BNB outshine DOT and ETH, but what of investor confidence?

- Sentiment around BNB turned bearish as its weighted sentiment dipped.

- Market indicators were bearish, suggesting a further drop in BNB’s price.

BNB Chain [BNB] has once again outperformed its contemporaries in real-life usability and returns. As per Polkadot Insider’s 3 June tweet, BNB was the top blockchain by real yield index. Other than BNB, Polkadot [DOT] and Ethereum [ETH] completed the top three of the list.

? Real Yield index of a blockchain refers to the measure of the actual return that investors or participants can earn from owning & engaging with that blockchain network, after adjusting for inflation

? It quantifies the real value & profitability of the blockchain ecosystem… pic.twitter.com/6ybKpJlPPe

— Polkadot Insider (@PolkadotInsider) June 3, 2023

What does this achievement mean?

The real yield index of a blockchain refers to the measure of the actual return that investors or participants can earn from owning and engaging with that blockchain network after adjusting for inflation.

A high real yield index means that the actual rate of return that users can receive from owning and participating in that blockchain network is relatively high.

Thus, at press time, investing in BNB seemed like a good option for investors. However, the ground reality was different.

BNB’s network stats do not look good

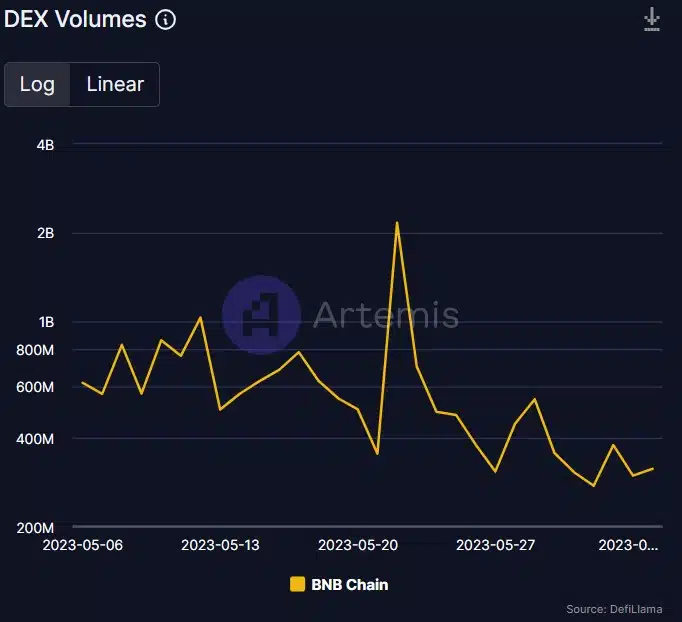

As per Artemis, BNB’s DEX volume reported declining momentum, reflecting BNB’s decreasing popularity on decentralized exchanges. BNB’s daily active addresses waned as well.

Investors aren’t confident in BNB Chain

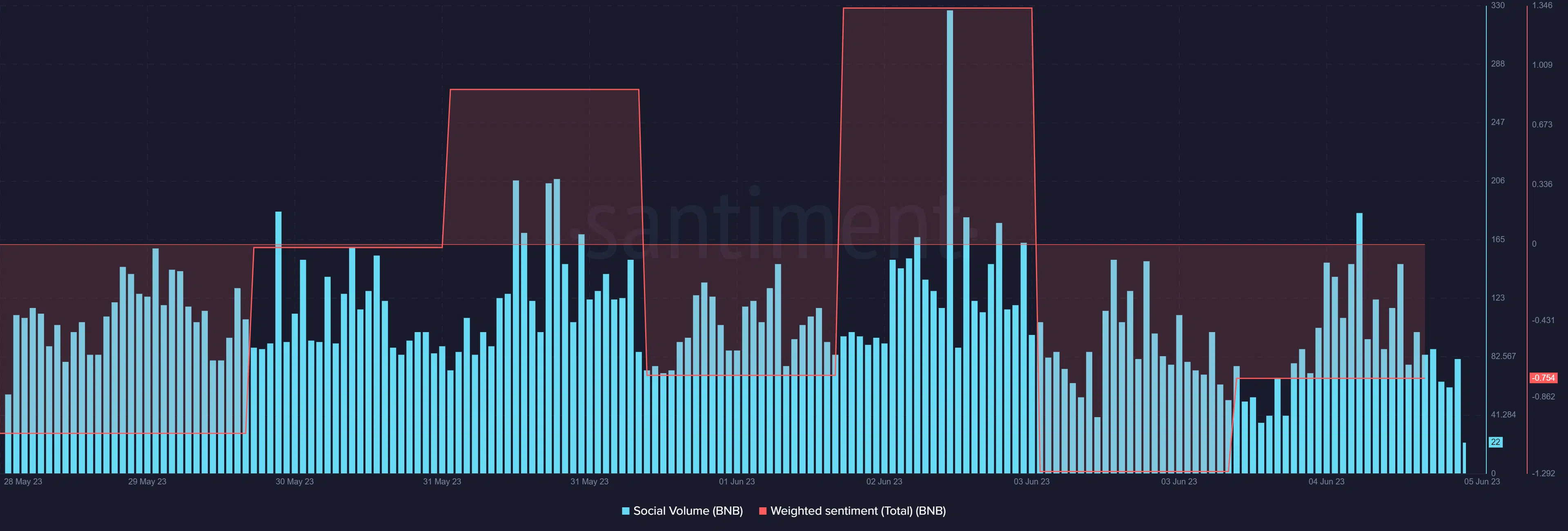

Santiment’s chart revealed that, apart from network stats, BNB’s popularity also registered a decline last week as its social volume went down slightly. Sentiment around BNB also turned negative, as evident from the dip in its weighted sentiment.

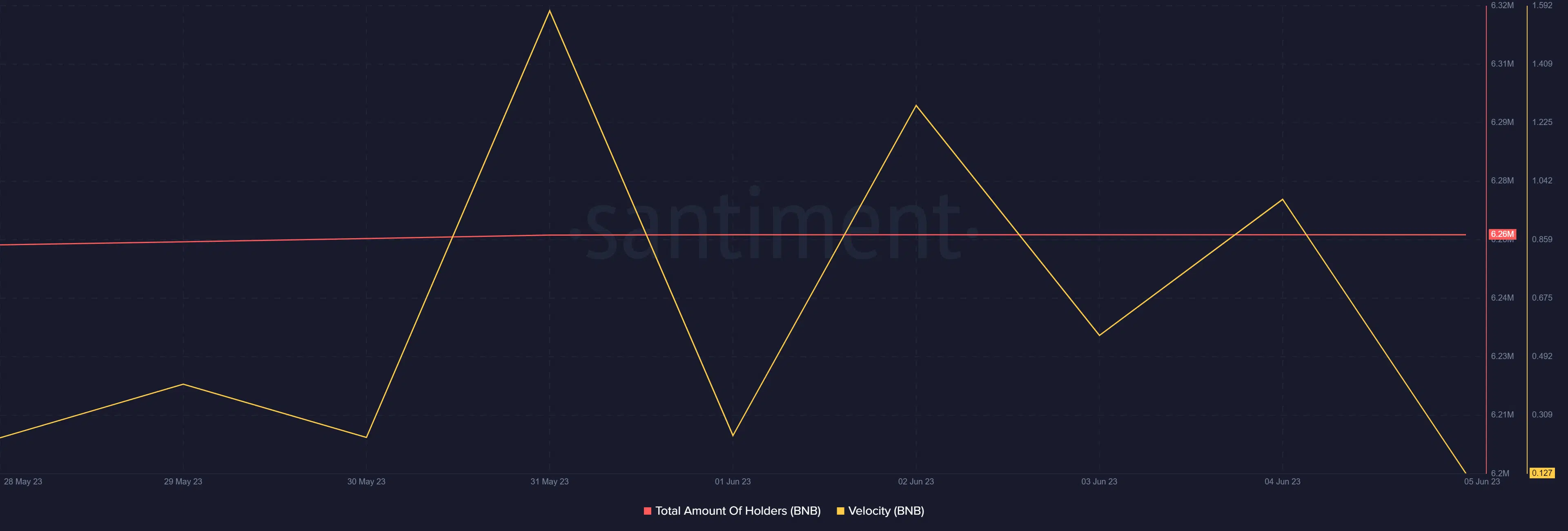

Additionally, the total number of BNB holders also remained stagnant over the last seven days. After spiking, BNB’s velocity plummeted. Simply put, a lower velocity means that a coin is used in transactions less often within a set time frame.

BNB’s troubles are far from over

BNB had a rough week as the coin’s price declined by 4% in the past seven days. According to CoinMarketCap, at the time of writing, BNB was trading at $301.14, with a market capitalization of over $46 billion.

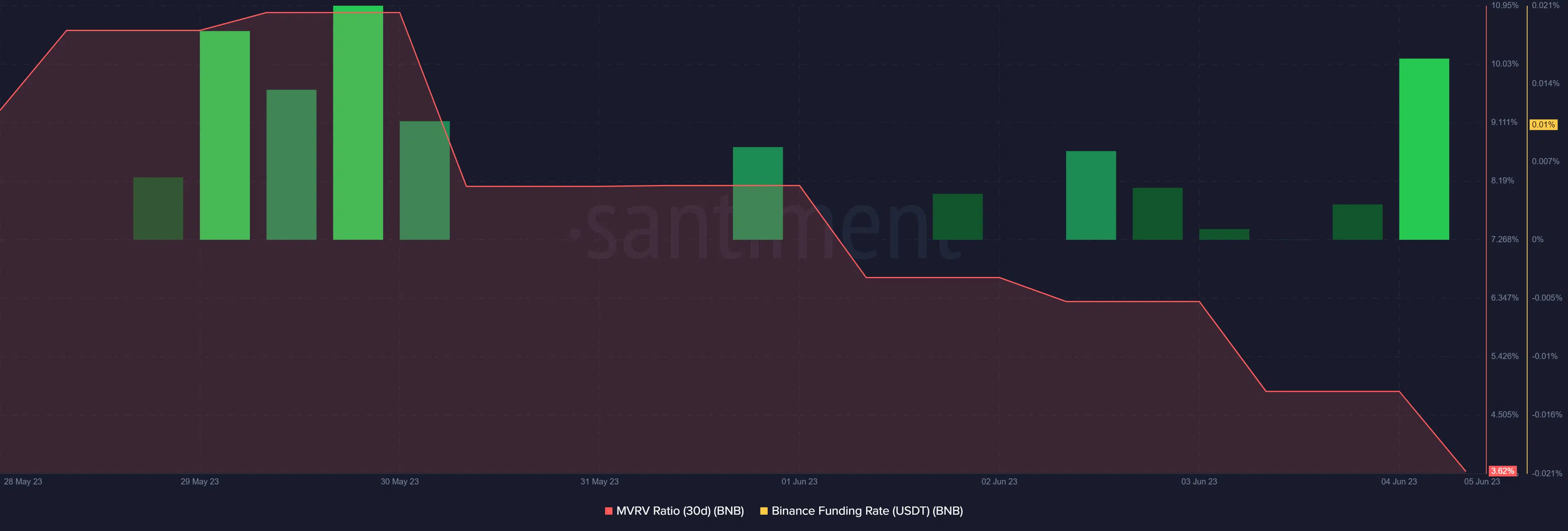

As per Santiment’s data, BNB’s troubles may last longer as its MVRV Ratio declined sharply last week. However, its funding rates were green, reflecting its demand in the derivatives market.

Is your portfolio green? Check the BNB Profit Calculator

The bears have geared up

The same bearish picture was also seen on BNB’s daily chart, as multiple market indicators supported the sellers. Notably, the MACD displayed a bearish crossover. Moreover, BNB’s Relative Strength Index (RSI) was resting below the neutral mark.

The Money Flow Index (MFI) also followed the same trend, further increasing the chances of a continued price decline.