BTC, ETH can opt for an unrelated path as fear grips stock market. Assessing…

- BTC and ETH managed to hold their ground during the 2020 pandemic

- BTC was trading above the $26,000 mark, but ETH had concerns to address

The crypto market is infamous for its highly unpredictable nature, as it is affected by several global developments. The latest data revealed that the crypto market may witness another cycle of high volatility as global market conditions deteriorate. This could also impact top cryptocurrencies, such as Bitcoin [BTC] and Ethereum [ETH].

As there is a possibility of the stock market falling, there are also chances of the crypto space undergoing a major price correction. However, a look at history and other datasets also hinted that the scenario might turn out to be different this time.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Is the market about to crash?

WhaleWire, a popular X (formerly known as Twitter) handle that posts updates related to the crypto market, highlighted that bankruptcy filings in the United States have been increasing. To be precise, bankruptcy filings have recently reached levels on par with the 2008 Great Recession and the 2020 COVID-19 pandemic.

WARNING: Bankruptcy filings have recently reached levels on par with the 2008 Great Recession and the 2020 COVID-19 pandemic.

This indicator often suggests that the economy isn’t performing well, and has historically always been followed by massive stock market crashes. pic.twitter.com/DHUEm59QUS

— WhaleWire (@WhaleWire) September 24, 2023

This indicator often suggests that the economy isn’t performing well. Furthermore, historically it has been followed by massive stock market crashes. As this increases the chances of a US stock market crash, many might expect the crypto market to follow a similar trend of decline. However, the case this time might be different as the crypto market has somewhat parted ways with the stock market.

For reference, if we consider the 2020 pandemic, while the stock market took a blow, most cryptocurrencies managed to hold their ground. In fact, the market boomed over the coming year, allowing top coins like BTC and ETH to reach an all-time high.

Bitcoin and USD are no longer tied together

Apart from that, another development that took place in the last few delays revealed that BTC broke its ties with the US Dollar. As reported earlier by AMBCrypto, BTC’s correlation index with the USD reached zero. For starters, the metric keeps track of the linear dependence between the prices or values of any two given commodities or assets.

Thus, it means that the US dollar’s performance will have no effect on how the king of crypto performs in the near future or until the index changes again. This further supported the possibility of the crypto market remaining unaffected by a possible US stock market crash.

On the contrary, the crypto market might benefit from such an adverse situation as more new investors might resort to cryptos and resort to making an exit from traditional investments for the security of funds.

Confidence in Bitcoin is high

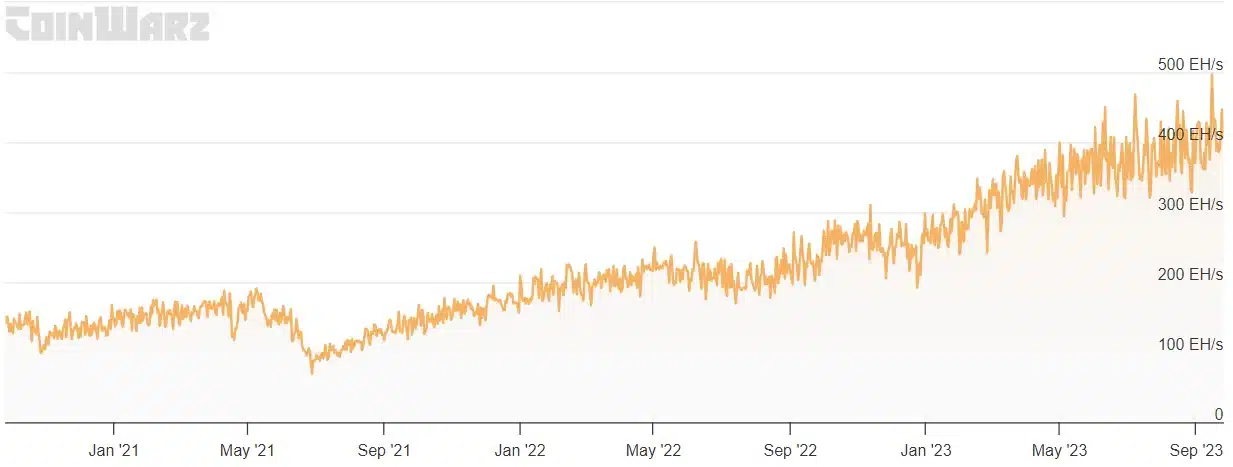

While we speculate about what might be ahead of us, let’s take a look at Bitcoin’s mining sector. Coinwarz’s data pointed out that BTC’s hashrate has been on the rise comfortably for multiple years.

This clearly reflected a billion-dollar industry’s trust in Bitcoin. Since BTC is the largest crypto, an increase in faith in BTC largely means that the world has confidence in the broader crypto market as well.

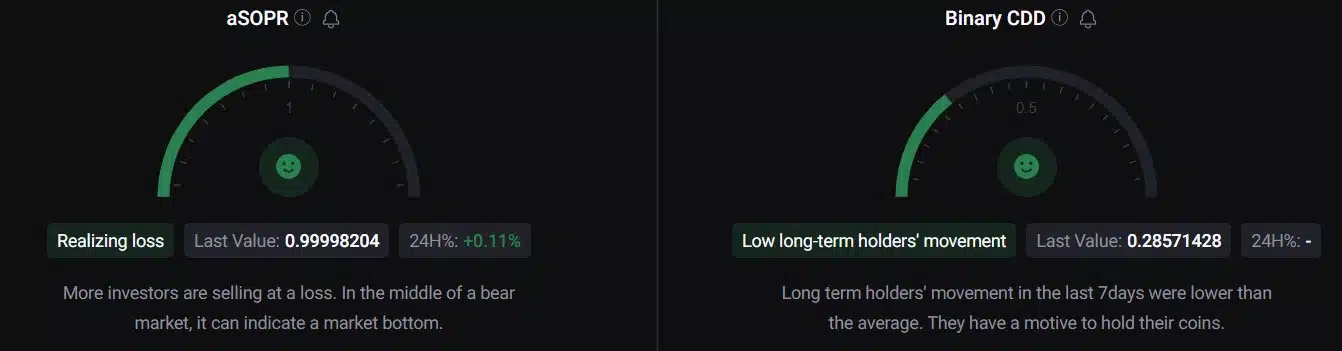

Additionally, a look at BTC’s metrics also suggested that the near future at least looks bright for the coin. BTC’s exchange reserve was declining, meaning that the coin was not under selling pressure. As per CryptoQuant, BTC’s aSORP was green.

This meant that more investors were selling at a loss, and in a bear market, this is considered to bring a bullish update. The same remained true with Bitcoin’s binary CDD, which revealed that long-term holders’ movements in the last seven days were lower than the average.

Moreover, BTC’s taker-buy-sell ratio pointed out that buying sentiment was dominant in the derivatives market. At press time, BTC was comfortably trading above the $26,000 mark at $26,107.82 with a market capitalization of over $508 billion.

A look at Ethereum’s state

While BTC’s metrics looked bullish, the same was not true with the state of the king of altcoins. As per CoinMarketCap, ETH was down by more than 3% in the last 24 hours. At the time of writing, it was trading at $1,577.01 with a market cap of over $189 billion. Like Bitcoin, the crypto market is also influenced by Ethereum’s performance.

Therefore, it’s important to also have a look at ETH’s state in order to assess which direction the crypto market might head in the following days. ETH’s Relative Strength Index (RSI) registered a downtick and was resting way below the neutral mark of 50.

Its Moving Average Convergence Divergence (MACD) displayed the possibility of a bearish crossover. This could push the token’s price further down. However, the Money Flow Index (MFI) was bullish as it went up in the recent past.

Is your portfolio green? Check the Ethereum Profit Calculator

Considering the aforementioned datasets and developments, the possibility of the crypto market witnessing a massive downtrend in the near future looked unlikely. However, as Ethereum bears step up their game, it will be interesting to see which direction the wind turns in the weeks to come.