Breaking down the 2 sides of the Ethereum price argument

The crypto market has continued bleeding, Ethereum’s price has dropped to the $2000 level based on data from coinmarketcap.com. Ethereum’s price has dropped over 20% in the past week and this may be a result of the increased selling pressure. The trade volume was up over 50% in the past 24 hours and this was indicative of the selling pressure. The price is currently over 50% away from the ATH of $4363, a month ago and despite that, it is likely to recover since the demand has increased despite the drop in price.

ETH price chart | Source: CoinGecko

The two sides of the ETH argument:

1. ETH is undervalued below $3000 and the bullish break is close since accumulation has increased below $2200, and

2. Based on analysts on crypto Twitter ADA and ETH are overpriced, while ETH is close to the $2000 level.

If we follow ETH‘s price, based on the chart and the resistance, since the resistance is at the $2200 level currently, there is a possibility of a 15% drop in price. Buying at this level is likely to lead to a loss in the short term if the selling pressure continues to rise. However, once the price is up, and rallies back, it may face challenges from short-term resistance up at $2,275.

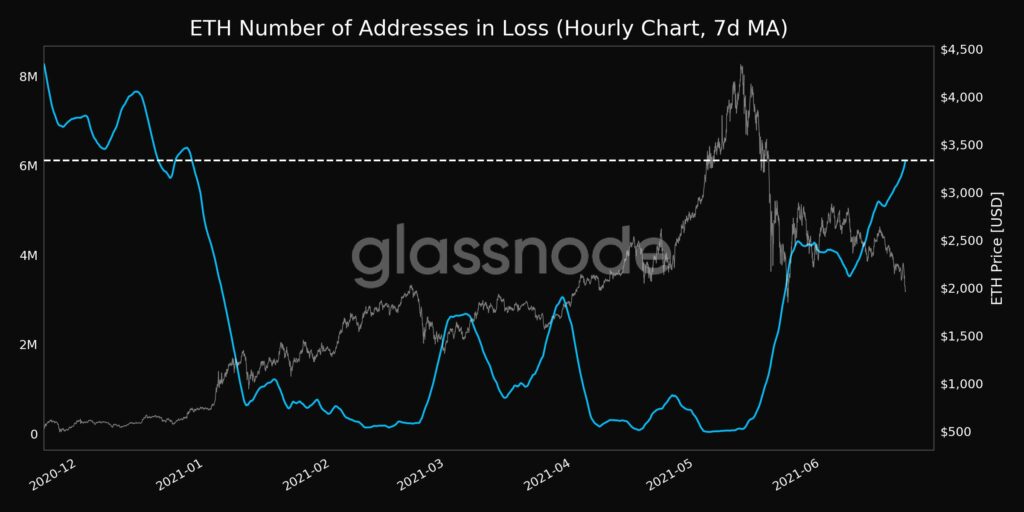

If we get back to that level, there’s a 13% trade to be had. Other factors that indicate that demand is rising are the out-of-range liquidity of stablecoins in ETH markets. A metric that supports the opposite narrative was the number of addresses, hitting its highest point in the past 5 months.

ETH Addresses in a loss| Source: Twitter

The number of addresses currently in loss based on the 7-day moving average. The five-month high is 6.1 Million based on data from Glassnode. Based on the above metrics, ETH’s price may drop to the $1800 level, however, the demand is on the rise and despite addresses running losses, the trade volume supports the likelihood of a price rally.