BNB rises against Bitcoin: What does this mean for the crypto market?

- BNB’s price performance was much better than BTC over the last month.

- Despite this, traders continued to hold a bearish stance against BTC.

Even though Binance has gone through massive trials and tribulations over the last few months, the BNB token remained unaffected. According to recent data, the BNB and other L1s’ Month-to-date performance against BTC was relatively high.

BNB competes with the big dogs

BNB outperformed BTC by 11.38% in the month of April. At press time, the token was trading at $587.72. Its price had grown by 18.10% after it tested the 512.9 level on the 18th of April.

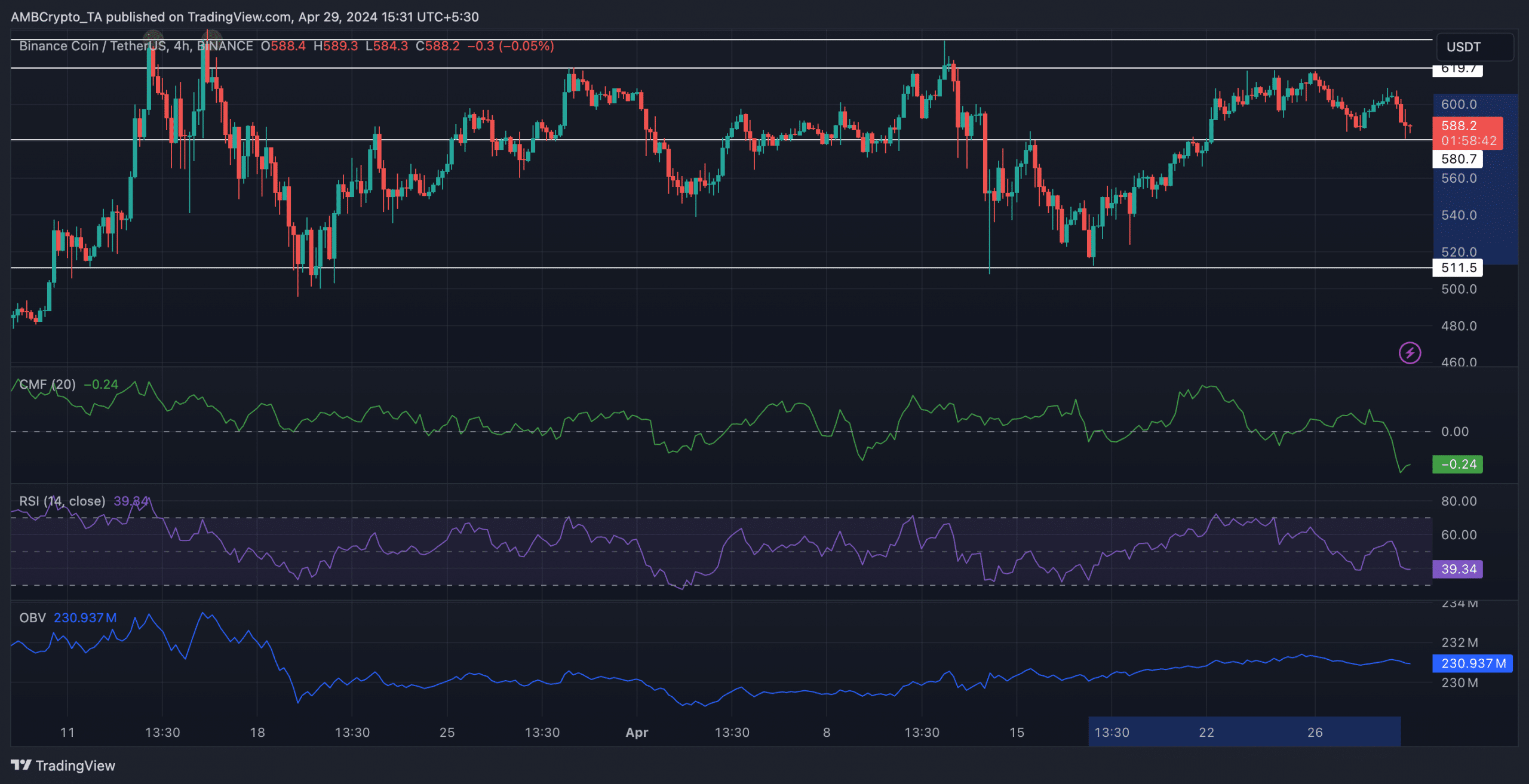

Despite the positive price movement, the token faced some challenges over the last month. The price movement showed extreme volatility and deviated between the $619 and $512 levels multiple times during this period.

The extreme volatility of the token can impact trader perception negatively and could affect open interest for BNB in the future.

The CMF (Chaikin Money Flow) took a hit over the last few days, indicating that the money flowing into the token declined.

Moreover, the OBV (On Balance Volume) of BNB fell significantly. If the OBV is trending downward, it suggests that selling pressure is outweighing buying pressure. This could be a sign of potential weakness in the price and might foreshadow a downtrend.

If BNB succumbs to the selling pressure, it may crash to the 511.5 level before rallying again.

Coming to the state of traders, it was observed that they had turned bearish against BNB in the last few days. The percentage of short positions taken against BNB had grown from 48% to 52%, at the time of writing.

State of the BNB network

The BNB network wasn’t doing too well either, it was observed that the activity on the network has declined significantly. AMBCrypto’s analysis of token terminal’s data revealed that the number of active addresses on the network fell by 21.6% in the last month.

If this trend continues, it could severely impact the overall ecosystem negatively and can even create downward pressure for the token.

Realistic or not, here’s BNB’s market cap in SOL’s terms

Along with the declining activity, the revenue generated by the network also fell by 33%