What you need to know as Ethereum staking hits new highs

- Total Ethereum staked has surged past 30 million.

- The ETH supply on exchanges has declined to almost a 5-year low.

Ethereum’s [ETH] staking contract has been consistently growing, reaching an all-time high. What is the status of exchange inflows amidst this expanding ETH staking trend, and how significant is the presence of Lido Finance in the ETH staking ecosystem?

Read Ethereum (ETH) Price Prediction 2023-24

Ethereum staking hits ATHs

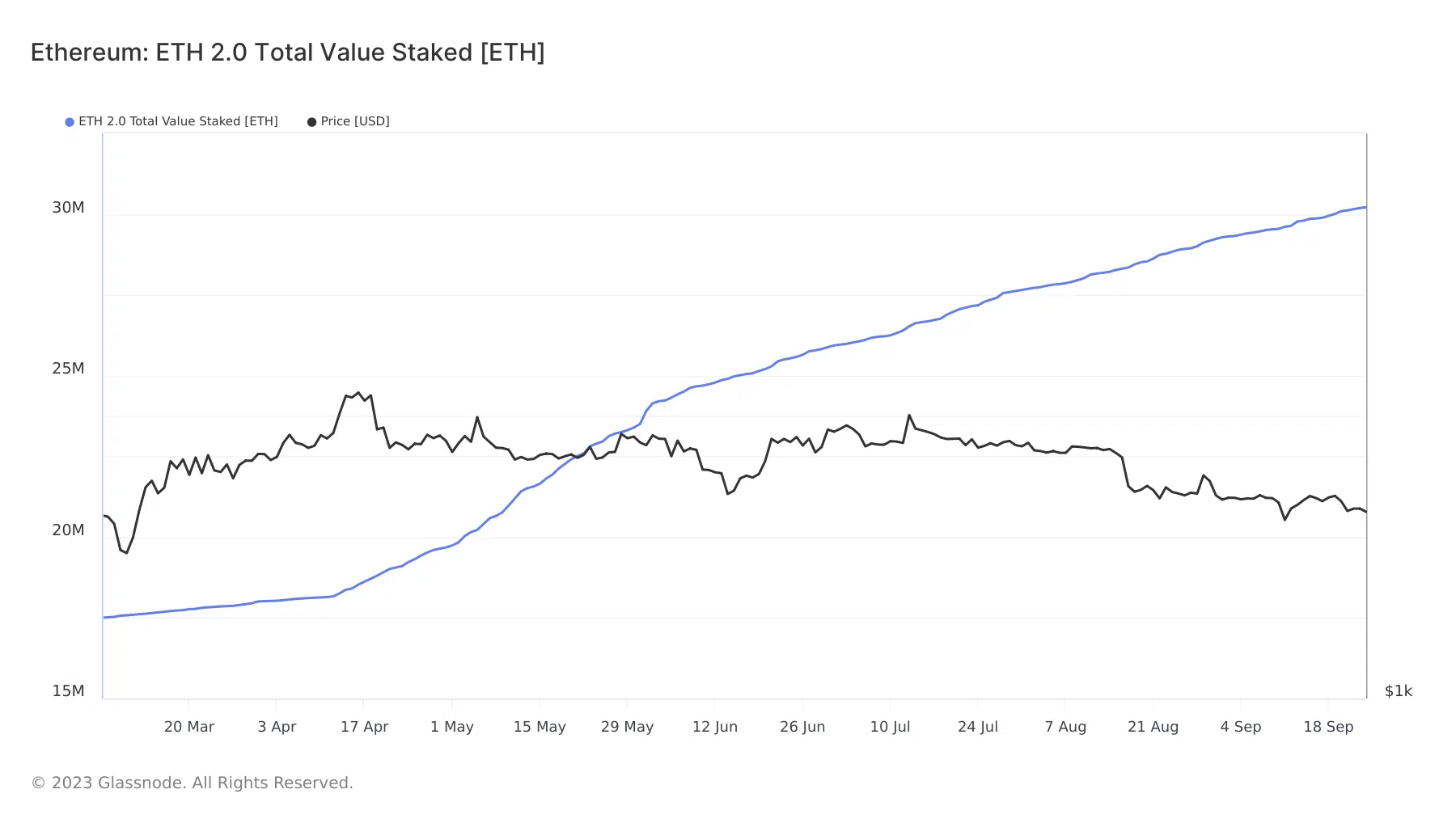

A recent Glassnode Alerts post revealed that the total amount of Ethereum staked has reached a record high of approximately 29.4 million ETH. This is not the first time we have seen such a milestone, as the staking contract has frequently reached highs since the inception of ETH staking.

At the time of this writing, the total stakes had surged even further, surpassing 30 million ETH, according to Glassnode.

Furthermore, a closer examination of new ETH stakes highlighted a consistent influx of ETH into the staking ecosystem. While daily staking activity may have exhibited a slight decline as of this writing, there continued to be a steady stream of new ETH stakes coming in.

Ethereum flow on exchanges declines

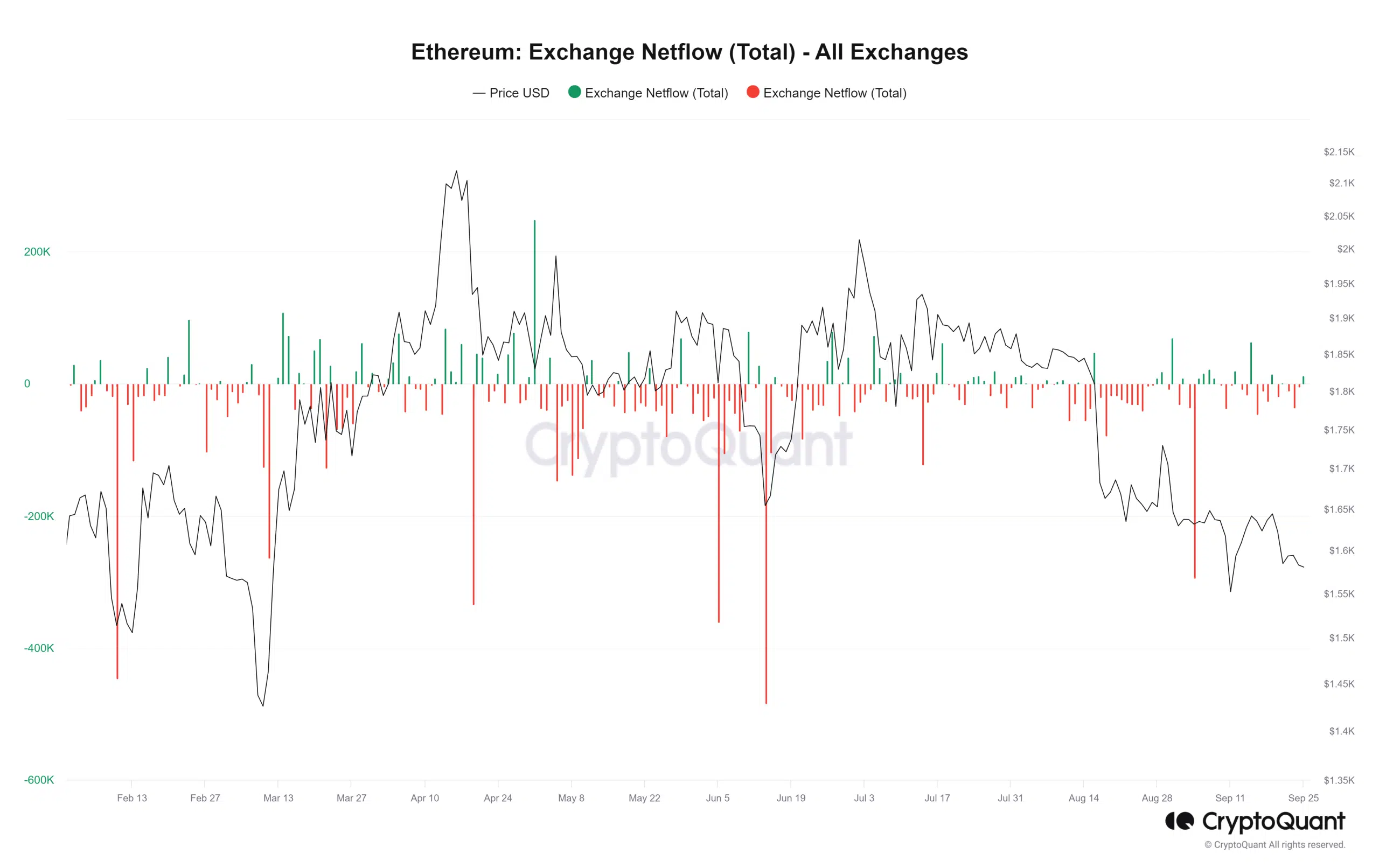

With the growth of Ethereum staking, a noticeable trend has been the reduction in the inflow of ETH to exchanges. While there has been some ETH inflow to exchanges, as evidenced by a chart from CryptoQuant, it has been outweighed by outflows.

At the time of this writing, the exchange netflow metric showed a positive balance of over 7,000 ETH, but the preceding days had seen dominant outflows.

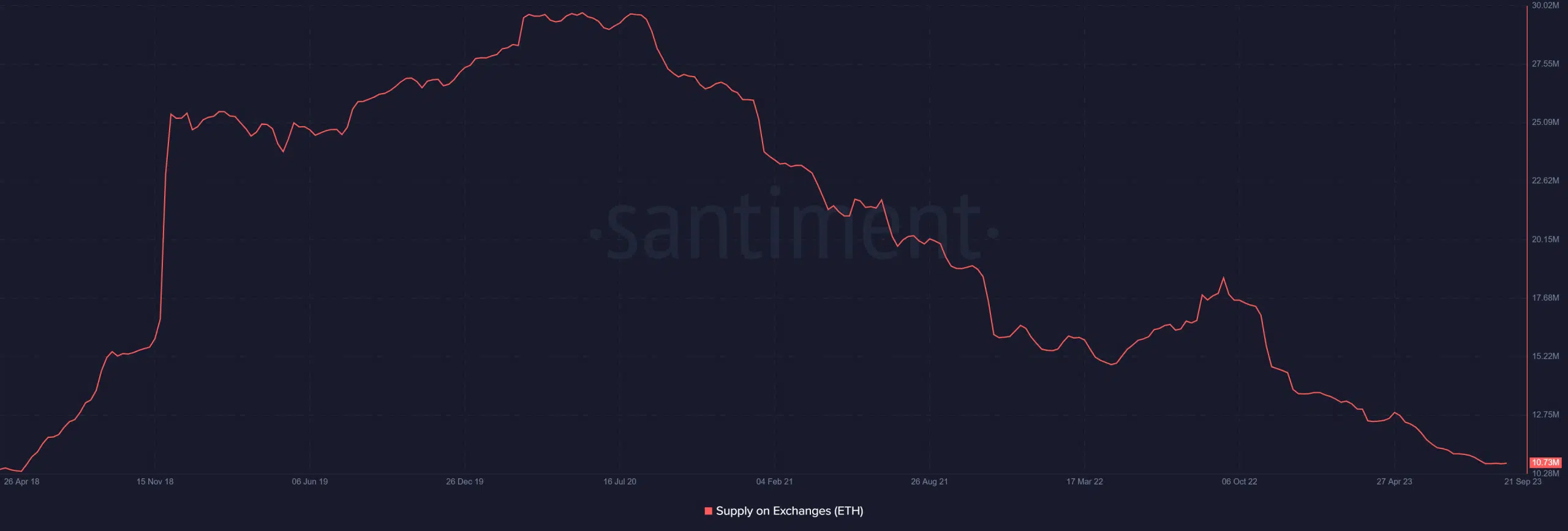

Furthermore, this increase in outflow has had a notable impact on the supply of ETH available on exchanges. According to a chart from Santiment, the supply on exchanges has experienced a significant decline over the past few months.

As of this writing, the supply on exchanges was around 10.7 million ETH, a level not observed in nearly five years.

How much are 1,10,100 ETHs worth today

Lido’s dominance still holds sway

The Ethereum staking ecosystem has been expanding, with Lido Finance emerging as a dominant player. According to data from Dune Analytics, Lido’s market share in ETH staking had surged to over 32% at the time of this writing. This significantly overshadowed the market share of other prominent platforms, such as Coinbase and Binance.

Lido’s dominance has ignited discussions about the security and centralization concerns within the Ethereum ecosystem, particularly in light of the substantial volume of ETH locked within the platform.