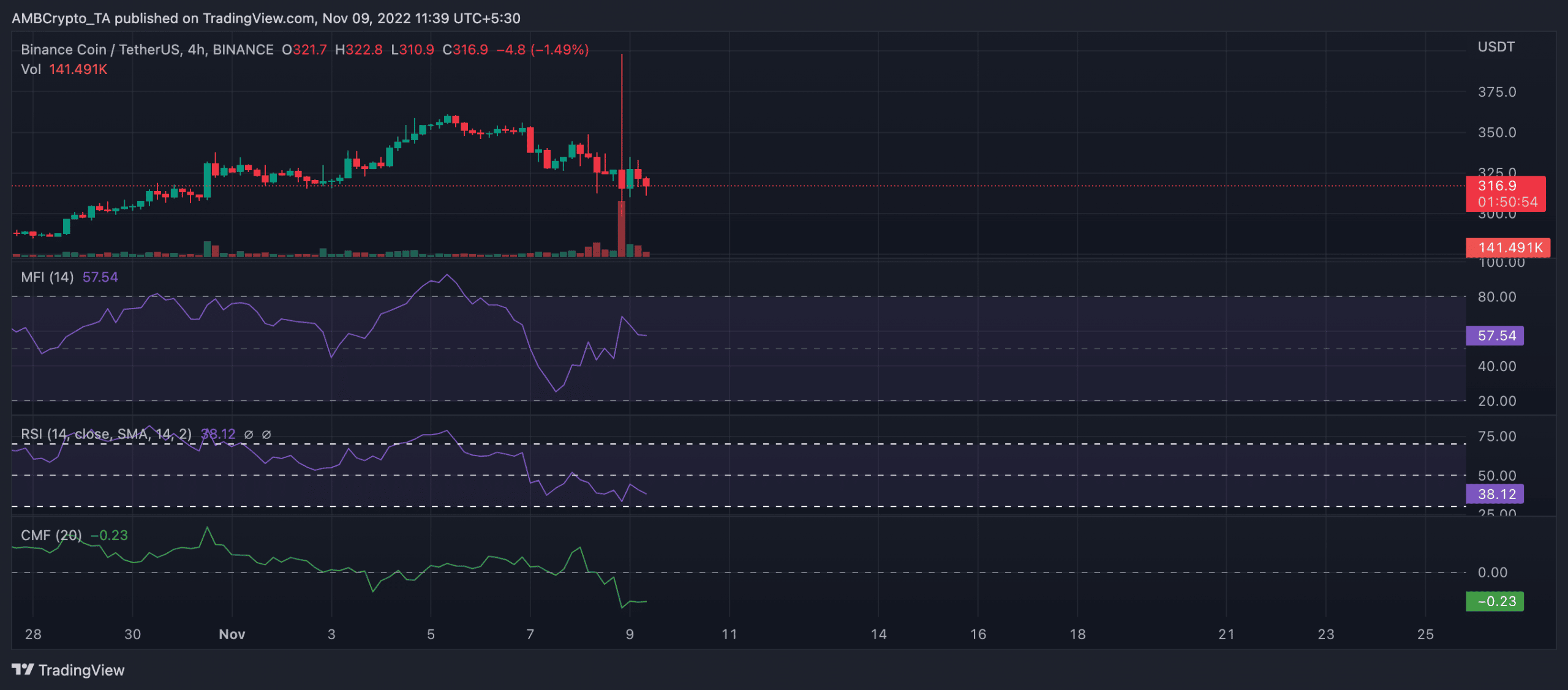

A look at BNB’s performance on a 4-hour chart offered a hint as to where the market might be headed. Buying pressure had waned significantly at press time as sellers went on a coin distribution rampage.

The coin’s Relative Strength Index (RSI) approached the oversold region at 38.12, at press time. Not faring any better, the Money Flow Index (MFI) was spotted headed for the neutral line in a downtrend.

Further, indicating that buying pressure had dropped significantly, the Chaikin Money Flow (CMF) posted a negative value. At the time of writing, the dynamic line (green) rested below the center line at -0.23.

Counting checks

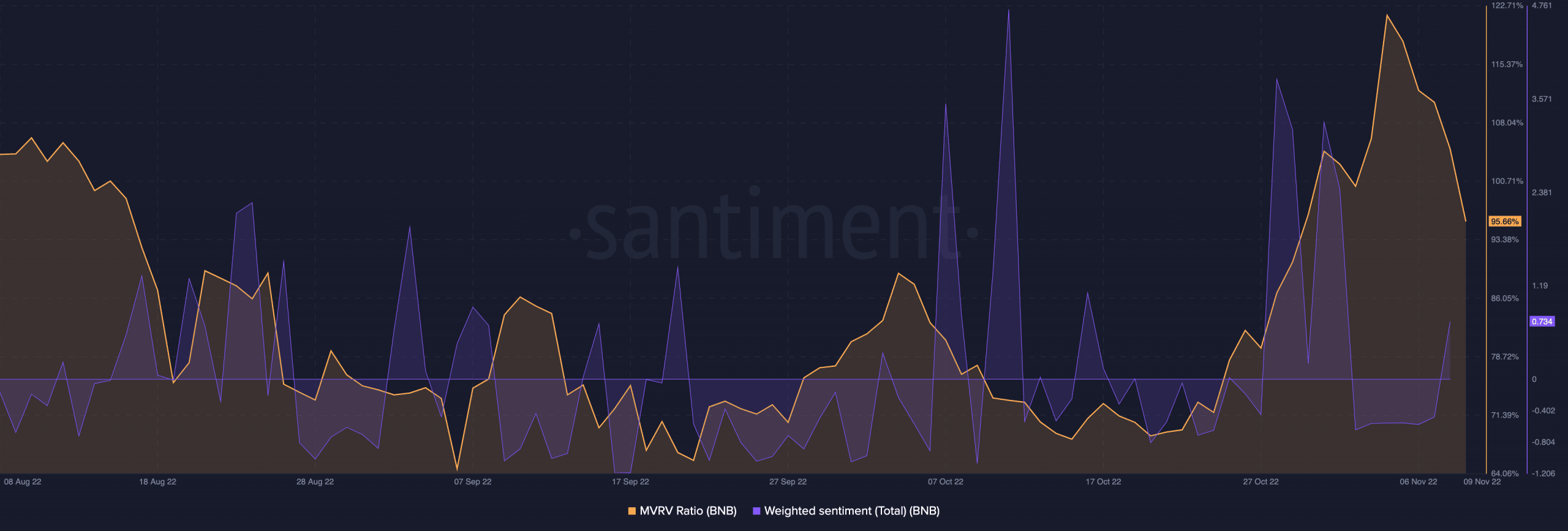

Interestingly, despite the rigmarole of price decline and the general downturn in the market due to the FTX saga, BNB holders continued to record profits on their investments, on-chain data revealed.

Per data from Santiment, BNB’s MVRV ratio sat at 95.66% at press time. This meant that if all BNB holders sold all their coins at the current price, they would still make double profits on their investments.

Positive sentiments trailed the coin, at press time.